SMAs = Cool Kids

It has taken over 20 years, but SMAs (Separately Managed Accounts) are now the “in” thing for muni investors. Growing at over 25% in recent years (at the expense of mutual funds), they are now available for anyone at any amount and for any type of muni investor. Why are they cool now? Are some cooler than others? MainLine defines this SMA “coolness” in this month’s muni review.

Munis continue to gorge on new issue supply. However, the good news is they continue to digest it slowly. The move lower in rates has been hard for munis to follow, with a new issue calendar averaging more than $5 billion a week versus the 2023 summer months. Munis are seeing good inflows and represent value once the calendar slows up. MainLine West sees munis having a strong finish to 2024.

Muni Market Review

Munis continue to struggle to keep pace with the rest of the US fixed income market. The Bloomberg Composite indices show munis were up .99% for the month, up 2.30% YTD, versus US Treasuries up 1.2% for the month, 3.83% YTD, and US Corporates up 1.77% for the month, 5.32% YTD. The story continues to be the surge in tax-exempt supply and munis trying to digest it all. September 2024 highlights were as follows:

- Muni yields were lower from 11 to 8 bps, with taxables lower by 15 to 8 bps. Year to date, munis are up 3 to 10 bps, while taxables down 31 to 1 bps.

- Year to date, issuance is up 38% from 2023 as issuers are continuing to rush deals to the market before the election.

- Longer-end munis represent good value, with shorter-end just average value. This can change quickly, given the potential changes in tax rates post-election.

- The muni fear indices are back down to their lows for the year, providing a good indicator of muni demand picking up in the next 30 to 60 days.

The delay on the liquidation of MainLine Tax Advantaged Fund V (as we wait for munis to outperform) will most likely push the launch of Fund VIII until early 2025.

Market News & Credit Update:

Hurricane Helena & Munis – Natural disasters can significantly impact municipal bonds, particularly those issued by regions directly affected by events like hurricanes, wildfires, or floods. These disasters can strain local governments’ finances, as they face unexpected expenses for recovery and rebuilding, which may lead to credit downgrades or higher borrowing costs. Revenue streams, such as property taxes or tourism income, can be disrupted, affecting the municipality’s ability to meet its debt obligations. However, many municipal bonds are backed by insurance or state and federal aid, which can mitigate the impact.

MainLine sees value in Texas PSF (Permanent School Fund) insured paper. PSF is AAA rated bond guarantee program for school districts and charter schools in Texas. They manage with very conservative asset coverage ratios and cap the amount they will guarantee. This is truly a AAA rated insurer. A large increase in issuance due to recent IRS approve to increase insurance capacity has caused spreads to widen out. Current spreads are at 35 to 40 bps versus AAA index, while historical average is roughly 20 to 25 bps.

The University of Chicago Center for Municipal Finance has been asked to do a study on the usefulness of tax-exempt bonds. They will explore the cost of tax exemption, versus tax and finance savings to municipalities. This comes as their remains skepticism in DC about the effectiveness of taxexempt bonds. MainLine says it is about time for this. U Chicago will garner respect for its findings, and we feel their findings will give municipal finance the respect it deserves. We look forward to sharing the results here later this fall.

SMAs = Cool Kids

Introduction:

SMA stands for Separately Managed Accounts and provides municipal bond investors with their own portfolio of bonds managed by a professional manager. Previously, it was used for high-net-worth investors with municipal assets of $1 million or greater, but over the last five years, more investment firms are offering them to the average investor. The average portfolio size is $450,000, but some offer the service to as low as $25,000 in assets. SMAs allow you to control your investment objectives by minimizing taxes, customizing liquidity needs, risk preferences, and even express your political opinions. This is all accomplished at a lower cost than most mutual funds.

Review of SMA Growth:

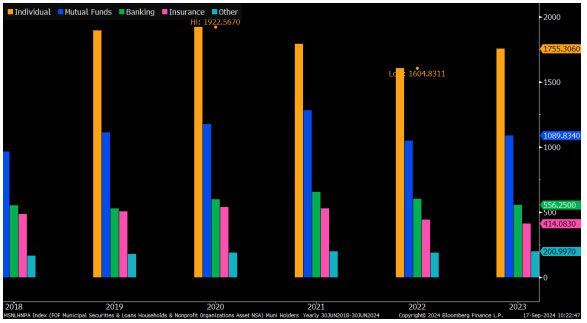

At the expense of the mutual fund industry, assets held by individuals (includes SMAs) have grown in recent years. After peaking in 2020 at $1.9 trillion muni assets held by individuals fell to a low of $1.6 trillion in 2022. Since that low, holdings have grown to $1.8 trillion by 2024. In that same time period, mutual fund assets peaked in 2021 at $1.3 trillion and are now down to $1.1 trillion. Many of the assets redeemed from mutual funds have moved to SMAs.

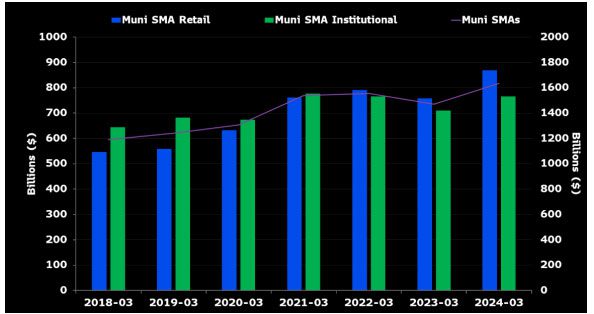

SMA assets have grown from $1.3 trillion in 2018 to $1.5 trillion in 2022 and now sits at close to $1.62 trillion (25% growth). Retail SMA accounts have been the fastest growing segment, growing from $550 billion in 2018, to close to $900 billion in 2024.

Who are the SMA managers? They are the usual suspects led by Goldman Sachs, Merrill Lynch and Bank of America (Managed Account Advisors, Nuveen, Blackrock, and Morgan Stanley. On average, the annual fee for a muni SMA is 24 bps, with a range of 19 to 40 bp.

Why are SMAs Cool?

- Lower fees: Mutual funds on average charge 52 bps, SMAs on average charge 24 bps. The combined use of algorithm trading, and electronic trading are making bonds more accessible, and portfolio management system being more automated, help lower costs.

- More tax efficient. Gains and losses can be taken when it is to the benefit of the investor. Mutual funds can realize gains and losses on trades and the investor is stuck with them whether they need them or not. Also, the use of AMT paper can be included or not, depending on the investors tax status. Mutual Funds do not always provide the option.

- More Customized: SMAs give the investor more discretion over the investments made. For example, credit quality, state income exemption, reinvestment, and any other items of interest. Investors in mutual funds will need to find a fund that best fits their needs.

- No NAV Risk: Mutual Fund investors are at risk of the current fund’s NAV, and investor buying and selling habits. NAV exposes investors to losses or gains when deciding to redeem principal. Since you own a pool of bonds, you will never receive par back ($1 for $1). SMAs hold bonds directly that will mature at par, giving no gains or risk of losses if held to redemption date.

MainLine West SMA Advantage

MainLine has been offering SMAs since we opened in 2008, back when SMAs were not “cool”. All the advantages of SMAs list above, are available at MainLine, along with our firm’s 16+ years of experience. This experience and our approach to being investor cost focused is what make us cooler than the rest of the SMA crowd.

- Lower Cost to Source Bonds: MainLine sources over half of its bonds from the primary market that we call institutional pricing. Our clients’ bonds are purchased at the initial pricing, which is the most efficient and effective way to buy a bond. In a study done back in 2019 on average, a bond’s price will be marked up 1.94% within 16 days of its initial offering costing the investor 24 bps of income. This 24 bps on a $5 million portfolio is roughly $12,000 in income a year and $120,000 over a 10-year portfolio life. MainLine minimizes the cost to its clients’ income when buying bonds.

- Lower Cost of Fees: MainLine charges a low fee of 15 bps for full service SMAs, or 10 bps for sourcing bonds. These fees much lower than the average SMA manager.

- Lower Principal Risk: MainLine West does its own credit work, while most SMAs screen by credit rating, trusting S&P & Moody’s opinions. If it meets the required rating, then it clears the electronic filter. Not only are we worried about principal risk today, MainLine also analyzes the issuer for the potential impact of climate change and principal protection over the next 30 years.

- Lower Computerized Management: MainLine does not let algorithm programs buy bonds for our clients, nor do we have an electronic trading system that buys large block of bonds and allocates them out to 100’s of clients if it meets with high level filters and criteria. MainLine designs SMAs individually and sources bonds from over 50 underwriters/broker dealers from all over the USA. We buy bonds for our client as opposed to finding clients for our bonds.

- Mainline West Value Add: We have developed a propriety trading model that adjusts a bond’s value for its call risk, sector, curve risk and other bond attributes. It compares this value to historical and current offered bonds and identifies those with intrinsic value to outperform for a buy and hold account.

Conclusion

MainLine West has been doing SMAs since 2008. We always knew the advantages of SMAs versus ETF’s & mutual funds. Now, everyone else has figured it out. We are still ahead of the crowd by taking the SMA advantages and executing in a way that saves our investors income, while not trying to save our cost and time at the expense of our client’s income. Not too many SMAs are cooler than that.

View the Monthly Review PDF here – View September Report Charts