A View into the Cost of Climate Change – “Natural Disasters and Municipal Bonds”

In the aftermath of Hurricane Ian, it seems like an opportune time to explore climate change and its costs. In July, the National Bureau of Economic Research issued a unique look at the potential cost of climate change by using the municipal market and information from natural disasters from 2005-2018. There are some interesting takeaways, some throwaways and, of course, some advice on how to weather the storm.

The muni market continues to endure the thrashing of “Hurricane Powell” and, once again,

underperformed during in the month of August. Munis represent good long-term value and are at levels not seen in close to a decade (not counting the 2-week COVID time period). In the next 30 to 60 days, MainLine believes others will finally appreciate munis again.

Muni Market Review

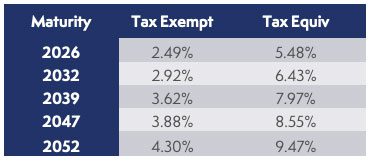

The muni market should be embarrassed with its performance in September. With credit quality at all-time highs, new issuance supply much lower and tax-equivalent values quite high, munis still underperformed. When will the average muni investor (mom & pop) decide rates are high enough and long-term tax value has returned?

Highlights for September are as follows:

- Muni yields were higher 80 bps to 61 bps, flattening, while taxable yields were higher from 60 to 33 bps, also flattening.

- Muni ratios are cheap along the curve, more so the farther out you go. The curve still has room to flatten, an investor can get 80% of the maximum income of the 30 year bond in only 7 years.

- New issuance continues to slow down and now is lower by 14% than 2021.

The Family of Funds continue to navigate hostile fixed-income waters and municipal bond underperformance. MainLine made a small deleveraging capital (10%) call for Fund VI at month’s end. This should help us with the restructuring of some trusts and will hopefully be returned in short order. Fund VI.5 is close to needing the same boost, which we are monitoring. Funds V & VII are holding up well.

Market News & Credit Update:

Municipal bonds are at yield levels that offer long-term value for investor looking for tax-free income for years to come. The State of California priced over $2 billion in bonds during the month of September looks like great long-term value for California residents when adjusted for taxes: 8% for 17 years. As of the end of September, national bonds were not too far behind.

The rise in rates and the struggling muni market have analysts revising their issuance supply predictions down by 15% to 20%. Supply is currently 14% lower than 2021. The amount of new project money remains unchanged, it is the refunding, and taxable components that have been impacted. This drop in supply has been a big reason the muni underperformance in 2022 has not been worse.

A View into the Cost of Climate Change – “Natural Disasters and Municipal Bonds“

Introduction:

In a July 2022 study by the National Bureau of Economic Research, muni market issuers impacted by an extreme weather event suffered “substantial price effects” On average from 2005 to 2018, over a ten-week time frame after the event, prices were adversely impacted. The amount of market value loss depended on several factors that are discussed in the study. This is the first “real” attempt to quantify the potential impact of climate change on the value of muni bonds. It is not perfect and not fully quantified, but MainLine thought it was interesting approach with some lessons to be learned.

Background:

Most studies on the cost of climate change have focused on the physical costs of slow-moving risks such as sea level rise, or on the stock prices of companies that are geographically diversified. The problem with these studies is that the effect on a regional located entity is missing, or how the costs of climate change can be impacting sooner than 30 years.

This study combined county level weekly bond returns with data from over 2,000 extreme weather

events that occurred from 2005-2018. More specially:

- Bonds prices were recorded weekly, using only fixed coupon bonds, classified as revenue or general obligation, insured or uninsured.

- Natural disasters were identified using the Spatial Hazard Events and Losses for the United States (SHELDUS). This database reports the counties affected by an extreme weather event and estimates the property and crop damage, injuries, and fatalities.

- Only disasters causing more than $3 per-capita (75th percentile threshold) were included.

- Included were issuers located in counties 500 miles or closer to the disaster.

- Data from Federal Emergency Management Agency (FEMA) is obtained to calculate aid provided.

- Of the bonds analyzed:

- 1996 total, 1186 revenue, 1316 GO (some bonds were “double barreled” and counted in both categories)

- Includes 25,426 counties

- 42% of the bonds trading were owned directly by households and over 50% by sophisticated institutional investors. This could influence pricing and trading behavior.

- The study uses basis points (bp) to quantify losses. To put this in perspective, a 1 bps loss on a $1 mln par bond maturing in 20 years is roughly $1,000 in market value.

Results:

- Muni bonds experiencing a natural disaster substantially reduced returns for at least 20 weeks following an event. The average decline was 31 bps ($31,000 on $1 mln par or 3.1%), over the post-event period. Bond price declines occurred gradually after the disaster, peaking at ten weeks.

- Revenue bonds were impacted much more than general obligation bonds. On average revenue bonds decline 51 bps, while GOs declined 13 bps.

- Bond insurance is perceived by investors to “immunize” the bond’s cashflow against natural disasters. Insured bonds, on average, declined 10 bps, with insured revenue bonds 14 bps, and GOs down 6 bps.

- Federal aid, if granted, helps reduce the impact on investors. Revenue bonds from counties that did not receive aid and uninsured experienced a 120 bps decline in value, more than double the average (51 bps) those receiving aid declined 28 bps (versus 51 bps). General Obligation bonds with FEMA support declined only 10 bps (versus 13 bps)

- Not all General Obligation bonds are immune. Those with a significant debt burden, and with low wealth levels experienced a 55-bps decline in bond value versus 6 bps for better quality bonds.

Conclusions: MainLine West Thoughts:

Overview thoughts of Study:

- MainLine applauds the approach to this study and its focus on municipalities based on past disaster costs to estimate future disaster brought on by climate change.

- Although the value of the bond declined, if held until par it is not a “loss” to the investor. There is no information on if there were defaults, missed coupon payments and no information on how long it takes for the bonds value to return to pre-disaster trading value.

- Pricing data is going to be flawed making the costs concluded in the study most likely “rough”. Municipal bonds are illiquid, do not trade frequently, have a wide bid/offer spread, and are influenced by the end-buyer. All these items add in flaws to price returns.

Investment Lessons:

- Diversification remains important. Concentration in a given geographic regions and sectors should be avoided.

- Demographics of issuer remain important. Wealth levels, debt burden, budget management practices, must be analyzed and meet credit standards for the investor.

- When investing in revenue bonds, focus on those providing essential services, and servicing desirable and important service regions.

- The study makes a point that insured bonds are immune to disasters. Insurance can add some value, but should not be the basis for any investment decision. As muni investors learned in 2008-2010, trusting a small-scale insurance company to back the debt of major world economies is a false sense of security. (I did look to see if the monoline municipal insurers were funding this study. They surprisingly are not.