State HFAs: An Oasis of Value

The municipal market is enjoying solid year-to-date performance versus taxables, leaving investors thirsting for value. Mainline still sees value in one very “SWANish” sector: State Housing Finance Authority bonds (HFAs). It is not a mirage that an investor can receive both higher income and have higher credit quality. This month, we show the reality of State H FAs and provide a primer on this “eccentric” sector of the muni market.

In March, after 2 years of being the “outcast” asset class, Munis are now back to being the “cool kid”. Munis experienced outflows every week but nine in 2023, for a total of $19 billion out, only 6 positive inflows in 2022 and total of $144 billion out, but now in 2024, munis have had 11 straight weeks (all of 2024) with inflows of $9.9 billion. Why? We know why this is the case – volatility is low and on the decline. Investors are returning to munis, setting them up for a good run in 2024. Expect them to stay rich, not sell off too fast or strong, and be nimble – prompting buying in moments when demand softens due to supply or taxable volatility.

Muni Market Review

The muni market showed our expected slight under performance in March but, year-to-date continues to outpace taxables. Year-to-date, munis are down -.39%, US Treasuries -.96%, and US Corporates -.40%. Muni technicals remain solid as volatility is low, and trending lower, inflows have returned to muni mutual funds, and relative tax-equivalent value still looks appealing to investors. March highlights were as follows:

- Muni yields were higher by 10 to 9 bps, with taxables lower by 2 to 3 bps.

- Year to date, issuance is up 25% from 2023 and 5% versus the five-year average. This supply increase is being met with the return of fixed income investors.

- 30-day average Muni yield volatility is now at 10%, down from an average of 18% in 2023, and 26% in 2022. This, along with still solid tax-equivalent yields, is why mun is will continue to “perform” in 2024.

Mainline expected a drag in performance in March, and April could remain mixed. If things are setting up the way we anticipate, this summer could be good for munis and provide a chance for Fund V to begin its divestment of assets.

Market News ~ Credit Update:

- The Detroit recovery story continues as the city has earned its first investment grade credit rating since it’s bankruptcy in 2014. Moody’s raised Detroit’s credit rating from Bal to Baa2. The City has posted solid operating results and has seen its tax base double over the last five years. This new “Motor City” does not appear to be the Detroit of our parents, as it continues to redefine itself. For more details about Detroit’s rebirth, please see our March 2023 Monthly Review on our website.

- Small US Local Governments (LG} that are looking for insurance against Cyber risk have found premiums to be escalating and prohibiting them to be able to afford coverage. To provide insurance for the small municipality, LGs have created cyber risk pools to spread out the risk and costs. The risk pool operations are overseen and governed by a third party and not a municipality. For example, New Jersey public schools have formed a cyber risk pool to save costs and provide mutual support in prevention of it.

State HFA’s: An Oasis of Value

Introduction:

The municipal market has had a good year-to-date versus taxables, and ratios are looking rich. Many sectors have tightened versus the benchmark curve, but Mainline still sees value in one, very “SWAN”ish sector: State Housing Finance Authority bonds (HFA). It’s not a mirage; investors can receive both higher income and have higher credit quality.

Background:

The municipal housing bond market remains a “boutique-ish” sector, representing strong credit quality and attractive yields to investors willing to accept average maturity dates and willing to do the extra research. Bond proceeds are being used to finance the purchase of homes by responsible first-time qualifying buyers with below median income levels. They are Federally tax-exempt bonds, designed to offer low interest rates to the home borrowers. There are two types of H FA issued bonds. Some are backed by GNMA/FNMA/FHLMC certificates and have a AAA credit rating. Others are backed by the HFA itself. Most of these have credit ratings AA- or above (92%). HFA bonds can be issued in many different structures, from term bonds – having a fixed maturity date, to PAC (planned amortization coupons) bonds which have a pay down schedule. PACs trade on an average maturity date basis, determined by the speed in which home loans are prepaid.

State HFA Credit Overview:

- State HFAs provide financing for first time buyers seeking a 30-year fixed rate mortgage that meet these high-quality standards:

- Typical FICA 600-700

- Fully employed

- Qualified to state maintained underwriting standards

- 80% maximum loan to value unless insured by investors

- Insured by FHA, VA or private mortgage insurance

- Secured by first mortgage liens

- HFA programs remain solid and strong with marginal affects from the subprime crisis

- On average, state H FA’s have debt service coverage a strong 7.8 times

- Credit quality according to S6-P is positive. In 2023 the US Department of Housing and Urban Development gave out awards on average $3,411 per unit of capital funds to the various State HFA’s

- Over the last three years, the average capital fund budget has increased 4 %

State HFA Value Overview:

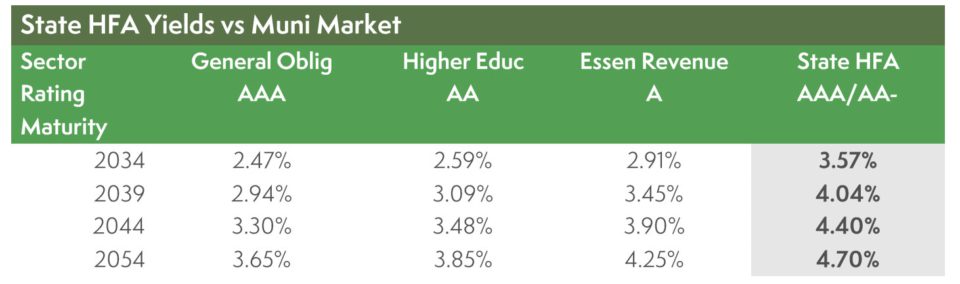

Yields as of 3/19/2024, 10-year call, 5% cpn, par cpn for HFA

The chart above shows State HFAs provide significantly higher income than like-rated and lower rated issuers.

- Over 100 bps in yield versus AAA General obligation bonds. This is $11,000 of additional income per $1 million invested.

- Over 80 bps in yield versus AA-rated Higher Education bonds. This is $8,000 of additional income per $1 million invested.

- Over 45 bps in yield versus lower A-rated essential service revenue bonds. This is $4,500 of additional income per $1 million invested.

Why the extra income with the higher credit quality?

- State H FA bonds are a “niche” market, requiring extra work due to prepay analytics. Some advisors are not willing to understand and monitor the mortgage market.

- Their “relationship” to the housing market, which is falsely tainted, due to the subprime crisis from 2008 to 2010.

- Call risk from prepayments can impact the return on the bond, depending on if they are bought at a premium, par or discount price. This can also create reinvestment risk, which can also influence total returns.

- Issuance size is usually not big enough for the big shop managers to get the allocations they need to split up amongst all their SMAs.

Conclusion:

- Investors can earn from $4,500 to $11,000 of additional income annually per $1 million by having an allocation to State HFA issuers.

- Investors have top-tier principal protection quality with State HFA credit ratings at AA- and higher.

- Mainline is a long-time expert and an active investor in State HFA bonds. They are an important part of our SMA portfolios and in each of our Tax Advantaged Opportunity Funds.

Higher income and higher credit quality – who says you can’t have both? State HFA bonds are not a mirage, but a reality. They require a little more expertise and homework, but Mainline thinks it is more than worth it for our investors. The sector remains an oasis of value for investors thirsting for value in muniland. Mainline believes State HFAs should be a core sector for all investors looking to Sleep Well At Night.