March 2022 – So Long LIBOR, SOFR Who? Welcome BSBY!

Ouch! March hurt muni investors to the tune of down 3.2% on the month. Outflows were steady, as economic and Fed policy uncertainties, led to a muni correction. As an opportunistic investor, MainLine thinks this could be the time to take advantage of cheap munis and a flat yield curve. The MainLine Tax Advantaged Opportunity Fund VI.5 is active deploying its remaining capital, and Fund VII is not far behind.

Leave it to US regulators to create a new flawed product to replace an old one that Wall Street abused. Then, leave it to Wall Street to invent a new product that works better than the Government’s option and sit back and wait for the regulator’s product to fail before introducing it.

- So long LIBOR, how we will miss you.

- SOFR who has nothing to do with hedging USD risk denominated non-overnight assets, which is why nobody is converting to it.

- Welcome BSBY, Bloomberg bank yield curve index that meets hedging requirements, but investors will have to wait a bit longer for.

- The MainLine West Tax Advantaged Opportunity Funds are very happy to meet BSBY, and it is well worth the wait

Muni Market Review

March was a bad month in muniland. An increase in US Treasury yields and economic and Fed policy uncertainties lead to muni mutual fund outflows that forced selling in the muni market. Yields were up, and muni underperformance is in full force, with weak technicals for the next 30 days. This looks like an opportunity to buy munis. Highlights are as follows:

- Muni yields were higher from 63 to 55 bps, as the curve flattened.

- Taxable yields were higher from 71 to 40 bps, as the curve flattened.

- Outflows continue and are at $28 billion year-to date. This is roughly 2/3 of the outflows in the COVID-prompted end of March crisis in 2020.

- The curve has become flat in muni-land:

- 80% of the curve’s full income can be earned with a 10-year bond.

- A five-year average maturing portfolio can earn a 2.20%-2.30%.

- Maximum yields on 4% coupon bonds, high credit quality is pushing towards 3.50%-3.70%.

MainLine feels this is the time to buy munis. Yields are up, muni valuations are cheap and, in the long-term, munis are primed for good performance. The MainLine Tax Advantaged Opportunity Funds are going to be taking advantage of the buying opportunity. If you have cash targeted for munis, this is the time to let us know.

Market News & Credit Update:

- The State of New Jersey has finally earned its first upgrade since 2005, with the general obligation bonds moving up one notch from A3 to A2 by Moody’s. The upgrade reflects “the State’s strong revenue and liquidity, and steps to more aggressively address liability burdens, including increasing pension contributions.” New Jersey is another example of munis on a credit quality high.

- Here we go again, talks of tax increases from the Biden administration return. The Treasury Department has released plans to raise $2.5 trillion in new tax revenue aimed at corporations and high earning households. The plan calls for a minimum 20% income tax on mega millionaires/billionaires (more than $100 million of wealth). How would this impact the muni market? MainLine feels it will be a non-factor. Although the wealthy own a lot of munis, the “megas” do not.

- A recent Barclays research report shows ETFs continue to grow as a way to invest in munis. Since 2007 (less than 1%) holdings have grown and are now at 7% of muni assets. This growth has continued year-to-date in 2022, even though the rest of the muni industry is seeing outflows. An analysis of the premium and discounts that ETFs can trade a show a limited ability for easy money, as market participants are able to buy or sell actual bonds against the ETF to keep things in balance

So long LIBOR. SOFR who? Welcome BSBY!

Background:

The LIBOR scandal during the banking crisis, brought about the demise of LIBOR-indexed products. LIBOR was a fictitious index rate set by Wall Street banks that was used to buy and sell investment products. During the crisis and the implosion of bank balance sheets, banks set the LIBOR rates to benefit their needs. This was not a big deal on a price comparison basis, but when you slant a multi trillion-dollar market by a few basis points, you can make a lot of money.

In 2017, regulators announced the phasing out of LIBOR and, in return, demanded a market-based index that reflected an actual market with actual trades, and not fictitious ones. At that time, they set deadline of June 2023 for the creation of a new benchmark rate and the entire conversion of over $350 trillion in LIBOR based products.

SOFR 101:

The invention of regulators SOFR (Secured Overnight Financing Rate) is based on the overnight risk-free lending that is published daily. It is a broad measure of the cost to borrow cash overnight on loans that are collateralized by Treasury securities. In other words, this is also called the US Treasury REPO market. The rate is calculated from actual market transactions in what is roughly $700 billion a day traded market. The current transition from LIBOR swaps has been indexed to only overnight investments, but it is anticipated by early summer longer-term fixed rate swap rates will be available. For example, a ten-year swap rate will be created from bootstrapping ten-year overnight repo rates.

The problem? There is no risk component (US Treasury backed) and limited yield curve slope priced in, as it is based on anticipated overnight rates. To be an effective LIBOR swap replacement for people who hedge like the MainLine West Tax Advantaged Opportunity Funds, both components are needed.

BSBY 101:

The invention of the Wall Street Banks that is based on the Bloomberg Bank Yield Index curve. This index is created by Bloomberg and derived from US dollar-based transactions on fixed income AA rated bonds/notes in the US and internationally. These transactions range from overnight to 30 years. So, the index will have credit spread and forward-looking yield curve anticipation built in.

The problem? BSBY is still 3 to 6 months away from full implementation. Two major Wall Street Banks are ready to get things going, but are allowing SOFR the chance to get settled in, before unsettling it. There have not been a lot of conversions from LIBOR to SOFR swaps. Those who have converted are doing so to hedge overnight cash flow risk. It is anticipated by the mid-summer BSBY swaps will be available and greeted with open arms.

Analysis: The Correlation of BSBY to LIBOR.

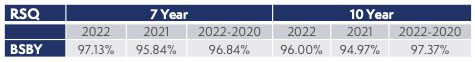

MainLine ran a regression analysis to see what the correlation of BSBY has been to LIBOR. If it is a good replacement, the correlation should be high. One limitation is that BSBY is new, and not yet fully functional. Therefore, the historical data is limited. ERIS provided MainLine with historical futures contract information on the two indices. Actual data from October 2021 to March 2022 and extrapolated information that they recreated back to January 2020 for 7- and 10-year fixed terms. The RSQ function in Excel, using daily price changes for each future index, were regressed over the time periods listed on the following page. The percentage result reflects the portion of BSBY that is related to LIBOR. Results are as follows:

The results show that BSBY price movement has been from 94% to 97% related to LIBOR. This is a high correlation that shows, given the data analyzed, BSBY is a good replacement for LIBOR

Conclusion:

- Unfortunately, the analyzed time period is limited, but the volatility in 2020 was high which was a good test. BSBY seems a good the profile of a “new LIBOR” index that meets with both US regulators and Wall Street banks requirements.

- MainLine West Family of Funds uses LIBOR index swaps to implement its strategy. The volatility, built in credit spread, and term structure has been part of the core strategy for the Funds (and their 10% to 12 % average total returns). MainLine was not a fan of SOFR and had concerns that it would alter the Fund strategies and may impact returns, due to the items discussed above. The creation of BSBY is the fix we had hoped for and allows the Funds to have the same risk and return profile using BSBY as it would have had with LIBOR.

- Fund VII will utilize the BSBY swaps when they are fully utilized, until then it will use an ERIS futures contract that mirrors LIBOR for the first year.

- MainLine will convert the other Funds swaps prior to July 2023 and, as soon as the BSBY swap market is liquid and in full use by the Wall Street banks.