A Decade of Muni Tales & Facts

June 30, 2022 marks the 10th year MainLine West has been publishing its Municipal Monthly

Reviews. It is amazing how quickly time passes by. We must have shattered some sort of record for municipal coverage and information. I am not sure how we came up with ten years’ worth of information, but in this month’s review you will see the topics discussed, the work involved, and a special thanks to our subscribers for their readership.

As for June, munis suffered another embarrassing month versus taxables. Is this the high-mark for yields and under performance –or- simply another “fake summit”? Early market indicators say “no”, while relative value and seasonal technicals say “yes”. So, two out of three ain’t bad. MainLine still feels today is an opportunistic time to build a tax-exempt portfolio to enjoy for years to come.

Muni Market Review

May looks like it was another fake summit on rates for the muni market, as June set a new high. Continued muni mutual outflows spurred on by a rise in US Treasury rates, inflation concerns, and indifference for muni value has the market in a tough place at the end of June. MainLine remains cautiously optimistic that we are now on the summit of muni yields for the year.

Highlights for June are as follows:

- Muni yields were higher by 13 to 37 basis points with the curve steepening.

- Taxable yields were higher 21 to 11 basis points with curve flattening.

- Issuance continues to slow down at the current higher level of rates. Total issuance is down 14% year-to-date versus 2021. Refunding is the biggest reason as it is down 38%, and new money is actually up 3%.

This remains an opportune time to buy munis. MainLine is building for clients 5-to-10- year laddered portfolios at 2.75%, 7-to-12 years at 3%, and long-term maximum yield at 4%. Let us know if we can build one for you.

MainLine is close to completing the legal and regulatory requirements for the Taxable Arbitrage Fund. It is the first of its kind and, therefore, has taken a bit longer to strategize and has endured more “red tape”. MainLine will look to begin presentations and fund raising in the coming months. The Taxable Arbitrage Fund will provide investors a source of longterm high income and wealth building for IRAs and other fixed income needs.

Market News & Credit Update:

The foundation of the muni market remains solid as credit news continues to be positive. Could this be the summit of this climb?

- On average, states have the largest General Fund balances ever (rainy day funds) at $112.7 billion, up from a record level in 2021 at $76.9 billion (47% increase). Now they are busy making plans to spend it.

- First time defaults year-to-date are at $581 million, down 38% from last year. 76% are nursing home/senior living issuers.

MainLine West Tax Advantaged Opportunity Fund VII is fully invested, and we feel will meet its anticipated performance objectives. More details:

- Anticipated payout of 6% to 6.25%.

- Anticipated life of five to six years (June 2027-June 2028).

- 40% of assets will be at par or close to par by the anticipated life.

- Average credit quality of AA, with all issuers providing an essential service.

- 82% top tier rated (AAA/AA).

- Anticipated NAV opportunity of 3% to 5%.

- Average muni yield ratio is 150%, long term is closer to 90%.

A Decade of Muni Tales & Facts:

Over 30 years ago, when I was in graduate school, there was only one chapter on muni finance in the

curriculum and it was about the difference between general obligation and revenue bonds. As of June 30, 2022, MainLine will be marking its ten-year anniversary of publishing its monthly reviews. So, to think we have found something to write about munis each month for ten years would seem quite a feat, given one chapter in grad school 30 years ago.

Since July 2012, we have been sharing with you our thoughts monthly, whether you wanted them or not. No break for COVID, no break for holidays, no break because we had nothing to say (kidding, of course). The monthly review started out as a way to educate MainLine investors about the municipal market and its performance. It has grown into a communication tool, not only to share market thoughts, but to conduct in-depth research, explore investment theories, share opinions, and sometimes have a little fun. We have always been honest and tried to look at things from both sides. I dare you to guess my political affiliation.

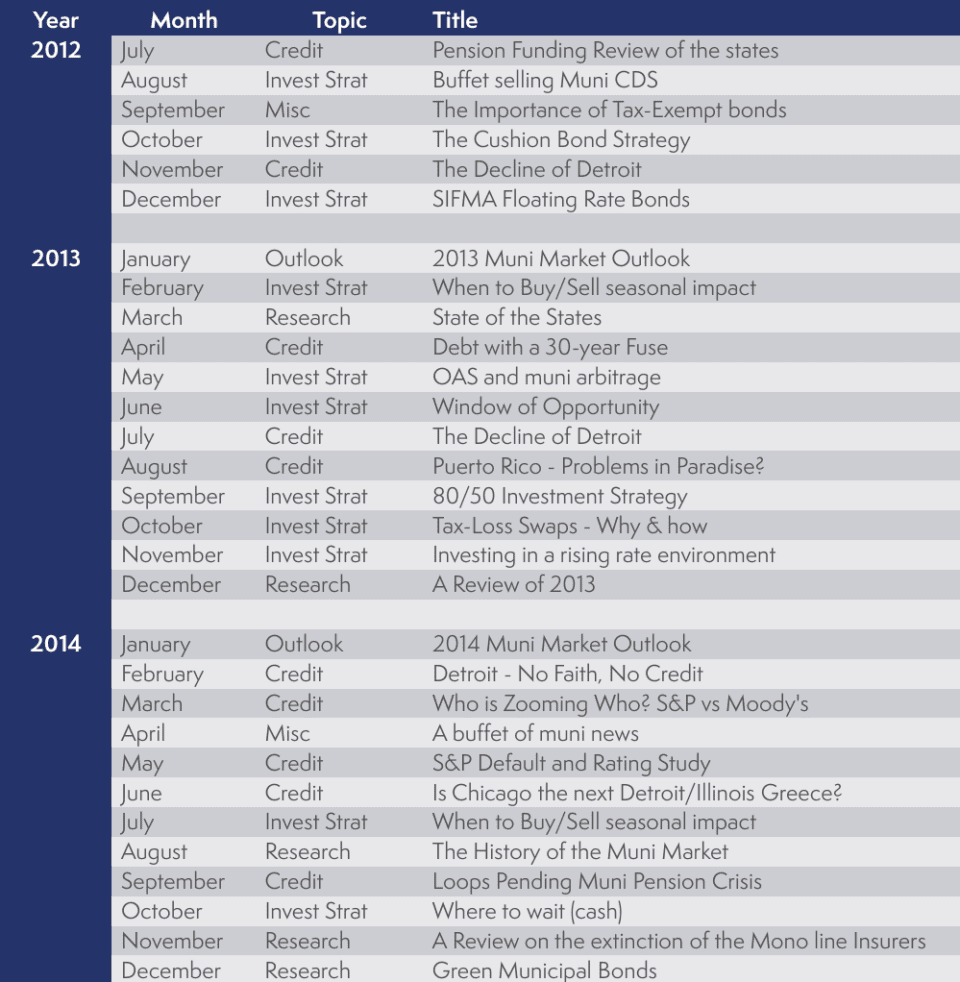

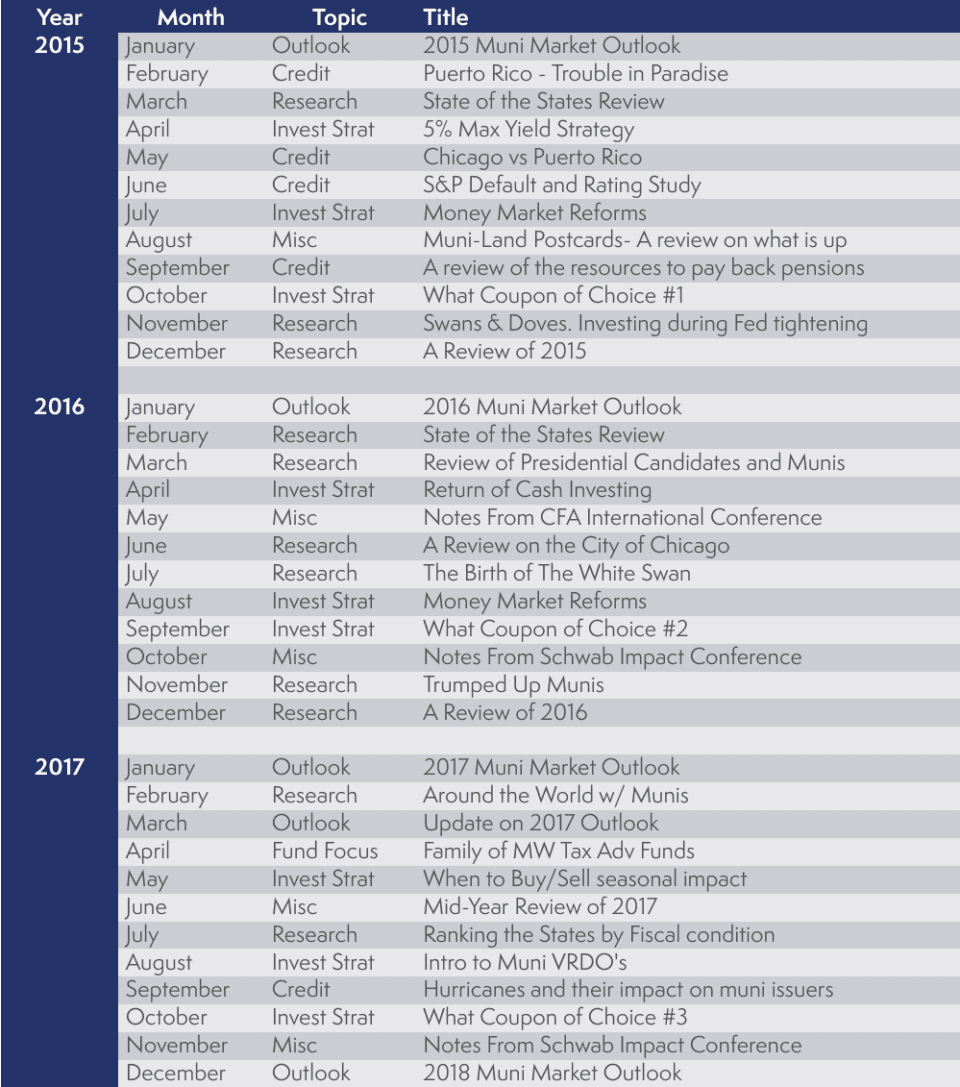

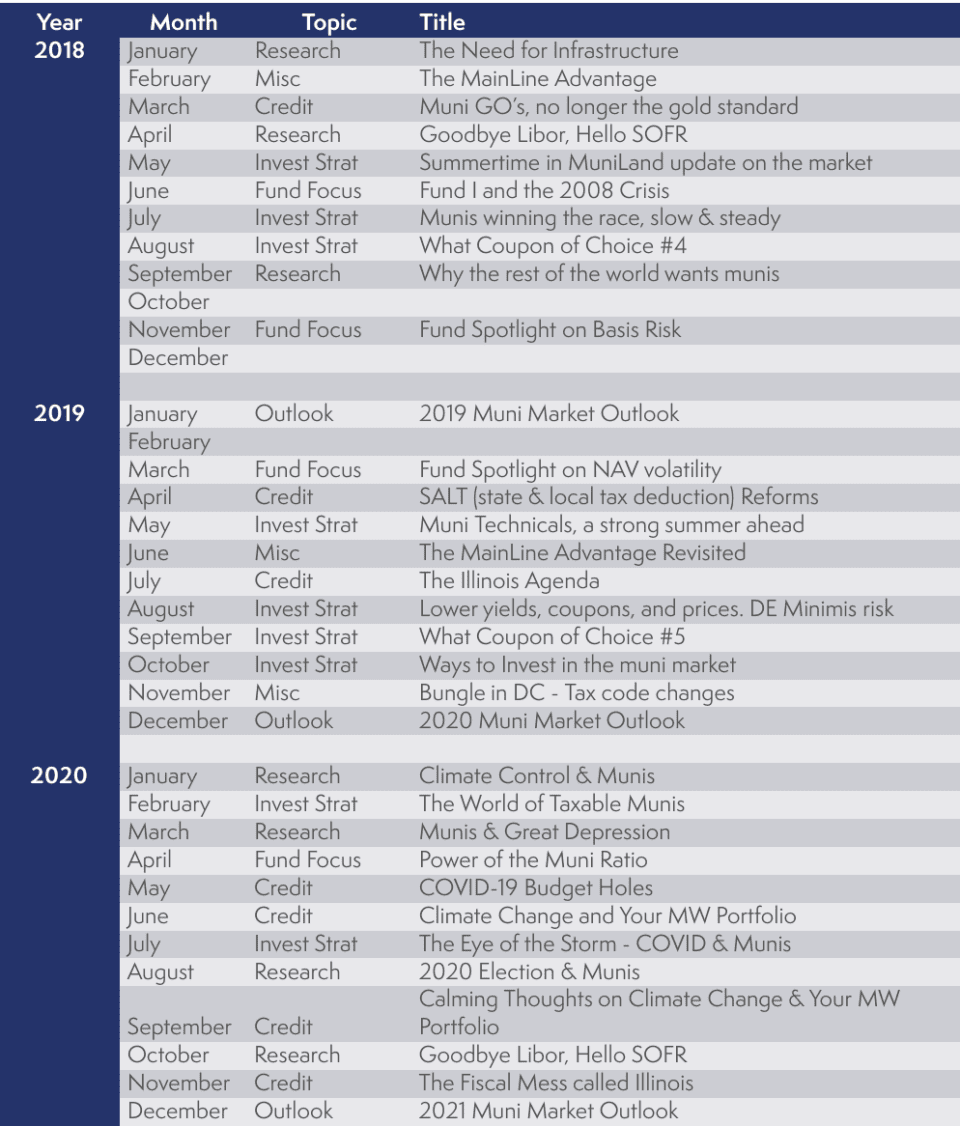

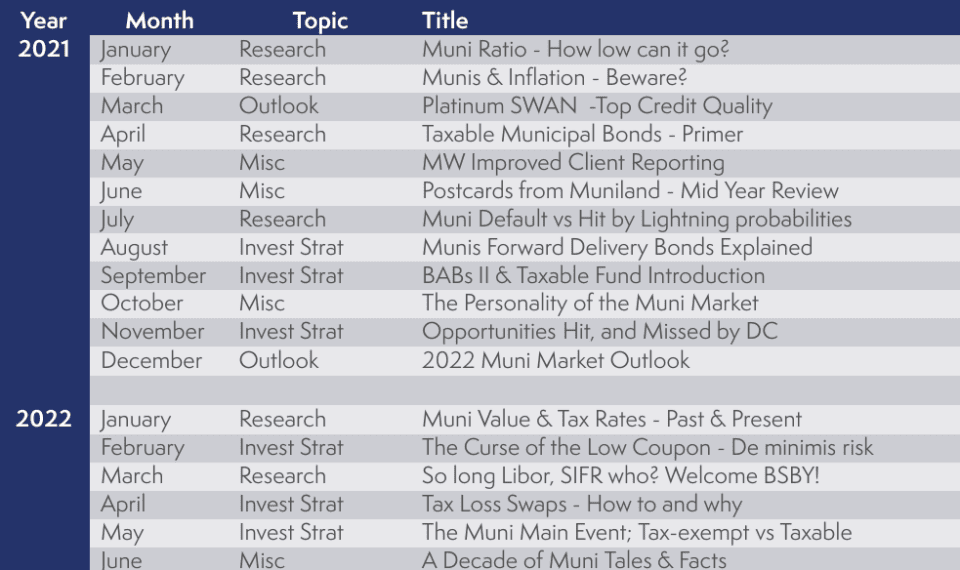

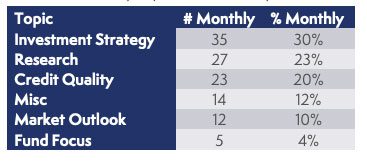

The monthly reviews have ranged in topics, but we can categorize them as follows:

- Market Outlook – MainLine’s forecast for market performance and events in the muni market.

- Research – MainLine features a theory or possible event and how it could impact the muni market.

- Credit Quality– MainLine analyzes a recent topic or entity and the credit quality implications in the muni market.

- Investment Strategy – MainLine focuses on opportunities and ways to attain value or avoid losses in the muni market.

- Fund Focus – A series of studies focused on the Family of Funds concerning risks, return attributes, and their strategic design.

- Misc – Review on several topics at a time, MainLine specific items, or information unrelated to munis.

The chart below identifies the breakdown by topic over the ten years of monthly reviews:

A few monthly review facts:

- We distribute the monthly review to over 250 individuals. Some are fund investors, some are SMA clients, and some are recipients who simply want our opinion.

- Roughly 50% each month open it. Experts say that is good (anything over 30%). Yes, we know who you are.

- A total of 116 reviews have been written. (Yes, that means we took four months off.)

- Recipients of the monthly review are contacts we have made, ranging from SMA clients, Fund investors and those we hope will one day be one or the other, or both. We do not distribute it publicly or randomly.

- We are always open for ideas, if you have one. There has been numerous times an investor has asked us a thought-provoking question and it ended up becoming a monthly review.

- We estimate that we have used the word “Swan” (Sleep Well At Night) 211 times, give or take 100, but who’s counting?

- We did get busted once for using an ”unapproved” image. Cost us $500. (It wasn’t even a good

photograph.)

Conclusions:

- A big thank you to you, our clients and readers. Your feedback, candid remarks, and interest has continued to motivate us to explore topics and ideas to share. I have learned a great deal writing these monthlies which, in turn, has allowed us to achieve better performance. The Opportunity Funds would not have the track record they have enjoyed without my spending days each month diving deeper into munis — sometimes finding good stuff, sometimes finding things I wish I did not see. All of it is part of the learning process. I have been learning for over 25 years now — the last 10 with you.

- A big thanks to my MainLine West partners Paul and Brad for the hours they spend each month reviewing and trying to understand what I am trying to convey. My English teachers back in my younger school days would wonder how you could still be sane while, at the same time, know what I am trying to say.

- We are looking forward to another ten years of exploring the muni market and, hopefully, teaching our investors what we learn. We will see if we can find another 120 topics to explore.

- Below is a “catalog” for the monthly reviews by release month. If you see one you would like us to send out to you, let us know. We would be glad to share.

Cheers to MainLine and its loyal clients!

The Catalog of MainLine West Monthly Reports