Electric Utilities vs. Climate Change

Climate change poses ongoing challenges that could impact utility bonds, necessitating a comprehensive evaluation of associated risks such as fire and carbon emissions. This sector is an essential service that faces challenges from regulatory, operational, litigation, financial and

social factors that all will impact credit worthiness. These challenges and their costs are still evolving, but as an investor in bonds maturing as far out as thirty-years, MainLine needs to start quantifying them and managing our clients’ potential exposure. This month, with the help of our summer intern, Peter Magen, MainLine begins this process.

After strong performance in June, munis faded in July. MainLine is looking for munis to bounce back in August. It is common for munis to react slowly to changes in US Treasuries and we feel this is the case in July. Technicals remain good for the next 30 to 60 days, and the fear index (volatility) is at all-time lows, giving us optimism while other analysts are being cautious.

Muni Market Review

After a big month of June, munis faded away in July and underperformed taxables. Heavy new issuance and increased secondary activity have been a weight on the market. It is also common for munis to be slow to react to moves in US Treasuries. For July the Bloomberg composite indices showed munis up .91%, US Treasuries up 2.19% and US Corporates up 2.38%.

Highlights for the month are as follows:

- Munis were lower in yields by 14 to 4 bps (curve steepening), while taxables were lower 41 to 19 bps (also steeper).

- Issuance remains strong and is up 34% YTD. Over the next 30 to 60 days, issuance is expected to remain high, but there should be more than enough cash flow from maturities and coupon payments to buy it.

- Volatility has taken another step lower in the recent month ( 10 year yield vol at 9%) and is at the lowest levels since our data base started in 2019. This bodes well for munis.

Going forward, the street has a mixed outlook for munis, MainLine is focusing on munis having a strong 30 to 60 days, catching up and outperforming US Treasuries before the election gets into focus. The liquidation of Tax Advantaged Opportunity Fund V is waiting for this outperformance.

Market News & Credit Update:

- AMT (alternative minimum tax) bonds are trading at all-time highs thanks to concern that the AMT exemption created in the 2017 Tax Cuts and Jobs Act will expire in 2025. This was enacted by the Trump Administration and reduced those exposed to the tax from five million in 2017, to only 200,000 in 2018. If it is not renewed in the next year, AMT bonds will have a lot less demand. Current spreads at 75 bps, versus average of 55 bps seems to have priced in most of this risk.

- The impact of the end of federal subsidies and a softening economy are starting to show up in state budgets. New Jersey, which ended its fiscal year 2024 with an historical $8 billion surplus, is now projecting a deficit and the use $6 billion of this to balance 2025’s budget. California, New York and Illinois have also heeded budget shortfall warnings.

- Bloomberg reviewed the use of Chapter 9 in the muni market. It shows the cost, difficult process and stringent eligibility requirements makes it a rare event. Since 1937 (Chapter 9 enacted), there has been only about 700 cases, versus Chapter 11 corporate bankruptcies which has 1,000’s every year. As muni investors, MainLine likes the fact the process is not easy as it makes the municipality work through its problems rather than just filing bankruptcy and not making bond investors whole.

Electric Utilities & Climate Change

Introduction/Overview:

Climate change poses ongoing challenges that could impact utility bonds, necessitating a comprehensive evaluation of associated risks. MainLine has diligently assessed these factors across all investorowned utilities, not only now, but considering potential industry and climate change over the next 30 years.

Background:

The analysis was to give MainLine more insight to credit risk in the Electric utility sector, review if investors principal and interest is at risk, and establish a framework for reviewing future client purchases.

To conduct this analysis, MainLine used credit reports from S&P Capital IQ, research from Morgan Stanley and Municipal Market Analytics, and other industry white papers and official statement disclosures to research climate risk on the electric utility sector of the municipal market. The ability to quantify climate change risk today, for tomorrow on electric utilities is an art, and not a science. MainLine will continue to need to evaluate and review the findings of this study. With this as a starting point, in cooperation with our other climate change studies, MainLine will continue to evaluate the potentially growing risk in our investment process.

MainLine focused the Climate Change study as follows:

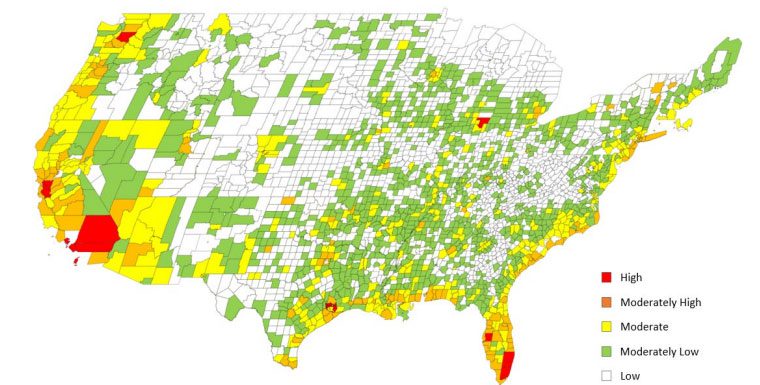

- Fire Risk assessment: The risk of higher temperatures, and less water increases the risk of fires caused by transmission lines. As experienced by Hawaii Electric in Maui, and years ago by South California Edison in California, if a utilities transmission of electricity causes a fire, the electric utility can be held liable for the damage. This damage could be at a cost that could threaten principal protection for bond holders. MainLine wanted to review our clients’ holdings and access that risk.

- Carbon Emission Risk Assessment: Sources of power that emit CO2 are not considered climate friendly and, as pressure builds to be carbon neutral, utilities that emit CO2 will be required to “clean things up”. Whether this involves transitioning to cleaner energy sources or implementing emission reduction technologies needs careful evaluation, considering the associated costs. A utility lacking cost-efficient options could incur costs, potentially straining its financial stability and posing risks to bondholders’ principal protection. Particularly worrisome are utilities heavily reliant on coal and those generating methane emissions from natural gas.

MainLine’s research is geographically displayed below showing the counties in regions where fire risk is a concern throughout the United States

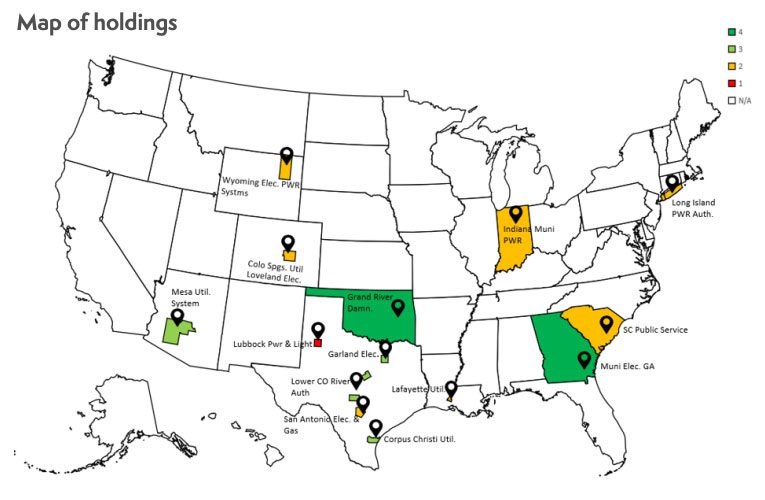

Issuers that MainLine view as having moderate to high fire and carbon emissions risk were further analyzed for operational and financial flexibility. This gives us the opportunity to analyze if the risk from fire or carbon emission exposure can be reduced, managed and or financially supported by the utility. More specifically:

- Operational Flexibility – This is a review on the ability of the utility to manage the risk or diversify away from it over time. What things can the utility do over time that will change our assessment of risk from climate change. Can the utility lower its risk of fire, or its reliance on carbon emission? Are there limitations to what they can do?

- Financial flexibility – This is a review on the financial strength and resources the utility has to help overcome the risks associated with climate change. Do they have the financial resources to fix the problems? Is the burden going to impact credit ratings, service costs and reliability?

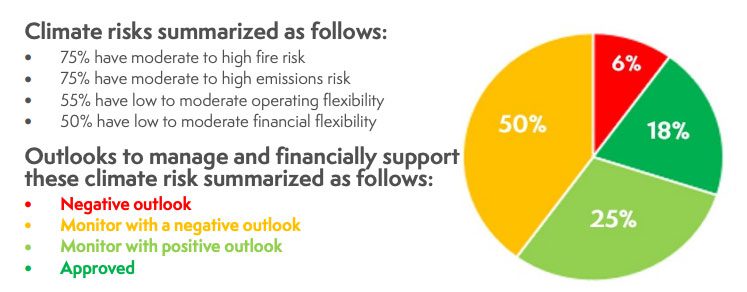

Once we have defined the risks (fire and carbon emissions) and the ability to manage them (operationally, and financially) the two will be compared and an assessment on whether MainLine feels there a chance of principal risk over the holding period of the bond. This is then categorized as follows:

- Negative outlook: Review economics of trade to sell.

- Monitor with a negative outlook: This means in MainLine’s opinion they will struggle to manage the risks of climate change but are not at risk for principal impairment at this time.

- Monitor with positive outlook: This means in MainLine’s opinion the issuer has the resources to manage the risks of climate change, but still have some challenges ahead.

- Approved: Climate friendly and no concerns now or the foreseeable future.

Client Holdings Conclusions

The Data:

What we found after researching 16 electric utilities owned by various MainLine West clients was quite diverse: Below is a chart showing the outcome of our four-prong analysis where we summarize the risk and outlooks on the electric utilities owned by our investors:

These issuers and their risks are both geographically and operationally different, creating an analysis that has many different sizes and styles. Each utility faces different challenges and have different ways they can try to manage them. Add to this the lack of consistent disclosure and sources of information you get quite the insight into the challenge climate change is having on our desire for reliable, carbon friendly, renewable energy. Below is a map of the holdings we reviewed with their outlooks. Detailed reports on the issuers will be provided to investors in their upcoming semi-annual reviews.

Conclusions:

Due to rising fear of climate change and government regulations, there has been an effort to lower carbon emissions by transitioning towards renewables. Most of the utilities have a target year to no longer use coal as a power source, hoping to cut their emission profile. Unfortunately, many are moving to natural gas, which creates methane emissions which are also not good for the environment. The use of renewables is on the rise, but there are financial and operational limitations for a lot of the utilities. MainLine feels most will not meet their carbon emissions free target dates.

- Move to renewables is not enough and cannot happen in the volume that is needed in the time required. Some utilities are not going to be able to match the switch any time soon. There needs to be a focus on making coal and natural gas more climate friendly.

- Fire risk is real and very hard to reduce and impossible to eliminate. The electric utility cannot move, and the cost to transmit the energy safely is pricey. The best investment defense is avoiding geographic areas with high fire risk, especially those with history. Yet the need for electricity is essential, so a provider in these “risky” areas will exist and if something happens, most likely repaired.

- There is no perfect electric utility to invest in, there is an essential need for the service. Does MainLine stop buying electric utility bonds? No, but we do evaluate and continue to monitor. What are we looking for?

- Fire Risk – Low to moderate fire risk or significant transmission underground, and no real

history of large destructive fires in the geographic area. - Carbon Emissions – Less than or equal to 20% coal and 60% fossil fuels as power sources

and working towards a full transition to renewable energy. The utility has non carbon options

going forward and are in line with current and future state and federal regulation. - Operating Flexibility: preferably a government owned utility, as well as being a sole

provider capable of setting rates independently. The utility should either generate surplus

energy or rely solely on its own production, serving a growing population with an average

median income at least 90% of the national average. Importantly, there should be no

pending litigation against the utility, and it should operate in a state that offers legal

protections or a fund to mitigate liabilities. - Financial Flexibility the utility should maintain at least 180 days’ worth of cash on hand or a

debt service coverage ratio of at least 1.5x. Its debt-to-capital ratio should not exceed 60%,

ensuring robust financial health and stability. These criteria collectively define our

requirements for a utility investment opportunity that aligns with our strategic objectives and

risk tolerance.- At least 180 days cash on hand or at least a 1.5x debt service level

- A debt to capital level at or below 60% and ability to borrow and raise rates to cover

costs without impacting operations. - Management history of solid, stable financial performance over years of changing

energy prices

- Fire Risk – Low to moderate fire risk or significant transmission underground, and no real

- MainLine will continue to monitor our clients’ holdings, and in their upcoming semi-annuals will provide a detailed analysis on each of the electric utility holdings in their portfolio. New investments will be reviewed with the above criteria to help ensure bonds bought are going to be principal safe for the next 30 years, as climate change evolves, or disappears.

- Our review also confirmed that the municipal market is still not differentiating between electric utilities with low or high climate change risk. Bonds to not trade at a premium or discount to each other. This allows MainLine to buy/sell bonds based on our credit outlook without giving up income. This remains a good time to “climate friendly” your Muni portfolio.

- Lastly, a special thanks to our summer intern Peter Magen who took the lead on this study, expanded it, and made it a reality.