Fund NAV Volatility Revisited

Munis finally stepped up in July with solid outperformance. Now, over the next 30 days, we are expecting some quiet time. In 2022, munis have proven to not like uncertainty or confusion. If the capital markets can choose a direction with inflation and the economy, munis should outperform over the last half of the year.

The Funds have had a tough first half of 2022, but on the flip side, Fund VII is set up to meet its objectives over the next five to seven years. Volatility in the NAV price for the Funds is not new, and is actually expected, particularly within the first couple of years when duration is at its longest and uncertainties persisting in the markets. This month, we update a study we conducted in 2019, analyzing Fund NAV volatility and showing how, in 2022, the Funds are just “doing their thing”.

Muni Market Review

The muni market finally got some of its legs back and performed well during the month (up 2.64% for the month – Bloomberg Muni composite index). Limited supply, good crossover value, and concerns with the economy (that highlight munis as a good late cycle performing sector) pushed munis lower and outperformed taxables.

Highlights for July are as follows:

- Muni yields were lower by 51 to 29 bps, with 10 year the best performing maturity and the curve flattening.

- Taxable yields were higher 39 to 22 bps with curve flattening.

- Issuance continues to slow down at the current higher level of rates. Total issuance is down 12% year-to-date versus 2021. This loss of new bonds has helped the market digest the outflows that continue from the mutual funds.

The muni market exited the month of July by “going on vacation”. It is a market that could use a month off to help settle retail investors down. The fall could be a test for our market if the outlook for inflation and the economy remain a mystery. 2022 has taught us that munis do not like uncertainty or confusion. Once the economic outlook points the way, munis should proudly outperform.

Market News & Credit Update:

- Just when the concern for states’ pension plans and funding ratios was all but over, the stock market declines of 2022 has brought them back into the news. In 2021, the average funding ratio was at 84.8%. It is now at 77.9% – a 6.9% (over one trillion) drop in assets available versus the liability. MainLine has always thought that the pension fund crisis was a long-term issue and year-toyear noise should not influence a fundamentally solid management plan. Different public plans are at different stages of their programs, and it more important to focus on the issuers’ commitment to contribution levels and managing liability commitments. Realistic investment returns will work out over the long-term.

- What a difference two years can make on the financial strength of a sector. Airports were on the “down and out” during COVID. Their high level of liquidity allowed them to ride out the decrease in traffic and set themselves up for better efficiency and improved operations. Credit agencies have been upgrading airports over the first half of 2022; Denver International, Dallas-Fort Worth, San Francisco International are recent examples.

Fund NAV Volatility Revisited:

It has been a tough year-to-date for the MainLine West Tax Advantaged Opportunity Funds. As we have

always said, one Fund’s opportunity is another’s pain. Fund V, VI, and VI.5 have seen their NAV’s drop year to date, but this same muni underperformance has provided Fund VII with an investment opportunity. MainLine first conducted this study in March of 2019 and feels like it is a good time to update it and share with investors again.

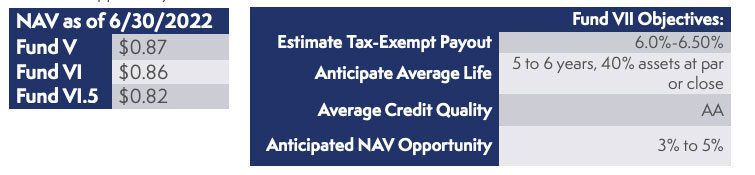

Below is a chart showing the NAV pain for Fund V, VI, & VI.5. The second chart highlights the forecasted opportunity for Fund VII.

What does this mean?

It means the Funds are doing what they have been designed to do and have done for over fifteen years. Let us show you this numerically:

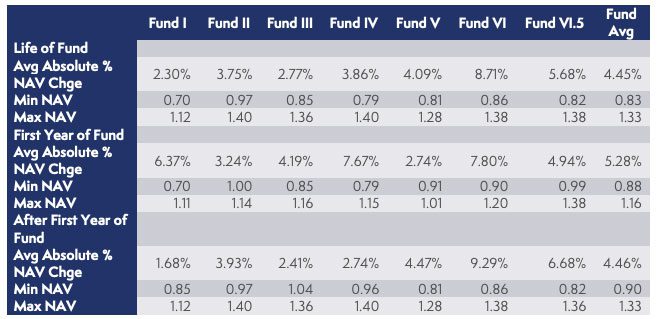

Analysis on Fund Monthly NAV Volatility:

Below is a chart and graph detailing the NAV history for each Fund focusing on the volatility by month since inception.

- The first year is the most volatile (5.28% vs 4.46%), as duration is at its highest, the market is usually still in transition, and the arbitrage outperformance roll has not begun.

- On average, the low NAV for the Fund’s has been $.83. This lines up well with the June 2022 NAV’s shared above for each of the active Funds.

- Over time, volatility has increased, with Fund V, VI to VI.5 being more volatile than Fund I to Fund IV. It has been a crazy couple years in “fixed-income land”, due to COVID and the reintroduction of inflation.

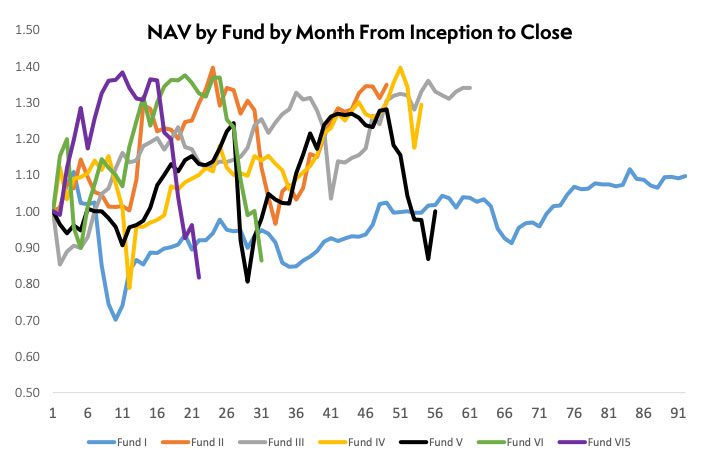

Above is a very busy graph, but if you take a moment and follow each of the lines, in most cases

you will see the following:

- Each Fund (except Fund III) has two to three down NAV time periods, followed by increases. It is not coincidental we have new Fund opportunities every two or so years, and the Funds lives are 5 to 7 years.

- As the Funds roll down the curve and pay out high tax-exempt income, the muni market does its thing, and the Funds do theirs, until the right moment to exit the strategy appears.

Conclusion:

- At this time, all of the Funds are a distance from needing the deleveraging capital and are in good shape to recover, once munis find their game again. They started recovering in July.

- The Funds are designed to need deleveraging capital if we see a two-standard deviation adverse move in the muni yield ratio. The market in 2022 has seen a 2 standard deviation move up in rates, but only a 1 standard deviation increase in the muni yield ratio.

- NAV volatility is the offset of the leverage used to pay out the higher income levels. MainLine is not concerned about the NAV during the first couple of years of the Funds. The Funds are designed to go up and down and provide a high level of exempt income. Over time, they roll down the curve and build up the momentum for an exit strategy that comes at a high final NAV – leading to the average 10% to 12 % total return.

- After a rough first half of 2022, the Funds are doing what they are set up to do, and MainLine feels are in a good place to meet their objectives as the earlier, now-liquidated Funds have in the past.