In 2025, Muni Experts – Expect Survey Says…

Mainline compiled several 2025 surveys from muni professionals to further enhance the outlook for the year ahead. These insights are drawn from the industry, for the industry, with a focus on keeping politics out of the discussion. It offers a concise overview of what municipal bond experts are forecasting.

Munis have hit the ground running in 2025. New issue supply and secondary trade volume are up and cashflow into the asset class remains strong. Munis performed in rhythm with other fixed income assets during the month, which demonstrates the tax-equivalent value investors are seeking in the asset class.

Muni Market Review

Muni supply continues to be a significant factor in dampening returns. Historically, munis tend to outperform in January due to the typically slow supply at the start of the year. This was not the case in 2025, as munis performed similarly to other fixed income assets, with cash from coupons, maturities, and calls reinvested into new bonds. In January, the Bloomberg muni composite was up .50%, US Treasuries were up .53%, and US corporate bonds were up .55%.

January 2025 highlights were as follows:

- Muni yields were mixed lower by 10 bps on the short-end, up 7 bps in the long-end with taxable also mixed 1 bp lower on short-end, 4 bps higher on the long end.

- Year-to-date issuance is already up 11% from 2024, which was the largest muni bond issuance year ever, as issuers continue to fund new infrastructure projects.

- The relative value of munis to taxables remains the same as it was a year ago, but tax-equivalent picture looks much better. Long term munis represent a 7.25-7.50% tax-equivalent yield, while intermediate term munis represent 6.25-6.50%.

- Not only is new issuance up, but secondary trade volumes are also up 10% versus 2024. Munis have hit the ground running in 2025.

The Mainline Tax-Advantaged Fund V has started liquidating assets, with a return of capital expected over the next 30 days. The current estimate is 15% to 30% of capital, depending on the market environment.

Market News &. Credit Update:

- Munis are already on the reconciliation list in DC. It took one day to get there. The Hill and Punchbowl News have compiled a menu of cost estimates for the reconciliation items that include the following: eliminate exclusion of interest on state and local bonds, elimination of nonprofit status for hospitals, and end tax preferences for private activity and Build America Bonds.

- In response to the reconciliation, the muni industry has officially released a study from the Government Urban Center-Built By Bonds, which was referenced in the 2025 Outlook. It states that the cost savings for tax-exempt issuance per family is $6,555 annually. In other words, the elimination of tax-exempt financing by municipalities would create a $6,555 annual tax increase. How is that for rewarding small-town America for turning red? Mainline will detail this analysis more in an upcoming monthly. The details warrant close examination.

- New this month and every month going forward, will be a review of the Mainline West Family of Funds. Due to the time lag of month-end results and this publication, the information will include the previous month’s return information and an updated portfolio review and Outlook. Mainline hopes this will help keep you better informed on progress of the Mainline West Family of Funds.

MainLine West Family of Funds Update As of December 31, 2024

Fund V: Total Return: 5.88% Life to date payout (tax-exempt): 5.52% NAV: $1.00

- The Fund continues to pay out stable tax-exempt income, up slightly from 2023 (5.39%) due to a favorable funding rate versus the floating swap rate. The NAY remains around a $1.00 NAY, as munis continue to work through high new issuance and range bound yields.

- The Fund is planning to begin liquidating assets and there will be return of capital over the next 30 days. We estimate a 15% to 30%return of capital, depending on the market environment.

Fund VI: Total Return: 4.28% Life to date payout (tax-exempt): 5.63% NAV: $.93

- The Fund continues to pay out stable tax-exempt income, up slightly from 2023 (5.54%) due to a favorable funding rate versus the floating swap rate. The NAY continues to trade below $1.00 as it waits for the 4% coupons to outperform, which will happen in the event munis finally outperform.

- The Fund re-levered at year-end, selling a bond with a short call and repurchasing with a longer duration bond, which also provides additional income.

Fund Vl.5: Total Return: 3.83% Life to date payout (tax-exempt): 5.42% NAV: $.93

- The Fund continues to pay out stable tax-exempt income, up slightly from 2023 (5.30%) due to a favorable funding rate versus the floating swap rate. The NAY continues to trade below $1.00 as it waits for the 4% coupons to outperform, which will happen in the event munis finally outperform.

- The Fund re-levered at year-end, selling a bond with a short call and repurchasing with a longer duration bond, which also provides additional income.

Fund VII: Total Return: 6.36% Life to date payout (tax-exempt): 5.43% NAV: $1.07

- The Fund continues to pay out stable tax-exempt income, up slightly from 2023 (4.71%) due to some trades in 2024 and a favorable funding rate versus the floating swap rate. The Fund has also enjoyed some NAY appreciation since inception as its arbitrage trade matures.

- The Fund re-levered at year-end, selling a bond with a short call and repurchasing with a longer duration bond, which also provides additional income.

In 2025, Muni Experts Expect – Survey Says…

Introduction:

Mainline has compiled surveys on the 2025 municipal market from Coalition Greenwich (a leading provider of strategic benchmarking, analytics and insights to the financial services industry) and Morgan Stanley. Included are the thoughts and opinions of muni professionals (portfolio managers, credit analysts, traders and financial advisors) on various topics going into the new year. Mainline finds this information insightful and shares it to highlight how the municipal market views itself and anticipates changes in the coming year. Let the survey questions begin!

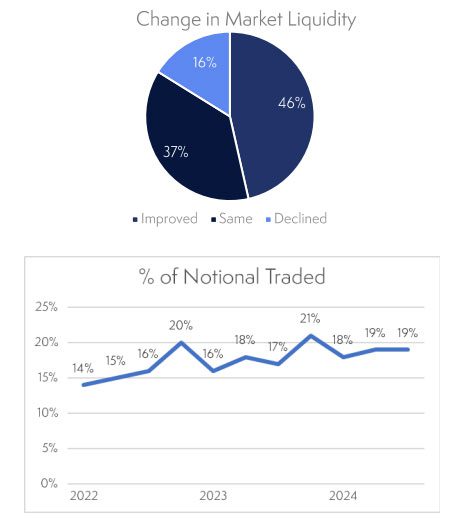

Will the exit of Citibank and UBS, along with the rise of electronic trading, impact market liquidity in 2025?

The survey on changes in market liquidity indicates: Almost half of those surveyed feel market liquidity has improved.

The use of electronic trading is expected to trend toward 40% in the years to come.

Survey says:

A significant growth surge is needed, as the past three years have shown a slow upward trend, with levels still only reaching 19% to 21%. One upside of increased electronic trading is the additional liquidity it supplies to the market.

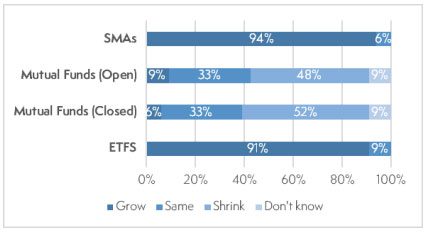

There are numerous ways to invest in munis. Recently SMA’s and ETFs have led the way. What are the expectations for 2025?

Survey says:

SMAs &. ETFs will continue to led the way, while mutual funds will continue to shrink.

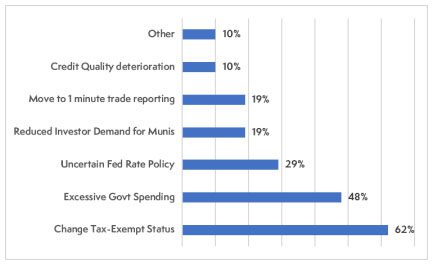

2025 ushers in a variety of concerns for the muni market. What do the muni professions worry about the most?

Survey says:

Change in tax status and excessive government spending are the biggest concerns for muni professionals.

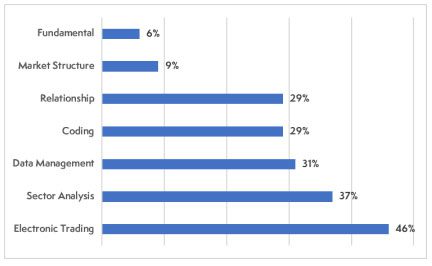

The muni market has continued to evolve in recent years. Structure, distribution, sector credit and technology to highlight key topics. What skills are muni firms looking to add to their trading desks in 2025?

Survey says:

Electronic trading and sector analysis skills are going to be in demand.

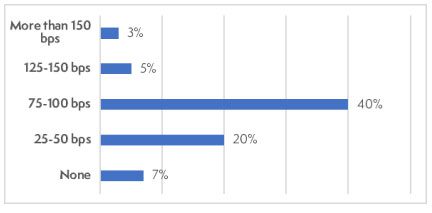

How many Federal Reserve rate cuts do you expect in 2025.

Survey Says:

75 to 100 basis point cuts in rates are the consensus average.

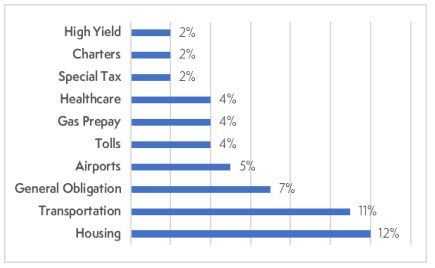

What muni sectors do the experts feel will be the top performers in 2025?

Survey says:

Housing and transportation sectors are expected to outperform in 2025.

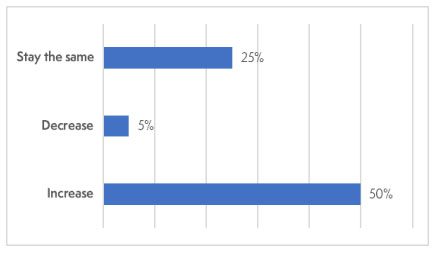

Will allocations to the muni market increase, or decrease in 2025?

Survey says:

Half of the participants feel allocations to munis will increase in 2025.

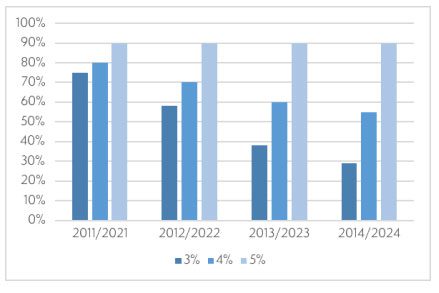

While not a survey question, this provides a valuable benchmark analysis for those concerned with call risk and coupon preferences. The survey did not include 5% coupons, it only included 4% and 3% coupons. The 5% coupon was excluded, as it is not a concern given that the likelihood of a call has historically been above 90%. As a result, 90% odds of a call was used in this graph, which differs from the original survey from Morgan Stanley.

Call risk remains for high for 3% coupons, with 70% extension risk. There is a 50% extension risk for 4 % coupons, but a high chance of 5% coupons being called.

Conclusion:

Alright, Mainline has laid out the 2025 Outlook, with insights from both muni professionals and Mainline West. Now, it is time to get everything organized and ready. Mainline will be hosting an investor call on February 19th at 5 PM EST, where we will discuss our 2025 muni market outlook and the forecast for the Family of Funds. We hope you can join us! If you cannot attend, we will record the call and make it available upon request. Be on the lookout for an email with a link about a week before the event!

View the Monthly Review PDF here – View Report Charts