Going, Going…Citi Gone:

Just like that, from third top underwriter over the last 11 years representing $50 billion a year (10% market share) to zero. Why? How does this affect the muni market? What does it mean going forward? How does it affect muni investors? How does it affect MainLine West? This month, we review muni underwriting over the years and what it means to have Citi departed from the market – like homerun ball over the left field fence.

For the month, munis were down small (-.51%) but, as the month came to an end, it was easy to see the swelling of bullish sentiments, as February will be a big month for reinvesting of proceeds. Adding to this, new issue supply and secondary market trading are higher on average year-to-date, it appears the muni market is not grieving the loss of Citi. It’s step in and get busy -or- strike out and get left behind.

Muni Market Review

The muni market cooled off in the month of January, slightly underperforming the other taxable indices. Munis were down -.51% versus US Treasury index at -.17% and Corporate down -.28%. As the month was coming to an end, munis were starting to set a strong course to lower yields. January highlights were as follows:

- Muni yields were higher by 11 to 7 basis points, with taxables higher by 6 to 11 basis points.

- Supply, not surprisingly, has started strong inTo date, new issuance is up 24% versus 2023, and higher by 7.5% versus the five year average. MainLine expects this to be a major theme in 2024.

- Muni yield ratios are rich, but investors are still interested in the tax-equivalent yield they can receive. Mutual fund flows have been positive for three weeks in a row. The last time this happened was in the summer of 2023.

MainLine thinks the recent selloff in January may represent one of the better buying opportunities for the first half of 2024. February will have a lot of maturities and bond call cash looking for bonds, providing third highest demand in 2024 after June & July.

Market News & Credit Update:

- Basel III capital reforms, if passed, will have some negative repercussions on the muni market. A letter filed by the Government of Officer’s Association, along with six other muni market makers, if passed, would increase borrowing costs, reduce liquidity and stability in the muni market. Muni bonds would be treated as a so-called “posted collateral” and require certain haircuts, which would increase capital from 8% to 20% needed on the books. This increase in cost would be passed down to cities and states, as banks will be less likely to own munis unless they earn more on them. The absence of the banks buying munis will decrease demand and increase yields (i.e. costs to the borrowers). The letter cites the low default rates on munis and how they should not require additional capital.

- Hawaiian Electric, a private electric utility company responsible for the Maui fires and faced with a potential $4 billion in lawsuits, has had the state submit a bill to issue securitized bonds backed by customer rates to cover the costs. Bonds will be sold and an in increase in power rates is likely to pay off costs over the next 30-plus years. This is of interest, as it deals with the essential service provider to a service region with limited options and the sensitive nature of the public paying for a corporate mishap. What else could they do – bankrupt the electric utility and start over? Who would invest in a new company? The plan still needs to be approved, which will be a political hot potato, but there are few other options. Hawaiian Electric issues tax-exempt bonds back by electric rates that have been considered distressed and selling for 68 cents on the dollar. MainLine has zero exposure to the issuer.

Going, Going…Citi Gone:

Introduction:

The big news at year-end in munis was Citigroup exiting the market. If you have been following our updates, this does not surprise us, but does baffle us with its speed. Now, we need to look at its impact on the muni market, going forward. Citi was forever a top-5 underwriting firm in munis, until they started cutting back in 2023, finishing 6th). According to Citi, “munis do not fit with the plan to make Citi the premier bank for large multinational corporations”. The street has already started replacing Citi’s presence, hiring their top flight professionals (some good friends) and growing internally. This underwriting void will be picked up by current underwriters grabbing more market share, and some new firms looking to become players. Yet, MainLine thinks this could be the beginning of a new trend in the issuance and distribution of munis to retail investors

On a personal note, it’s just hard to imagine munis without all of the research and market making skills Citi has always provided MainLine. Lots of good friends and important moments in MainLine’s 15 year career have been shared with “The Citi”. Just ask Fund I. Citi will be missed in muniland in many ways, and by MainLine West.

Background:

Citi departing the muni market is not the beginning or the end of changes to come, it will just be the moment everyone points to, as things are changing. Citi is not the only change that MainLine is aware of. UBS (top 20 underwriter) and Goldman Sachs (Top 10) are also looking to cut back. Underneath Citi’s explanation for leaving munis are some pure economic facts and the bottom line of the bank. Munis have never been a get-rich business for anyone, but have always been regarded as low risk. After the last three years and the market price swings and increased regulations, some firms are questioning the economics of muni versus other investment classes. Citi stopped questioning and made its decision to move capital elsewhere. This will not change and could cause more “unloading” of muni business in the years to come by other banks. Let’s revisit the past first, then we can look to the future.

Data Analysis:

Data used is from 2013 to 2023 (11 years). Source Bloomberg All muni underwriting (long, short, competitive, negotiated, and commercial paper). Here is an overview of what we found:

- The muni distribution system has been stable and consistent.

- Distribution is Non-Diverse.

- Slowly changing its players and distribution flow in recent years.

Consistent Performance:

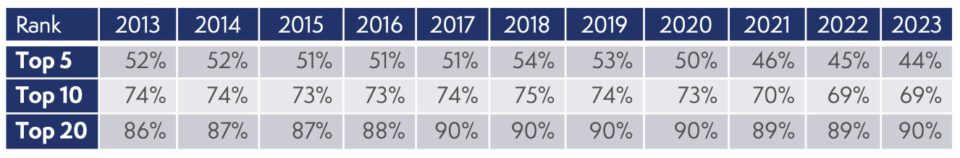

Below is a chart showing the top 5, 10 and 20 underwriters and their percent of total that they underwrote each year:

- Top 5 averages 50% of all new bonds, tight range of 44% to 54%

- Top 10 averages 72% of all new bonds, tight range of 69% to 75%

- Top 20 averages 89% of all new bonds, tight range of 86% to 90%

The above demonstrates consistent market share from consistent underwriters, but this has slowly

been declining. These players have built a book of bankers and established relationships with the

issuers. This keeps business from moving quickly to other underwriters.

Large Bank & Broker Dealer Dominated:

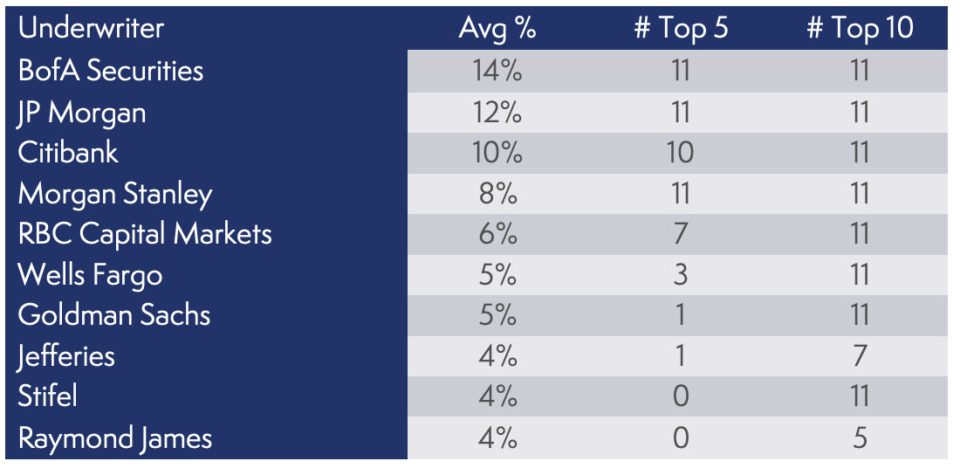

Municipal bond issuance is dominated by big banks and broker dealers. Below is a chart showing the

average market share over the last 11 years by underwriter and how many times they were ranked in

the top 5 and top 10:

Bank of America (BOA) is the clear leader, averaging 14% of all underwritings each year, followed by JP Morgan at 12% and Citibank at 10%. More highlights:

- BOA and JP Morgan have always finished top five, Citi came up short for the first-time in 2023.

- There are seven firms that are always in the top ten.

- Only 12 firms have occupied a top-10 position and only eight a top-5 position.

This shows a non-diverse distribution system that has been stable, well known, predictable and worked well most of the time. Costs to issuers have been on the decline, pricing disclosure is better, but both of these are still suspect at times.

Going Forward

Citibank is completely out of munis, UBS is only doing competitive underwriting, and Goldman has significantly reduced their muni sales staff. Let’s do some quick math:

- Citibank averages $50 billion a year in underwriting volume

- UBS averaged $3.1 billion; we can estimate this to be at least half of what it was when they did negotiated deals, as well.

- Goldman Sachs averages $20 billion. Let’s assume they stay at the same pace, which at this moment is not much different than 2023 ($2 billion lower). The decrease in sales staff will create a need for new distribution paths to maintain high underwriting levels.

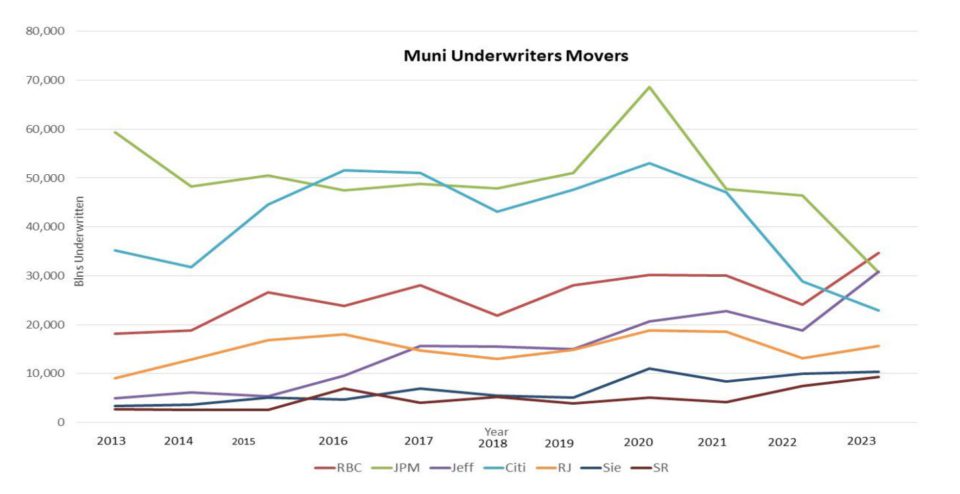

This means an estimated 13% of the issuance will need to be underwritten by another firm, or roughly $54 billion. Who could this be? Let’s look at the latest movers up and down in muni underwriting:

As Citibank and JP Morgan are down over the years, Jefferies, and RBC have grown. Smaller firms like Raymond James, Siebert and Samuel Ramirez have also been growing. Other than these firms, it is also rumored that Hilltop and Oppenheimer & Co are looking to hire Citi employees and grow their underwriting business.

The market will pick up the 50+ billion in issuance and it will take a group of firms to handle it. New and old firms can add muni personnel to pick up the underwriting needs, but how will distribution of muni be impacted, as costs and large firms cut back on sales and support staff? There has been a slow movement that the Citi and Goldman Sachs decisions highlight in changes to the distribution system. This change is the increase in the use of electronic trading platforms and algo models making markets. The small retail or wealth advisor (SMA) will be limited to buying bonds this way as resources for orders under $100,000 (give or take) will not have a place at the underwriting desk or top sales offices.

Conclusions:

The top underwriter firms, secondary market providers and distribution systems are changing and,

along with them, the question of how to manage within the muni market for better value, cost savings

and opportunities.

- Look for more “players” in the underwriting space, and more of a focus on regional coverage working with same region issuers. There are already smaller shops, and newer ones getting involved in 2024, like Truist and StoneX.

- Expect new top tier and growing underwriters. The top 10 and 20 will now be more fluid. Investors will need to be alerted to find who has the bonds and who needs them.

- There is a growing industry for trading Munis on platforms and with “algo” models (will highlight in a future monthly review) feeding on and eating up retail clients. Both provide munis to investors in a simple fashion, but at a cost with prices up and down that can be greater than 2%. At current yield levels for a 20+year bond, this can be 30 basis points in yield or 10% decrease in annual income. Small retail and SMA managers will be limited to getting their bonds here.

- A majority of the muni investors will not notice a thing right away, but over time they will. Their bottom line will be lower, due to less income (higher costs to getting bonds) and prices paid or sold will cost total return. Yet, with that will come a greater ease to buy and sell the bonds you want – at a price.

- MainLine’s clients will see no difference in execution from us. We are committed to institutional access, even if it means making new friends at new muni shops and monitoring who has the bonds and where they are coming from. The buying power of our Tax Advantage Funds and client base will keep our buying access from the underwriting desks and major sales offices. This is important to obtain the best prices on bonds before they are marked up.

View the Monthly Review PDF here – View January Report Charts