Good Riddance 22, Part II:

I still greet my first 2023 “Hellos” with “Good riddance to 22”. Yet, I have to admit I am still having bad dreams and catch myself looking in that ugly, broken rearview mirror. So many lessons to be learned… I am hoping, by working through more of them this month with you all, I can exorcise all of the demons and enjoy the 2023 view.

What confusion? What correction? The muni market rally started on January 2nd (yes a holiday) and continued through month -end. It took the change of a calendar year for investors to finally embrace the tax equivalent value of munis. It has been so one-directional and led by value, with no new bonds being chased by lots of cash. So far in 2022, the market has already gained 35% to 50% of what analysts expected for the entirety of 2023.

Does this mean we have another correction ahead? Most likely not, but there may be some backing off of yields and better value when issuance finally gets going in the next 30 to 60 days.

Muni Market Review

The muni market enjoyed a rebirth in January and now investors cannot get enough of them. Low issuance and strong demand has munis posting a 2.87% return for the month, outperforming US Treasuries that returned 2.51% (Bloomberg composite indices). Some types of munis were up twice as much (bonds with lower coupons, and more credit sensitive sectors). Highlights as follows:

- Muni yields were lower by 47 to 39 bps as the curve steepened. Taxable yields were lower from 35 to 25 bps as it also steepened.

- Outflows have ceased, as investors are reallocating funds to the muni market, prompting inflows for three weeks in a row. The technicals were already bullish with more proceeds from coupon and maturity payments than supply in early 2023. These inflows are making it harder to find bonds.

- Supply is down 23.6% from 2022, and 51.5% from the five-ear average. More discussion of this below, as MainLine expects issuance to pick back up in the next 30 days.

MainLine Family of Funds have performed well in early 2023 with NAV’s roughly 5% to 10% higher than year-end.

Market News & Credit Update:

Muni issuance in 2023 is off to the slowest start since 2018 when the Tax Cuts and Jobs Act change dampened supply. New issuance is down 24% from 2022, with issuance for the month is estimated to be around $18 to $19 billion. In 2018, only $16 to $17 billion was issued. In 2017, a change in tax code stopped tax-exempt prerefunding and threatened to cut the muni market off to some sectors. There was an increase in issuance in December of 2017, front running these anticipated changes. Why is it so low in 2023? Higher borrowing rates, and still some uncertainties in the market, have issuers waiting to sell bonds.

The top ten muni underwriters for 2022 underwrote 68% of all deals, up from 66% in 2021 and Bank of America remains the clear-cut leader. This continues the upward concentration trend since a low of 54% in 2013. Some of the players have changed in the bottom five, but the top 5 still underwrite approximately 50% of the total. They are: Bank of America 12%, JP Morgan 11%, Morgan Stanley 7.5%, Citigroup 7%, and Royal Bank of Canada 6.7%.

If DC is foolish enough to default on US Treasury debt payments, how would this hurt the muni market? MainLine feels yields would move upward in sympathy with US bonds, but not to as great a degree. Munis would outperform, supply will remain low, and the fundamentals of the muni market would not be impaired. Some Federal fund dependent sectors, such as certain types of housing, transportation (Garvees), and hospitals that depend on Medicare funds could have adverse rating actions. People still need water, electricity, public education, hospitals, and other essential services. In fact, it may offer a Family of Fund opportunity moment. MainLine West Tax Advantaged Opportunity Fund VIII?

Good Riddance 22, Part II:

MainLine proclaimed, “Good riddance to 22”, yet so much happened that there still remains a few more lessons to be learned and a few things that slipped by unnoticed. Let’s review some other 2022 “fun facts”. We promise this will be the last time MainLine looks back, as the view ahead looks a lot better.

Real Outperformance 2022

Munis outperformed impressively in 2022, and that was without looking at the tax equivalent return. Estimating the adjustment for taxes the performance for 2022 looks like this:

(2) Tax exempt income is grossed up Fed 37.5%, 3.80% Medicare Tax, and 2.5% (5% state tax, w/ 50% assets)

SALT 2022 Revisited?

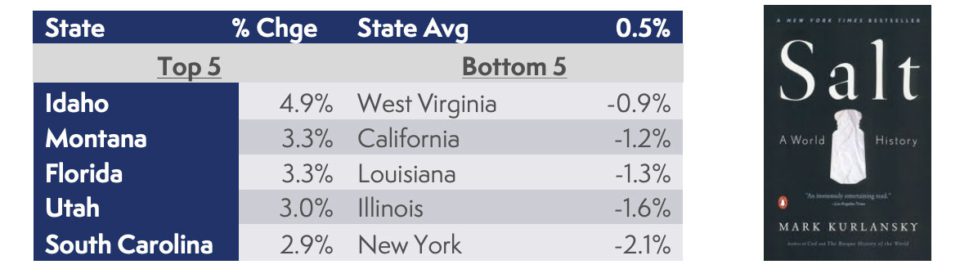

Population change from July 2020 to July 2022 shows an interesting trend:

High tax states are experiencing out-migration of the population, low- or no-income tax states are having in-migration. Texas is actually 6th on this list for growth at 2.7%. Do we think any of this also had to do with SALT? The 2017 tax reform placed a $10,000 cap on the State and Local Tax (SALT) deduction on Federal returns. This cap has created a large increase in the effective tax rates for residents in high-tax states. Salt trade financed and determined the course of history by defining where colonies were settled. Is SALT now redefining the course of USA politics and wealth?

Bad Riddance?

Texas Permanent School Fund, the “OG” of Muni monoline insurance is close to full capacity. Veterans of the muni market know and have respected the PSF tag as the gold standard in principal protection. PSF guarantees bonds issued in Texas by public schools throughout the state. It is AAA credit rated, its underwriting program is fully collateralized and insures the repayment of coupon and maturity payments. Even during the monoline meltdown from 2008-2010 in the muni market, PSF remained AAA-rated. PSF increase its capacity in 2009 to ensure more bonds and is now about to reach its limit of $117.3 billion. This does not mean it will go away, it will have the capacity to insure as old bonds mature, are called, or become uninsured. It could also at some point in the future get approval to increase capacity. What does this mean? The value of PSF bonds is likely to go up, and why do other states not look to duplicate this type of support for its public schools? PSF is the only monoline insurer MainLine has ever trusted to protect muni investors.

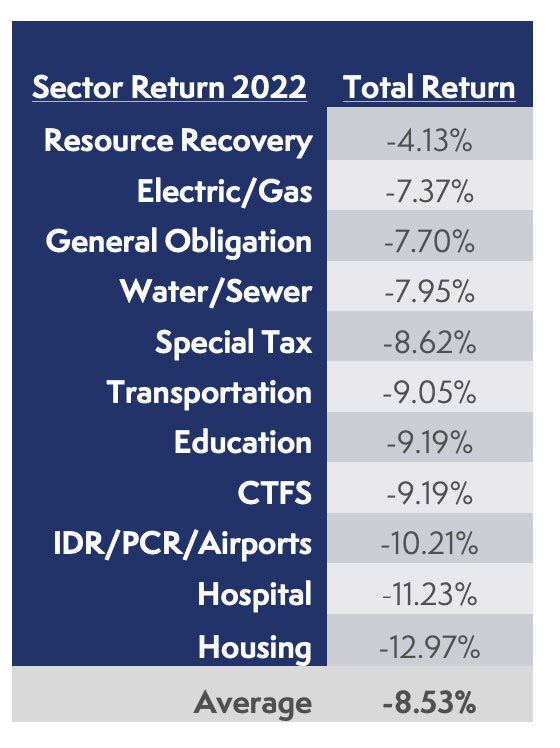

2022 Sector Performance, Second to Coupon and Duration:

In 2022, performance of individual muni bonds had a wide range of returns. In our 2023 Outlook, we showed the difference in a bond (same issuer and maturity) and the total return range from a coupon of 2.375% (down 32.6%) to 5% coupon (down 13.9%). Another big factor in performance pain was sector. This chart shows that, depending on the sector, returns were down 4.13% to 13.0%. Housing is at the bottom of this list, as they are issued at par (low coupon) as credit quality remained strong in 2022. As for other sector comparisons like hospital versus electric/gas? This shows the credit concerns facing hospitals in 2022, and the noncyclical nature of steady credit quality electric utility bonds. Weaker credit sectors felt the most pain. Imagine how a low coupon hospital bond must have felt?