Rebirth of the White SWAN:

The investment performance of municipal bonds over the long-term continues to be outstanding compared with other US mainstream asset classes. This performance has remained impressive, even through seven “market stressed” events from 2007-2022. MainLine updates a 2016 analysis and the

results remain the same even after these events. How does 8% tax-equivalent with top quality principal protection sound for the next 10 to 30 years?

As of the end of February, the muni market is back to a reset for 2023. Yields were down big in January, and back up big in February, netting a change of +4 to -2 bps year-to-date. Munis have yet to settle down. MainLine feels the recent sell-off represents an opportunity to get long-term tax-exempt value once again, but it could be another 30 to 60 days before the muni “cruise control” kicks in.

Muni Market Review

It is official, munis are back to where they started at the end of 2022. After being up 2.86% in January, the Bloomberg composite index was down 2.26% in February, netting to marginal year-to-date total returns of up .6%. This was not a surprise and no, this is not going to be a repeat of 2022. Munis still have a lot going for them, we just need more stability from the Fed and the economy, and strong muni technicals will take off, again. Highlights as follows:

- Muni yields were higher by 59 to 36 bps as the curve flattened. Taxable yields were higher from 59 to 28 bps as it also flattened.

- There was one week of muni fund outflows in February, year-to-date inflows are over $7 billion, which is not much compared to the $145 billion that flowed out in 2022. There is a lot of money waiting to make its way back to munis.

- Supply remains down and not showing signs of increasing. Year to date versus 2022 issuance is down 22% and 33% from the five year average. At some point, there are projects that need to be financed, and supply will pick up.

Market News & Credit Update:

What is more surprising than Payton choosing to coach the Broncos? Or Prime Time the CU Buffs? How about Illinois getting another credit rating upgrade to A-. There are no longer any states rated below “A-”. The State’s budget is getting closer to being balanced, and budget management is back in style in the state. Do not be too quick to high-five Governor Pritzker. The receiving of Federal funds over the last three years from COVID and economic stimulation during a period of a good state economy, could be viewed as a “blue state” bailout from DC. Yet, I think you still have to give the State some kudos. They could have just wasted the money and not looked to make improvements, as they have done for decades.

Puerto Rico Electric Power Authority (PREPA) is challenging in US District court that creditors have claim only to existing funds, and not future revenues as they work through bankruptcy court. Why does PREPA, a worthless muni creditor, and its attempt to skip out of paying its bills matter? Revenue bonds have always had a preferred position in a chapter 9 filing. All revenues are first lien to the creditors, and cannot be redirected to other entities. If the court rules that PREPA can segregate funds, next up could have the Chapter 9 process challenged.

In another developing credit issue and redefining a process, Florida Governor DeSantis is looking to take control of the Reedy Creek District, which was set up to give Disney self-governing rule. The proposed changes would see the district to be overseen by the State and give it the power to be involved in decisions and impose taxes. The $1 billion in debt outstanding will remain unaffected and repayment from the current revenue sources. Reedy Creek has become a political toy that thankfully did not become a muni bond concern.

The Rebirth of the White SWAN:

Over the long-term, the investment performance of municipal bonds continues to be outstanding compared with other US mainstream asset classes. This performance has remained impressive, even through seven “market stressed” events from 2007-2022). Although all of the events did affect valuations and returns, they did not affect the principal protection, the pillars of strength in municipal finance or the long-term performance of munis. These events included the following:

- The 2008 banking crisis, collapse of Bear Stearns and Lehman, and the demise of monoline insurance in the municipal market.

- In 2010, Meredith Whitney’s appearance on 60 Minutes, calling for widespread defaults in the municipal markets.

- In 2013, the “Taper Tantrum”, City of Detroit default and the expectation of Puerto Rico’s pending default.

- In 2016, “BREXIT” and the surprise Trump election.

- In 2017, uncertainty surrounding municipal taxation was caused by the Tax Cuts and Jobs Act.

- The 2020, COVID 19 pandemic that shut down the economy and caused havoc in financial markets.

- 2022 Aggressive Fed tightening and the return of inflation.

Municipal Bond SWAN Qualities Defined:

Sleep well at Night (SWAN) means investing in munis for the long-term and not having to worry about getting your money back, while receiving good tax-exempt income in return. If you knew your muni investments would give you 8% tax-equivalent over the next 10 to 30 years and receive full principal back, my guess is you would sleep well at night.

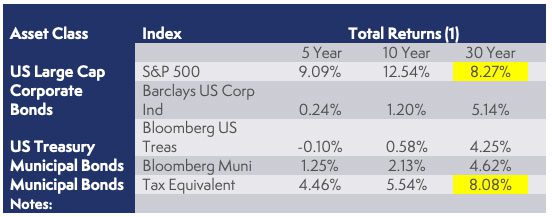

After a horrible inflation-fearing 2022, COVID 2020, and 2017 Tax Reform, munis over the years have provided above average tax-free returns and protection of principal. The charts below show the returns of munis versus other asset classes for 5-, 10- and 30-year time horizons:

(2) Tax exempt income is grossed up by average federal tax rates and 2.5% (5% state tax, w/ 50): 2022, 5 yr & 10 yr includes 3.80% Medicare tax

Over 30 years, munis on a tax equivalent basis have kept up with stocks and outperformed all other US fixed income asset classes. 5- and 10-year returns are a bit lower than stocks, but still outperform other US fixed income assets. Investors and Advisors have under-appreciated the tax benefits of munis and have under-appreciated the principal protection powers. The chart below shows default rates for all S&P rated municipal and corporate bonds over the last 30 years.

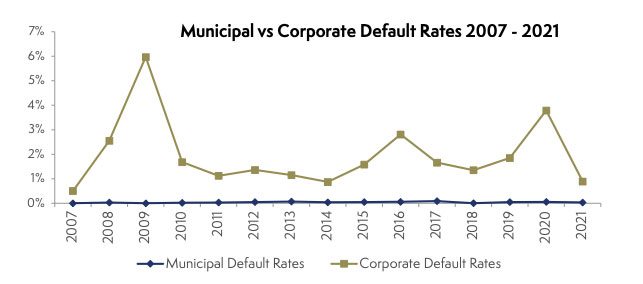

On average, muni defaults occur 3 out of every 10,000 issuers, while on average 1.81% of corporates have defaulted. That is a 60 times greater chance of default for corporate bonds! Look at the maximum defaults for corporates in 2009, when 597 defaulted out of 10,000, munis maxxed out at 9 in 2017, as Puerto Rico sank. It’s not even a fair comparison, but what else are we going to compare it to?

Munis Swimming Through the “Turbulent” Years 2007-2022:

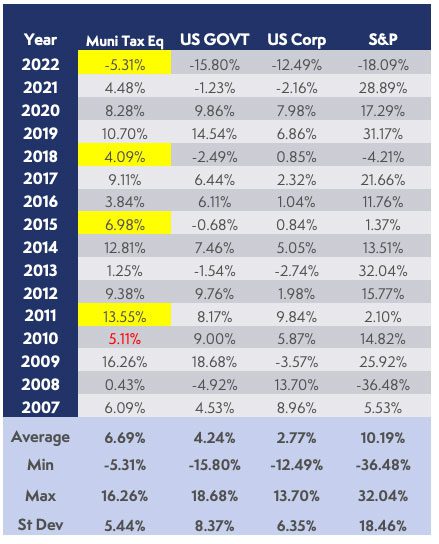

A good SWAN long-term strategy should not be affected by the year-to-year ups and downs of the market. You manage reinvestment risk, hold good quality bonds until maturity or until they are called, and an investor should enjoy the returns shown above. Yet, sometimes investors get off track, go through life changes, or they become undisciplined in their investment plans. Let’s see how munis have done through each of the 16 “turbulent years” we discussed above. The next chart shows returns by year, adjusting munis for taxes.

Fixed income total returns from Bloomberg composite indices: Munis = LMBITR, US Govt = LUACTRUU, US Corps = LUATTTUU, S&P = SPX Muni adjusted for tax-exempt income annually as noted in 30m year chart.

The years highlighted in yellow are when munis were the top performing class, including stocks. Return

numbers are bolded when munis are a top fixed income performer and numbers in red when munis were the worst of all asset classes in performance. Final count out of 16 turbulent years:

- 4 outperformances (highlighted in yellow) (25%)

- 8 top fixed income asset classes (number in bold) (50%)

- 1 underperformance (number in red) (6%)

On average, annually munis outperform all fixed income asset classes 6.69% versus 4.24% and 2.77%. Stocks did better at 10.19%, but also showed over three times the volatility with a standard deviation of 18.46 vs 5.44. More return for more risk. In fact, the standard deviation for munis is the lowest amongst all asset classes. This is another SWAN feature and should help investors keep to the muni plan. Slow and steady wins the race in fixed income, and over thirty years, it is a photo finish with stocks.

The final piece of a SWAN strategy after good stable return, is principal protection and to see how this changes during “turbulent” times. Below is a graph showing default rates by year from 2007 to 2021 for all S&P rated munis and corporate bonds.

The graph above is not a fair fight: munis default rates from 0% to .09% versus Corporates from .5% to 5.97% on the same axis. It does not matter what year, what time frame, what crisis, the muni default rate remains barely measurable. The default rate declines even further if you focus on rated bonds and avoid certain sectors.

There have been times when the muni market seemed to be driving off a cliff and there undoubtedly will be tough times ahead. The fundamental pillars of strength of muni finance remain in place and this has not changed. The muni market provides a very important function at the state and local level. Unless the current US Government system changes, this should not change. People need clean water, electric power, schools for their kids, hospital care, and a whole lot more essential services that muni finance provides.

Bonus SWAN Coverage:

We could not help but have some fun with this and hope some of you appreciate it. The timing seems appropriate, and I do not want the 5 minutes infomercial I recently watched to go to waste.

Sleep Well At Night Muni Portfolio?

- Top shelf principal protection.

- Long-term top performing tax-equivalent returns.

- No fuss, low day-to-day noise, just keep those taxexempt coupon payments coming.

Sleep Well All Night Body Pillow?

- Contours to your body.

- Provides pressure relief.

- Breathable cooler fabric.

Being an expert on both, I declare the muni portfolio is the clear-cut winner!