February 2022 – The Curse of the Low Coupon:

By month’s-end, the muni market was a mirror of the taxable market, but day-to-day challenges did not make it a smooth ride. The market remains soft and vulnerable, especially given its first two months of sub-par performance. Add in the fact that the next 30 to 60 days is usually a technically weak time of year.

Some investors prefer buying bonds at par, comfortable with the knowledge they are paying $1 for each $1 they get back. Some are even more excited to buy long-term bonds at a discount. This is fine if rates go down, or the bond is held until maturity. If rates go up, and bonds need to be sold prior to maturity, these “par bonds” may be at a market discount, and, if big enough, they would not be fully tax-exempt. The result is a much lower value than a fully tax-exempt bond in order to make up for the tax now incurred from the deep discount. The market refers to these as Market Discount outside De Minimis bonds. MainLine calls this the curse of the lower coupon. In this monthly review, we demonstrate where this curse comes from, how much it hurts, and how to avoid it.

Muni Market Review

February had a lot of up and down days for munis, and not always in the same direction as taxables. However, by month’s end, they mirrored each other. Munis are on soft ground right now: outflows continue, supply is way down, and deals are hit or miss day to day. Highlights are as follows

- Muni yields were higher from 12 to 3 bps, flattening again as they did in January trying to stay in line with taxables

- Taxable yields were higher from 13 to 2 bps, with continued flattening.

- Outflows continue, as a rise in rates has created concern with muni investors. New issuance is

down by 22% year-to-date, which is helping keep the market from selling off more than it has.

Munis are entering into a technically weak time of year. Given the last two months of poor performance and outflows, if munis can stay even with taxables, it will be a major victory. MainLine is looking to take advantage of any further underperformance if it occurs in the next 30 to 60 days. We recommend you prepare to do the same.

MainLine West Tax Advantaged Opportunity Fund VII is open for subscribers and we have a limited number that can be accepted. When the opportunity hits, we plan to move fast. Please contact us if you have any questions or need the necessary paperwork to become an investor.

Market News & Credit Update:

- A good thing can just be too good. There are eleven states considering cutting income or

corporate tax rates, as budgets are balanced and general fund balances are growing, due

to a surplus of revenues. These tax cuts give rise to potential legal battles over a provision of the

American Rescue Plan that bars states from replacing revenue lost from tax cuts with portions of

the $350 billion allotted for pandemic assistance. - The recent increase in rates from record-low yields over the last couple of years has given rise to

bonds trading at prices below their de minimis levels. Barclays reports that 70% of 2% coupon

bonds now qualify as bonds trading at impaired prices, due to tax ramifications of the

market price discount. MainLine goes more into this potential risk of buying par coupon bonds

in times of low interest rates in this month’s credit review. - Final 2021 credit rating changes, according to Moody’s, shows that 73% of them were upgrades, 27% downgrades. This represents the most positive credit trend since 2007, 3 upgrades for every downgrade.

The Curse of the Low Coupon:

Introduction:

On average, municipal yields have risen on average 60+ basis points from the beginning of the year. Bonds bought at par before 2021, are now trading at a discount. Yes, this means the bonds are cheaper, but it could also mean in some cases a portion of the return is now taxable and the price a lot cheaper than what the change in rates would imply thanks to the coupon rate. If you are a buy and hold investor, then there is no concern. If you are a “par buying investor” worried about the liquidity of your bonds, this monthly is for you. The curse of the low coupon can also be called bonds trading outside De Minimis.

This is an update to a monthly credit review published in July 2019, when yields were setting record lows and MainLine was warning investors about their choice of coupons at that time.

Market Discount (Within De Minimis) Bonds exists when a bond price falls in value after it is issued. This is defined as the difference between the purchase price of a bond and its stated redemptio price at maturity. In the case of a bond sold with original issue discount (OID), market discount is defined as the difference between the purchase price and the issu price of the bond, and accreted OID. Unlike OID bonds, market discount is not treated as taxexempt interest because it does not represent the interest expense of the issuer. The market discount is taxed as ordinary interest income in the year a bond is sold, redeemed or transferred. The yield on the bond will need to be adjusted for the tax owed on the accreted portion of the price return.

Market Discount (Outside De Minimis) Bonds exists when a bond is at a significant market price discount below that of its OID price. To qualify as an outside of De Minimis bond, the market discount price must be below 0.25 percent of the face value of a bond times the number of years between the bond’s purchase date and maturity. The amount of market discount related to the .25 percent of the face per year is taxed at the capital gains tax rate. However, the market price discount that exceeds this amount becomes taxable at the investors ordinary income tax rate. This can significantly lower the after-tax return for a bond outside of De Minimis, compared to one that is still within it.

Analysis:

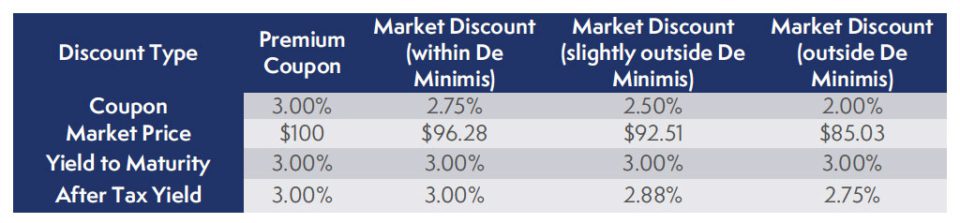

Let’s assume we bought four bonds back in the summer of 2019 at a 2% yield with the same credit quality, same call and maturity dates, but different coupons. Then, let’s assume both bonds are priced today to the same yield to maturity of 3%.

The bonds outside de minimis (2.5% & 2.0% coupons) do not provide a full tax-exempt yield. Instead of paying a 3% tax-exempt yield (like the two higher coupon bonds), the discount on the bond becomes taxable, lowering the tax-exempt yield on the bond. Instead of 3%, the 20% coupon is yielding a 2.75% tax-exempt yield. Why does this matter if you bought the bond at par to begin with?

If you do not plan to sell the bond, the fact that it may be trading outside of de minimis is irrelevant. If you do sell the bond, a buyer will require a higher yield to maturity than the 3% and, therefore, pay a lower price. For the 2% coupon bond to provide the investor the targeted 3% tax exempt yield to maturity, the price will need to be $80.68 or a 3.33% yield to maturity. This is roughly 5% lower in price, thanks to the low coupon on the bond.

Conclusion:

An investor may think purchasing a lower coupon will provide more income. However, there is a risk that, in the wrong type of market at the wrong time, low coupon bonds could be a curse and cost investors proceeds when selling the bond.

We are not recommending everyone exclusively buy 4% coupon bonds or higher. Lower coupon bonds can have better performance and pay higher yields. We are highlighting that you should seek coupon diversification amongst your bond holdings. MainLine also recommends diversifying portfolio risks such as: use of proceeds, reinvestment risk, and geographic risk. An investor should limit the purchase of 2.00% to 2.50% and even 3.00% coupon bonds as, when rates go back up, there may be tax implications. A diversified coupon structure will insulate the portfolio from drastic price swings and provide the best strategy for most investors.