2024 Election Preview – Muni Style

Peanut butter and jelly, stars and stripes, chicken wings and beer, politics and munis – some things just go better together. You cannot talk about munis without discussing politics. Once again, MainLine takes a look at munis and the pending election. This time, we ask the question “Do munis like the color red? (Republicans) or the color blue? (Democrats) -or- are they colorblind?

Munis started summer out hot and on pace for strong outperformance, but as it comes to an end, munis have withered under an intense new issue market and early election anxiety. Although this is not what MainLine expected, it does set up for a late-year chance for munis to still make good and finish as an outperformer for the year, as we have expected. Now, we just need to get the election noise behind us.

Muni Market Review

Munis finished the summer months, limping into the fall. What started as a bullish looking three months has turned into underperformance, due to high new issuance, and increased volatility as we approach election time in the fall. Munis were up .79% for the month, 1.30% YTD, US Treasuries were up 1.30% for the month, 2.60% YTD, and US Corporates up 1.57% for the month, 3.49% YTD. August 2024 highlights were as follows:

- Muni yields were lower from 33 to 8 bps (curve steepening, with taxables lower by 23 to 12 bps. Year to date, munis are up 14 to 18 bps, while taxables down 17 to 7 bps.

- Year to date, issuance is up 33% from 2023 as issuers are hurrying deals to the market before the election in the fall. This should set up for low issuance in the final months of 2024.

- The muni fear indices are back up from 10% in July, to 25% at month end. Not a good indicator for performance over the last month or in the next 30 to 60 days.

The MainLine Tax Advantaged Fund V liquidation looks like it is more likely to happen at year’s end to early 2025. Once the election gets behind investors and fewer new deals are available, munis should finish 2024 in a good spot.

Market News & Credit Update:

- According to Municipal Market Advisors (MMA) 2024 is slowly becoming the worst year for the higher education sector of the muni market since 2009. To date, there have been 15 technical defaults as declining enrollment and rising costs have hurt the smaller colleges that were already under financial stress from COVID. How does an investor avoid a flunking school? Stay high in enrollment, over 3,000, lower in acceptance rate (applications per admissions 80% or lower) growing admissions, and low debt levels. The upper tier of higher education is doing very well.

- According to Bloomberg Intelligence, SMAs (separately managed accounts) have gone from roughly $0 in assets before 2013, to over $1.6 trillion (over 40% of holdings) in 2024, growing over $100 billion a year. Although we have questions about these numbers, they do make a statement. Why are SMAs becoming so popular? Why has MainLine West been offering SMAs since we opened in 2008? Next month, we will explore the growth and benefits of SMAs.

2024 Election Preview – Muni Style

Introduction:

Politics and munis: some things just go together. You cannot talk about munis without discussing politics. So, do munis like the color red (Republicans?) or the color blue (Democrats)? As we approach the 2024 Presidential election, MainLine thought this would be a good time to see what color munis really are.

Background:

MainLine reviewed the total return of the muni market versus US Treasuries over the last nine elections to see if they under or outperformed and how that related to who won as President. We wanted to see if muni performance was different depending on if red or blue won the election. To do this, we used the Bloomberg composite indices for both asset classes. MainLine also measured the returns using different scenarios as markets do not react within a specific time frame. We looked at two different time frames:

- Election day until month-end (November 30)

- Election day until year-end (December 31)

Data Analysis:

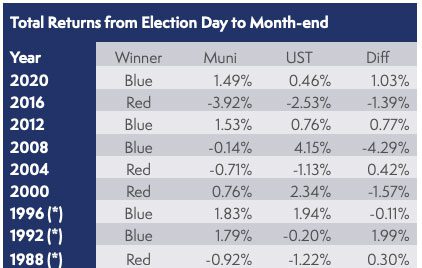

Below is a table showing returns from Election Day to month-end (11/30):

- Munis outperformed 5 out of 9 times

- 3 times when blue won

- 2 times when red won

- Max outperformance by 1.99% when Blue won

- Max underperformance by 4.29% when Blue won

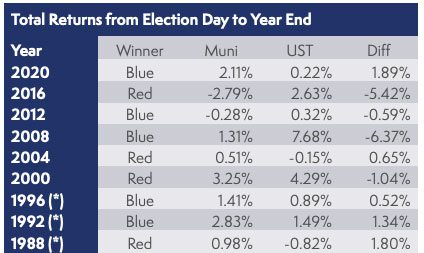

Below is a table showing returns from Election Day to year-end (12/31):

- Munis outperformed 5 out of 9 times

- 3 times when blue won

- 2 times when red won

- Max outperformance by 1.89% when Blue won

- Max underperformance by 6.37% when Blue won

The results are the same using both time periods, and pretty much even with a slight lean to blue, but not significant. So, what determines how munis perform if politics is so important? It’s more about the issues and potential policies being proposed at election time and not about the color. Munis are focused on things such as:

- Tax policy changes: Increase in tax rates helps increase the value of munis, tax rate cuts will decrease the value of munis

- Changes in Federal Government spending programs. Where is the spending going? Infrastructure? Federal aid can be stimulus and help muni credit quality adding value or, at the end of it and not renewed can create budget holes that can weaken credit quality and muni value.

- Federal mandated programs and their effect on state’s sovereignty and bank accounts. Are there potential policies or programs that will add costs, but not revenue? Muni credit quality could be impacted adversely if they add costs but no new revenue.

- The willingness to balance the federal budget? Where would cuts come from? Less aid to states? This would hurt credit quality of munis. Review of federal tax break for munis? This can all decrease value for munis.

- Review of issuers that qualify as non-profit. In 2017, hospitals and higher education were sectors scrutinized and exempt status challenged. This hurt their bond value at that moment in time.

- Federal Government management of municipality debt. Any policies or programs that restrict or add to the ability of municipalities to issue and service their debt can help or hurt their value. An example of this is the ability to refund old debt.

What do we see for 2024 Presidential Election policies from a Muni view?

- Tax Policy Changes: The biggest impact will be what happens to the Tax Cuts and Jobs Act of 2017 which is due to sunset at the end of 2025. This gave top earners a lower 37% tax rate and exclusion for alternative minimal tax. If it is not extended, the top tax rate would go back to 40%.

- If Red wins, there is a good chance the tax cuts will be extended and tax-exempt muni value will stay unchanged. Then there could also be some concern with budget cuts needed to fund the tax cuts. Would there be a consideration to take away the federal tax break munis receive to help pay for the tax cuts? That could really hurt muni value.

- If Blue wins, there is a good chance there will be no extension, and this would increase the value of munis. There could also be further considerations to increase taxes on the rich, which would be even a bigger value add to tax-exempt munis.

- It’s the Economy, Stupid: Red and Blue are both looking to spend money to grow the economy and help others. This should help state economies, which should improve credit quality and add value to munis no matter which color wins. What is the impact on the national debt and possible inflation? That is a bigger problem than munis.

- State Rights and Federal Mandates. This is a catch-all for me. The includes gun control, abortion, immigration, and climate change legislation as examples. Are the policies of the winning party looking to restrict or encourage state sovereignty? Depending on the state, this could impact demographic growth and long-term credit quality. The trend has been to take away state rights and create more federal control and unfunded mandates. This could long-term hurt muni credit quality, and both colors are guilty of this.

- Election uncertainty, fraud, and violence: Munis and volatility do not go hand in hand. In times of erratic and violent market moves, munis usually underperform as liquidity disappears and the average muni investor is worried about losing money. If there becomes uncertainty during the election process on policies, leadership and social unrest, it will adversely be reflected in muni performance.

If you are rooting for muni market outperformance in 2024, with the policies of concern at this moment, Blue appears to be your color of choice to win. A Blue victory, coupled with light issuance due to the front-loading of issuers prior to the election, could push munis to finish the year strong. As I once heard from an old-timer muni man, “If you want to live like a Republican, you have to vote like a Democrat”. At least that appears to be the case in 2024.

View the Monthly Review PDF here – View August Report Charts