Cut Tax Bill and Increase Tax-Free Income?

Does that sound too good to be true, especially after paying your tax bill last month? It almost sounds like one of those infomercials that says “eat all you want and lose weight”. Well, this one is true and the time is right. This month MainLine reviews how you can cut taxes (weight) and increase income (food) at the same time. In this month’s review, we will discuss how it works and give an example of the benefits you can receive, if you call us now, “before the offer expires”.

The month of April was another “sensitive” one for munis and appears to be the worst month on record, with the month’s return down 2.77%, dragging the year-to-date index to down 8.82%. I think we can safely say, in 2022, munis have “corrected” thanks to economic and Federal Reserve policy uncertainties. Now what? MainLine feels munis are cheap and represent value relative to taxables and, at current elevated yield levels, can provide a good source of tax-free income for years. How does 7.5% tax equivalent assuming a 5% state income tax sound?

Muni Market Review

The muni market continues to correct in 2022, on average increasing year-to-date 3 basis points for every 2 basis points in taxable increase. The further out the curve an investor goes, the more underperformance. April saw yields increase 48 to 54 basis points, as redemptions continued, due to investor confusion on the Fed and overall economic outlook. Highlights are as follows:

- Muni yields year-to-date are up 184 basis points 5-year, 167 basis points 10-year, 156 basis points 30-year.

- Taxable yields year-to-date are up 159 basis points 5-year, 134 basis points 10-year, 112 basis points 30-year.

- Outflows accelerated in April, as concerns coupled with weak technicals due to tax payment season, continued. MainLine believes this will begin to improve in the next 30 days, as anticipated demand should outpace what has been a low volume new issue market.

- Muni credit quality remains strong and CDS spreads are at, or near, what they were one year ago. Credit concerns are not an issue in muniland, but evaluations to taxables look different.

MainLine Tax Advantaged Opportunity Fund VI.5 is now fully invested, and Fund VII is over half invested. Munis represent value relative to taxables, and yield levels are as high as they have been since 2019. For example: long 4% coupon bonds are trading at par, and 10-year good quality bonds are earning 3+% taxfree. If you have cash targeted for munis, this is the time to let us know.

Market News & Credit Update:

- Surprise? According to Moody’s default rates stayed low during the pandemic. The average fiveyear default rate went from .08% to .10%. This compares to 7.2% for corporate bonds. I guess we can still say munis remain the SWAN (sleep well at night) investment, even during a global pandemic shutdown.

- A BOA/Merrill Lynch research report date 4/22/22 shows that 13 states’ nonfarm payrolls have recovered to pre-pandemic levels. There are ten other states within 10% of full recovery and a dozen still below 80%. This wide range is due to the concentration of each particular state’s employment industry, the desirability for people to live there, and the socioeconomic status of its residents.

- New York and California are looking to expand the scope of their corporate tax code to include online businesses and out of state retailers. Recent guidance from the Multistate Tax Commission challenges states to rethink the federal law regarding the tax treatment of transactions whether in person or on-line, and how it should be treated the same. This could provide states a big tax revenue windfall.

Tax-Loss Swaps – Lower 2022 Tax Bill, Increase Tax-Free Income for Years.

Introduction:

First, the bad news – if you bought bonds in the last couple of years, there is a good chance they now have losses after the back-up in rates year-to-date in 2022. Now, the good news – you can use these

losses to offset your tax bill for 2022 and increase your tax-exempt income going forward. The conditions are right for the first time in a long time for investors to engage in tax swap losses. This involves the selling and realizing of losses from a municipal bond, and then reinvesting in a new one. Tax Loss Swaps – Lower 2022 Tax Bill, Increase Tax-Free Income for Years.

MainLine feels this is a good time in our monthly credit review to revisit how you can minimize taxes at year-end and take advantage of new higher tax-exempt yields in the municipal market.

Background:

Year-to-date, municipal bonds have underperformed and yields increased from 184 basis points to 156 basis points along the curve. This is a good time for investors to put cash to work or, if you anticipate gains from another investment in 2022, realize some tax loss swaps with your municipal bonds. Investment losses can be used to offset capital gains, whether or not the losses are short-term. However, there is one concern an investor must be aware of before executing a tax swap loss trade – “The 30-Day Wash Sale Rule”. The IRS will not allow an investor to realize the loss for tax purposes if the proceeds are used to purchase an “identical” bond within 30 days of the sell.

For this rule, the term “identical” refers to meeting two of three criteria:

- Securities issued by the same issuer.

- Securities with the same maturity date.

- Securities issued with the same coupon.

Before executing this strategy, MainLine would recommend reviewing your portfolio and its risk profile. If you are concerned with some of its aspects, the redeployment of proceeds from a tax-loss sell could be used to shorten duration, improve credit quality, improve bond call and coupon structures, and still improve book yield.

The Trade:

MainLine will review a simple tax-loss strategy: buy and sell a similar bond, but will not qualify as a

30-day wash sale.

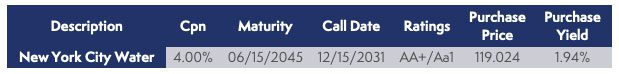

- Realize losses on a long-term 4% coupon bond from a high-quality New York issuer, buy a

4% coupon long-term bond (different maturity, and issuer). For example:

Let’s assume we bought $1 million of the bond above on 09/23/2021 (date of issuance). If we were to sell the bond near the market evaluation on 04/22/2022, the trade would harvest $181,430 in market losses that could be used to offset investment gains. This looks as follows:

Now let’s take the proceeds of $998,960 and reinvest in a like-rated and close to the same maturing bond but with the same coupon.

This tax-loss trade will provide the investor an additional 196 basis points of annual income (3.90%- 1.94%) and offset $181,460 in gains from other investment income. This 196 basis point increase, after reinvesting the lower proceeds amount of $998,960, will provide an additional $16,531 of taxexempt income per year. There is also no change in the underlying sleep well at night structure of the portfolio – just the saving on tax payments.

Conclusion:

As we have shown, tax-loss swaps, at this time, can provide shelter from paying capital gains tax and increase a portfolio’s tax-exempt income. An investor could also use this strategy to sell issuers with credit concerns or change geographic exposure after moving to earn more state-exempt income.

If there is a need to offset investment gains or plan for them, MainLine feels you should contact us to discuss further.