2022 in the Rearview Mirror

Would you judge me if I said I wanted 2022 in the rearview mirror as fast as possible? Well, it is – and you can. Many lessons in finance were learned, whether you bought fixed income, IT stocks, or the new curse word: Crypto. The good thing about investing is, in the long term, if you stay patient and have a smooth riding investment plan and perhaps even take advantage of the opportunity, you can withstand any potholes, cracked asphalt, or poor working GPS and reach your destination.

MainLine takes a quick look back (actually a glance in the rearview mirror) in this month’s monthly review, as we are preparing for 2023. If you remember our 2022 Outlook, Confusion, Correction, Cruise Control, I think we are batting .667, but as 2022 disappears on the horizon, cruise control is just what we are hoping for, as we continue to drive into 2023. The big question that remains: at what speed and how bad will the road get?

Muni Market Review

November was an amazing month for the muni market, posting a 4.7% Bloomberg Index return, outperforming US Treasuries that posted a 2.35% return for the month. Investors finally realized the value in munis. Low supply and plenty of cash all led to a big month of muni price recovery.

Highlights for November are as follows:

- Muni yields were lower by 54 to 68 bps throughout the curve. Taxable yields were lower from 52 to 62 bps throughout the curve.

- Outflows have slowed up, but have yet to turn positive, yet cash levels are high, due to maturities and coupon payments. The 7-day muni rate is at 1.85% which is 45% of one month Libor (4.14%). The long-term average is 70%, therefore reflecting a lot of cash in muniland, which is being used to buy bonds.

- Supply continues to drag and is now 18% lower than 2021. Higher interest rates causing a decline in refunding issuance is the main reason for this drop.

- MainLine anticipates the muni market will continue to perform well for at least the next 30 to 60 days, with positive year-end/year beginning technicals.

MainLine thanks everyone for taking the time to view our Fund Investor call and for your feedback. All deleveraging capital has been sent back as of December 9th. The restructuring for Fund VI & VI.5 is complete for now and the recovery of the Fund’s NAVs has begun.

Market News & Credit Update:

- The good credit news on Chicago continues, as an upgrade from Moody’s takes it out of junk status from Ba1 to Baa3, with S&P showing BBB+. The city’s improved budgetary management, increase in revenues, increase in pension contributions, and a decrease in debt costs has brought to an end the seven year junk bond status of the city.

- Munis have always been known as bonds for the public good, but now they are becoming known for being environmentally and socially conscious. ESG issuance has been growing through the years and is estimated to reach 20% of issuance in 2023. Not surprising as it goes hand in hand with what municipal finance is all about.

- 2023 MainLine West Muni Outlook will be available by mid-January. Last year’s title Confusion? Correction? Cruise Control? was missing that final item in 2022. Is 2023 the year for munis to cruise?

2022 Municipal Market-A Look into the Rearview Mirror

Muni Performance:

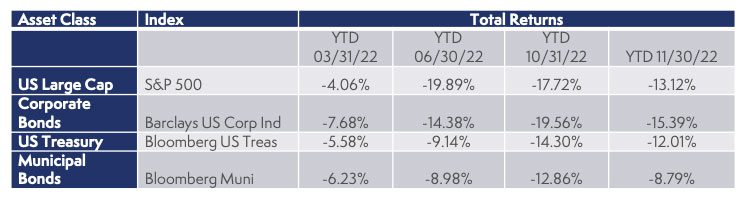

In 2022, until the month of November, the muni market was on a one-way, badly paved road to places nobody wants to go. Below is a chart using Bloomberg indices showing the horrible journey in 2022 for various asset classes, and the dramatic change over the last 30 days. It has been a tough road for munis, but a lot tougher for everyone else.

Another way to look at the horrible road travelled in 2022 is the year-to-date (11/30/2022) changes in yields.

This change in yields over 2022 is a two standard deviation move (happens less than 5% of the time). The degree of the move, plus the muni underperformance from 15 to 30 years, creates conditions that are even less frequent than a 5% probability. These are conditions only seen offroad or in third world countries, not roads munis usually travel.

Muni Road Hazards:

Supply/Demand:

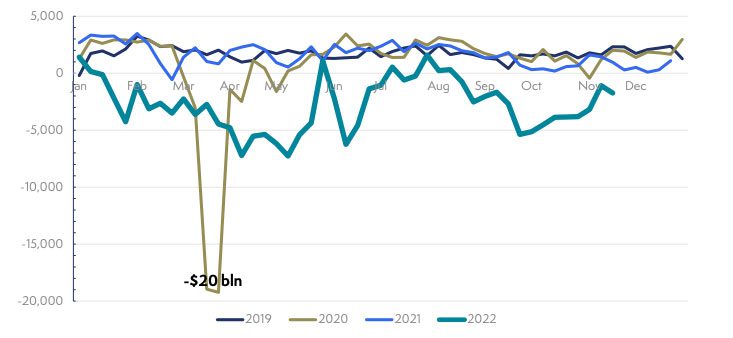

Mutual fund outflows have been steady and downward, as a total of roughly $130 billion year-to-date has flowed out, with only seven positive inflow weeks. To put this in perspective, it represents over 10% of all money that was invested in tax-exempt mutual funds has been liquidated. The below charts show the weekly outflows for 2019-2022 by week

Volatility:

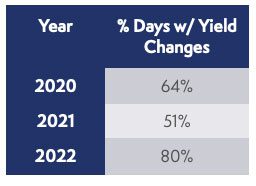

Nobody likes to drive on a road with blind turns and uneven pavement. Muni yield volatility was high in 2022 versus recent years. Below is a chart showing the percentage of days rates went up or down during the year:

The volatility of the market, along with the uncertainty with Federal Reserve Bank polices, caused confusion and concern for investors, and liquidating muni bonds was their answer. Historically muni yields are less volatile and change 6 bps for every 10 bps of taxable yields. The chart above shows on average from 15 to 30 years, munis changed 12 bps for every 10 bps of taxable yields.

Muni Credit Quality:

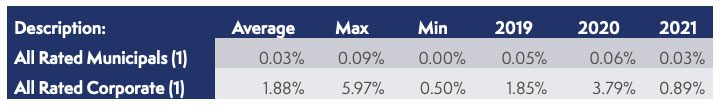

The one good thing about the 2022 journey is we are still driving a hybrid Lexus, with all wheel drive. As measured by various indices, munis continued to represent the strongest of credit quality. Default rates as calculated according to S&P rated issuers in 2021, released in 2022 showed as follows:

So, in 2021, 3 out of every 10,000 issuers defaulted in muniland, while 89 corporate issuers defaulted. Long-term (since 1986), numbers are the same for munis, but corporates averaged 188 defaults for every 10,000 issuers.

Notable bad-boy issuers like Chicago, Illinois and New Jersey were upgraded multiple times. Healthcare credit quality was one of the few sectors that showed some weakness, as labor shortages and increases in costs combined to squeeze cashflow and profitability, causing numerous healthcare systems to be downgraded.

Conclusion:

2022 has been the road trip from “H.E. double hockey sticks” for all assets classes, but as the year comes to an end, munis have been showing they can still be a fine smooth ride once the uncertainties, confusion, and a poor GPS are dismissed. Stay tuned for the trip itinerary for 2023.