Muni Finance – A Pillar of Strength

Is it by chance that municipal default rates consistently compare favorably to corporate default rates? MainLine does not think so. We believe there are forces of nature that keep municipal credits from experiencing the credit meltdowns experienced by corporate bonds during every economic recession. As the capital markets are now forecasting another economic slowdown and a widening of corporate credit spreads, MainLine feels this is a good time to review one of these pillars of strength, which

highlight the fundamental soundness of muni issuers and their balance sheets.

August is over, as most likely is the muni market vacation. August saw munis wandering in their own world, looking up from time to time to catch back up to the fixed income markets. Low issuance, low trading volume, and low attendance shows in the muni market’s mixed performance and retracement of July. The muni market’s fundamentals remain solid and the poor performance for the first half of 2022,

unjustified. The second half of 2022 should be better, although it remains to be seen if the market can completely make up for the first half.

Muni Market Review

The muni market seemed to be walking to its own beat, or maybe not at all during the month of August. Summer vacations, lack of issuance and lack of trading volume had munis perform with a delayed and moderate response to taxables, underperforming on the long-end, outperforming on the short-end and just right in 18-19 years. For the month, munis mostly reversed their performance in July.

Highlights for August are as follows:

- Muni yields were higher 52 bps to 40 bps flattening while taxable yields were higher from 71 to 29 bps, extreme flattening.

- Bid wanted volume in the secondary market was down, at roughly 65% in August versus January through May. A complacent muni market tends to trade with a delay to other markets.

- New issuance continues to slow down and now is lower than the five-year average by .4%, 13% lower than 2021. This has really helped muni performance in the last couple of months

The muni market enters the last half of 2022 with a lot of positives. Credit quality is still strong, ratios showing some value, and technicals should be solid going into year-end. This has been a heck of a year for managing muni money. The fact remains that muni finance fundamentals have not changed, and the pillars of strength that make munis the long-term value add they have always been are still strong.

Market News & Credit Update:

- Muni analysts are optimistic about muni returns for second half of 2022 after a horrible six months. After being down 8%, analysts are forecasting a 3% to 6% return over the last 6 months, not quite making up for the horrible first half. Reasons for the better performance: fund flows are expecting to slow and become positive, US Treasury rate volatility should decrease, and the historical appeal of munis as a late economic cycle safe haven.

- Where has all of the taxable muni debt gone? Taxable issuance from May through July is down 60% from 2021 levels. Why? Higher interest rates impacting taxable refunding by muni issuers and higher borrowing costs impacting the willingness to issue new debt. This drastic drop in issuance, coupled by recent infrastructure and other DC programs not including taxable municipal bonds, has the MainLine West Taxable Arbitrage Fund on short-term hold. The Fund has met all regulatory requirements, is fully registered and approved for investing. It just needs more bonds available in the marketplace.

MUNI FINANCE – A PILLAR OF STRENGTH

Introduction:

MainLine West has always believed that there are five fundamental forces that provide unique underlying credit quality strength in muni finance. They do not change with the economy, the weather, or over time. We believe these forces are imbedded in municipal finance, they occur without much effort, and provide a stabilizing force to the market.

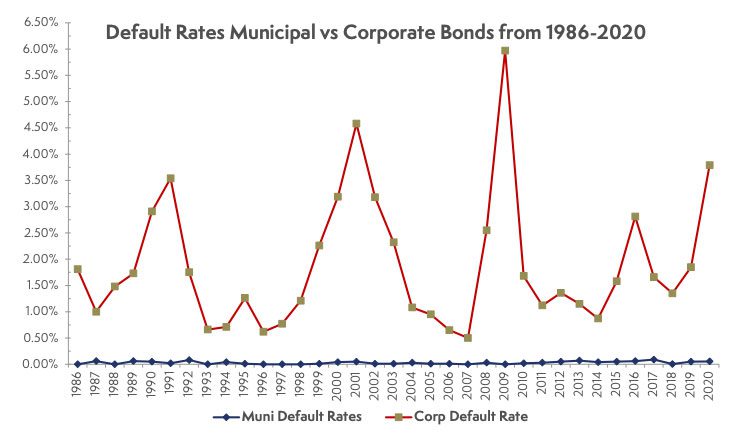

This is reflected in the long-term default rates of munis versus corporate bonds. On the next page is a graph and chart showing the superior principal protection of munis bonds versus corporate bonds:

As the chart above shows, on average, muni default rates for all rated bonds from 1986-2020 has been .03% versus 1.88% for corporates. This means that for every 10,000 issuers, 3 municipalities default and 188 corporations’ default. It seems silly to even compare the two. Yet, after a lot of muni trash talk in the first half of 2022 and the economic prospects going forward, MainLine thought this would be a good time to review one of these pillars of muni finance strength.

Pillar Strength Review:

Of the five pillars, the one that we feel puts the strength of muni finance and their balance sheets in direct focus is as follows:

State and local debt repayment is not a large financial burden for its residents. On a comparison with income levels, the percent of funds needed to support debt obligation is quite low versus other sovereign entities. Debt service usually has a first lien on revenues when it comes to paying the bills also making it a priority.

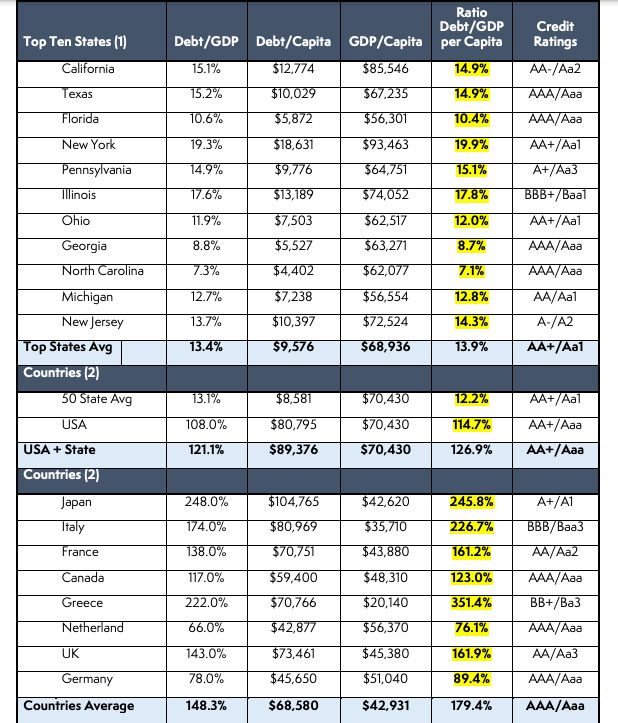

A good way to look at the level of debt at the state and locality levels is to compare it to other sovereign credits. To do so we will compare debt per capita, debt per GDP, the ratio of debt and income per capita, and S&P/Moody’s credit ratings for top debt burden states, the USA and seven various countries. The debt level of the states includes all locality debt within the state. This is to create a full picture of the debt burden on a US citizen. The debt/GDP ratios for the countries does not consider the local debt from any of its “states” or providences.

In the chart below there is a lot of information on debt and GDP levels and comparing them per capita and by credit ratings. The eleven states represent the largest and have a wide range of “muni credit quality”. The eight countries represent a wide range of “international developed sovereign debt” from the strongest to some of the weakest. MainLine’s analysis will focus on the comparisons of the ratio of Debt/GDP per capita ratio (highlighted in yellow). This seems like the best measure to use as it equates debt and wealth levels per person for the various entities. Wealthy countries can support more debt than poor ones, as they have the wealth to pay it back easier.

(2) Locality debt is not included in the Country numbers. This will only increase the ratio.

Conclusions:

What does this chart show us?

- States show a much lower debt burden than the top-rated countries and are also lower when compared to the full debt burden of USA citizens by adding the USA debt level to the numbers.

- Compared to countries, state debt per wealth burden is very low at 14%. This means debt only equals 14% of what the resident of that state is making in income.

- When combined with the USA ratio, there is a big jump up to 127%. Comparing this to other developed countries of various credit ratings, it remains below the average of 179%. More specifically:

- USA is very comparable to Canada at 127% vs 123%. Remember, the Canadian number is actually higher, as the number above does not include local debt.

- Only Germany and the Netherlands are lower than the USA.

- Italy, Japan, and Greece have close to over twice the burden.

- The USA citizen (at 127% of its income needed to support national, state, and local debt) seems high even if it compares well globally. It has grown significantly since we did this study in 2015 when it was at 80%. The main growth has been at the national level as the state/local burden was actually higher at 18% in 2015. Since then, it has shrunk down to the 14% calculated above. This means income levels have grown faster than state/local debt over the last six years. Impressive right? Too bad DC and the national debt couldn’t do the same. At this time, states have their fiscal and debt management house in order.