The Muni Main Event: Taxable vs Tax-Exempt

May was the first month in 2022 of positive returns in muniland. The Bloomberg muni composite index was up 1.50% for the month and now shows a year-todate loss of 7.5%. It has been at times a violent ride in the fixed income world performance battle. This month, MainLine West is sponsoring the Great Muni Main Event. May we introduce:

- In one corner, the new up and comer Taxable Munis

- In the other corner, reigning champion Tax-Exempt Munis.

From the same hometown, both work for the public good, both live for the same length of time (final maturity) and both have the same protection powers (credit rating). So, which one is winning the

performance battle of 2022? Sign into your MGM, Caesars, Fan Duel, Bets River, Draft Kings, Sports Illustrated Sportsbook account (did I miss one?) and place your bet! The final results may surprise you, but MainLine finds them intriguing.

So, let’s get ready to muni rummmmbbbllllleee!

Muni Market Review

What a difference a month or, better yet, a week can make. Munis have represented value after selling off all year, cross over buyers jumped in and the rally was on. Mutual fund cashflows finally turned positive and with the summer technicals being strong, munis could be set up for a good summer after an initial resettling. Highlights are as follows:

- Muni yields were lower by 36 to 24 bps on the month with the curve steepening.

- Taxable yields were mixed, lower by 10 bps for 5- year maturity, 5 bps higher for 30 years.

- Muni ratios still show value versus 2021, having recovered halfway. The curve is very flat compared to history and an investor can earn 80% of the max yield with a 7-10 year maturing bond.

- Issuance is lower by 8% versus 2021 and appears to be slowing at these higher “borrowing” levels. This has helped support the recent muni outperformance.

There remains value in the market, as not all sectors, coupons or call dates have recovered. There could be a slight step back in coming weeks as munis have hit it hard and fast. MainLine continues to encourage investors with cash to get the value that remains.

MainLine Tax Advantaged Opportunity Fund VII is now roughly 80% invested and we will be selective with its final purchases as it looks for out of favor issuers and bond structure. MainLine will provide a report detailing its’ progress and expectations in the next couple of weeks for its investors in Fund VII.

Market News & Credit Update:

- Analysts estimate there will be $123 billion of cashflow to reinvest over the coming months from maturities and coupon payments. This is 1.5 times the average issuance over the last five years for the coming months. It is anticipated that this money will stay in munis, helping the summer outperformance.

- The State of California currently has a record breaking budget surplus of close to $100 billion. Now, rating agencies are waiting to see what they will do with it. An upgrade is possible depending on what they spend it on, how much they spend and what they do with their current tax rates. The state has enjoyed a boost in revenues due to its wealthy residents and their gains in wealth during COVID and post recovery. California is another example of the “platinum” credit quality of muni issuers at this time after COVID.

- MMA (Municipal Market Analytics) issued a report on what an issuer should do now to prepare for when climate change becomes a credit risk. By looking at past natural disasters as a prototype, issuers should lay out a plan now on how they will manage impairment due to climate risks occurring and how they will make investors whole. MainLine feels this is important for high risk issuers who want to continue to access the muni market in an affordable manner for their tax paying residents.

The Muni Main Event – Taxable vs Tax-Exempts

Introduction:

Mainline has highlighted the taxable muni market and its opportunities over the last couple of years. What better way to do this than to match up their performance with the tax-exempt market in times of market volatility. Year-to-date, the 2022 muni market gives us a good chance to look at the two types of muni bonds, compare their performance and understand any differences if they do exist.

Did taxable munis fall in price as much? Did they rise as much? Did they ignore munis and just follow the taxable market? Let us meet the candidates and the tale of the tape:

The Muni Main Event

VS

- Market Size: $830 billion

- Priced as a spread off the US Treasury curve

- Maturities from 1 to 100 years

- Both non-call, & 10 year call, par coupons

- Top principal protector

- Funds public good projects

- Main investor – taxable fixed income funds

- Years of experience = 12

- From all over the USA

- Market Size: $3.7 trillion

- Priced off an independent tax-exempt curve

- Maturities from 1 to 30 years

- 10 year callable various/premium coupons

- Top principal protector

- Funds public good projects

- Main investor- retail/individuals

- Years of experience = over 200

- From all over the USA

Background:

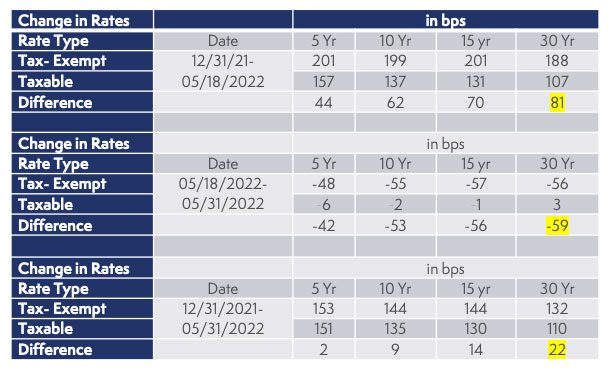

The first five months of 2022 has been a wild ride for fixed income investors. For this analysis, we compared returns for two time periods, and then combined them. We looked at the change in rates and total returns during the rise in rates from 12/31/2021 to where they peak on 5/18/2022. Then we looked at total returns from 5/18/2022 to 5/31/2022 when taxable rates were stable and muni yields dropped quickly. Lastly, we combine the two time periods and look at taxable and taxexempt performance over the entire five-month time frame. The nonstop time series, changes in directions and magnitude of the market moves, makes for a great environment to host our event.

Below is a chart showing the change in yields between the tax-exempt and taxable market by various maturities and during the designated time periods discussed in the previous page:

The charts above show yields for tax-exempts were much more volatile than taxable yields going up

and down. Overall, as of May 31, muni yields advanced up 81 bps (30 year), back down 59 bps and remains 22 bps higher on the year than taxable yields.

So, in a time period where the change in US Treasuries yields have outperformed the change in tax exempt yields, and knowing taxable munis are priced off the US Treasury curve, what is the betting

line on which muni outperforms?

- +$200 TaxableS?

- -$200 Tax-Exempts?

Round 1: Total Return Analysis by Index:

MainLine highlights two different total return analyses during this battle. The return information comes from two sources:

- Bloomberg general composite indices provided by Barclays.

- Independent analysis using bonds issued in 2021 and calculating their returns.

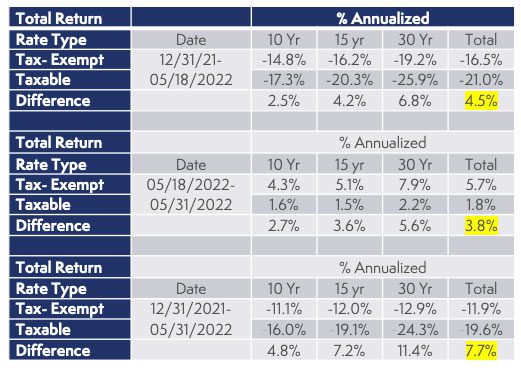

Bloomberg indices performance shows the following:

Round 1 goes easily to tax-exempt as taxable underperformed in all time frames. They have larger losses in an up-rate environment, smaller gains in a down-rate environment. In both cases the change in yields in taxable rates we reviewed above was less than in tax-exempt. What gives? MainLine wants another round to dig deeper into this poor performance from taxables.

Round 2: Independent Bond Return Analysis:

To learn more about the performance of the two types of munis, MainLine went to the source; individual bonds. Mainline focused on three parts of the curve, 10-year, 15-year and 30-year bonds for total return comparisons. Total returns were calculated for bonds issued at the same time by the same issuer, comparative maturities, with the only difference being that one bond was taxable, the other tax-exempt. There are 17 bonds in each data set and the results are below for the total return analysis.

Round 2 also has taxables underperforming in both markets and tax-exempts landing a knockout punch. The basket of bonds we used show tax-exempt outperforming by 7.7% over the entire time frame, which is close to the Bloomberg indices (7.4%). It is also interesting to see this taxable underperformance is along the whole curve and is worse the longer the maturity.

What does this tell us? MainLine sees one main message: opportunities in taxable bonds are related to the tax-exempt market, but valuations are not as tightly correlated as the casual investor would have thought. There is slippage in taxable spread changes that are meant to equate their value to the changes in tax-exempt bonds. Mainline feels there are some explanations for this difference:

- Taxable munis have longer duration risk. Taxables are issued with either “make whole” calls (essentially non-call) or with par call in 10 years all at par coupons. So, in a lot of cases, they are priced to maturity, especially in a rising rate environment making them 30-year duration bonds. Most tax-exempt bonds are priced to the 10-year call date even though they have a longer maturity as most are issued with a premium coupon.

- Yet in a falling rate environment, taxables with the longer duration should have done better, but they did not. So, having a longer duration is not the only performance fault taxables have.

- An immature market, which is still developing and finding a place in asset allocation and investment programs:

- Institutional investors (taxable fixed income mutual funds) are a much bigger percentage holder of taxable bonds than they are for tax-exempts. So the buyer base is more concentrated, and has other options for fixed income to invest in. Until mutual funds start buying taxable bonds versus corporates and agency bonds, they will not have a strong demand and prices will be negatively impacted. Tax-exempts biggest investors are individuals and in smaller denominations with no real alternatives.

Taxable investment community is not as educated on municipal credit quality or market technicals. It’s all about how the muni yield looks versus other taxable products. - Liquidity appears to be bifurcated in taxables between large and small deals. The larger deals are of more interest to the big investment houses which causes them to price richer and trade more frequently in the secondary market. Smaller deals tend to be cheaper and have less price volatility as they are not traded as much. This can create some noise when looking at taxable total returns during a volatile time frame.

- Institutional investors (taxable fixed income mutual funds) are a much bigger percentage holder of taxable bonds than they are for tax-exempts. So the buyer base is more concentrated, and has other options for fixed income to invest in. Until mutual funds start buying taxable bonds versus corporates and agency bonds, they will not have a strong demand and prices will be negatively impacted. Tax-exempts biggest investors are individuals and in smaller denominations with no real alternatives.

- Mutated supply and demand technicals: Taxable supply relies on the ability to refinance at lower borrowing rates. Demand is based on how bonds look versus other taxable bonds and not on tax savings. Tax-exempt supply is based on a number of factors, not just level of rates, and there is no alternative to their “tax equivalent” income.

Conclusions:

- Taxable munis have some unique return characteristics. They are at this time a “boutique market” that requires expertise and a different approach to municipal investing.

- As time goes on, taxables will become more liquid and some of the uniqueness will disappear. Yet looking at the items discussed above, some of the uniqueness will never leave and at MainLine, uniqueness equals opportunity.

- Opportunities in taxables parallel those of tax-exempts, but to fully realize them takes a slightly different strategy and execution.

And the Winner is:

It looks like an easy early round knockout win for the reigning tax-exempt muni champion.

MainLine believes a rematch is due at some point. This was a battle in just one market moment for five months. It has provided good insight into the market reaction of taxable munis during muni volatility and how it is different than tax-exempts. There are performance attributes that impact returns and, therefore, opportunities that an investor will need to “train for”. Like boxers with different fighting styles, taxables can win if given the right chance. Now, MainLine needs to get into the Taxable corner to coach and train them up for a future rematch.