Red Dawn Rising – White SWAN Setting?

Over the years, there have been several “defining” moments in the muni market – some good, some bad. Two of the top-five significant events would have to be the Tax Reform Act of 1986 and Meredith Whitney’s 2010 doomsday prediction for the financial demise of major cities. One event was bad for munis, while one was good. It all came back to the “news” versus the reality. One could label each event a “once in twenty-year muni opportunity (or disaster)”. MainLine views the change of political color in the USA from the 2024 election as one of these potential moments. Will it result in opportunity or disaster? Will the rise of the “red dawn” cause the setting of the “for the public good” WHITE SWAN market -or- will it be a beautiful sight for SWAN investors?

Background:

The 2024 election has presented the muni market one of its greatest challenges since the tax reform of 1986, when Ronald Reagan and the Republicans changed the shape of the market. The resurrection of Donald Trump and the Republicans controlling all three branches of Government has created a red wave of risks to the muni market.

The Tax Reform Act of 1986 lowered the top income tax rate from 50% to 28%, while raising the bottom tax rate from 11% to 15% (MainLine West will review the impact of the 1986 Tax Reform in a monthly review in 2025). Not only did it almost cut a third of the tax-equivalent value of a muni, it also eliminated the ability of certain types of entities from issuing tax-exempt bonds. The 2024 red wave could do all of this, and more.

The 2010 Meridith Whitney call for a muni market demise predicted the end of municipal finance as we know it, as she claimed major cities would be going bankrupt. She was completely incorrect and those who invested when she made her meritless prediction made a lot of money. MainLine Tax Advantaged Opportunity Fund II was one such benefactor. Executed in January 2011 and closed in January 2015, Fund II stands as MainLine’s best performing fund to date, with a total return of 16.9% and a tax-equivalent yield of 23.7%.

So, what happens in 2025? How does a SWAN investor ride the red wave? Some surmise Munis will struggle to keep up with other fixed income assets, due to political and tax reform concerns, and may never recover like they did in 1986. Others think this struggle will validate munis and its importance to society and create another “2010 Meredith Whitney investment moment”. What does MainLine think? When does this happen? How do you prepare for it? Grab a SWAN floaty and join us for our 2025 Muni Market Outlook.

2024 Review of the Muni Market

For most of 2024, the muni market was on a smooth ride. Munis never really underperformed, or outperformed. Even when technicals became positive, higher than expected issuance kept performance from getting too strong. Then, when technicals grew weak, issuance slowed up and prevented munis from trending too negative. As 2024 was coming to an end, the smooth ride was starting to get a little bumpy. For the year, Munis (up 1.05%) still managed to outperform US Treasuries (up .58%), but underperformed US Corporate bonds (up 2.13%) without adjusting. for taxes. A rough estimate for tax-free income puts munis ahead on the year up 3.50% tax-adjusted.

Muni Performance Review

In 2023, after record curve flattening, record Fed tightening and twice having two standard deviation moves in rates up and down (129 bps), 2024 was much more tame. Yields moved within a 50-bps band throughout the year, with some increase in volatility pre and post-election time.

- 10-year has traded from 2.28% to 3.06%, averaging 2.70%

- 15-year has traded from 2.77% to 3.27%, averaging 3.04%

- 30-year has traded from 3.42% to 3.90%, averaging 3.68%

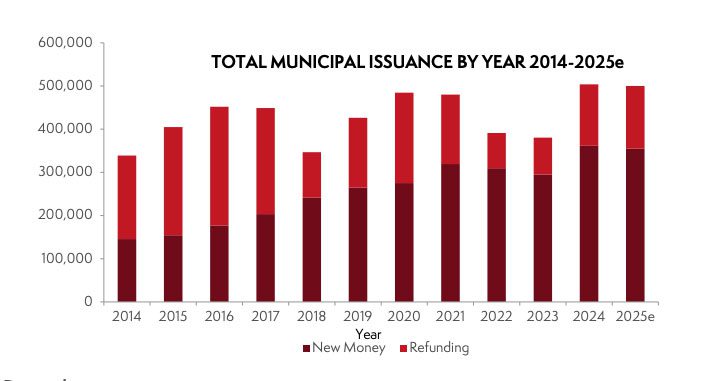

The big muni theme for 2024 was the positive performance in a year of record new issuance of $504 billion (topping 2020’s previous record of $484 billion). Entering the year, market estimates were from $400 to $425 billion. This 20% higher than anticipated issuance met slow but stable demand, as fund inflows were up a bit for the first time in two years. The fear of less liquidity with the absence of Citibank and UBS did not materialize, as munis were never tested. There was good two-way flow all year and the market remained smooth and was always accessible. The muni fear index did spike at year-end, as the presidential elections created volatility in markets, along with some new economic uncertainty.

Other themes for 2024:

- Continued slow transformation of the market, due to the growth in SMA accounts at the expense of mutual funds.

- Heavier reliance on electronic trading and the impact on liquidity and bid wanted flow, due to Algorithmic trading in muniland. Whether they admit to it or not, most major muni players have set up algo models to trade small par amounts to the SMA advisors, making a nice profit doing so.

- MainLine West Tax Advantaged Opportunity Funds clipped the coupon for returns and remain in a holding pattern, waiting for better muni outperformance. More details in their quarterly reports due out in a couple weeks.

Red Dawn Rising – White SWAN Setting?

Municipal Market Outlook 2025

Introduction: At the start of 2025, munis are at “fair value” versus recent levels, but in MainLine’s opinion, this does not reflect the “red risk” on the horizon. What is a red dawn? It is the reality that the Republicans will be in control of all three branches of the Federal Government and have a recent history of being unfriendly to the muni market. Why is this a concern? Just looking at it as a White SWAN expert, here are the red wave risks to be concerned with:

- Tax Rate Reductions

- Restriction on tax-exempt status for select issuers

- Potential loss of tax-exempt status

How will munis manage these risks in 2025? How could market technicals and fundamentals offset these risks? How much is noise and how much becomes reality? Either way, we see thick, rolling red storm clouds on the muni horizon. MainLine will be prepared and in shape for what could be a long year.

Muni Returns in 2025:

MainLine anticipates the market will dip after showing early-year strength, before eventually recovering and rising again. The key questions are how strong the early surge will be and whether the market will rebound after its subsequent decline. MainLine sees the possibility of three wideranging outcomes from the muni market in 2025:

- The Red wave is all noise, where we experience a moment of bright glare and bravado. Ultimately, munis will have a “clip the coupon year”, after a ride downward, then trending and back to even.

- The Red wave comes in violent and leaves with a whimper. Munis are under extreme stress, but by the end of the year, is an outperforming asset class, as its tax-exempt status is reaffirmed and importance as an asset class is embraced.

- The Red wave rolls in and takes munis under, with their tax-exempt status challenged and the long-term value in new issues and outstanding bonds in question. Muni value becomes priced as taxable, causing munis to underperform. What will be the final value of “tax-exempt status” when the red wave finally washes back out?

What are MainLine’s expectations? Mainline would love to see scenario #2: another fortuitous Meridith Whitney investment moment and (finally) a real-numbers discussion about the value-add of the tax exempt municipal finance market. MainLine views scenario #3 as a real long shot, but others are sounding the alarm and, therefore, its potential damage must be accessed and discussed. Scenario #1 appears to be the consensus and feels the most likely outcome.

Muni Technicals: Supply, Demand, Tax-Exempt Value & Volatility

Supply:

2025 will likely set another record for issuance, led by new money. Infrastructure needs are large and expanding, after years of delay, due to higher borrowing costs and red tape. Add to it the need to prepare for climate change, lower tax revenues, increased cost of projects due to inflation, and the end of federal aid and stimulus funds and you get a need for more bonds. Estimates range from $500 to $525 billion in supply for 2025, which looks like it could break the new record of $504 billion set in 2024. MainLine continues to see this elevated level of issuance to be a new trend going forward for many more years.

Demand:

2025 demand, as defined by “organic growth”, is also expected to set a new record. Organic growth is defined as cash from muni maturities, coupon payments plus estimated bond calls. In 2025, this is estimated to be $467 billion, up $40 billion from 2024. This is still going to be short $40 billion of the estimated supply, so funds will need to come back into the marketplace. Inflows were up marginally in 2024, but there will need to be a continued return of investors from those that left in 2022 and 2023 to support this supply growth. How attractive are munis as we enter 2025?

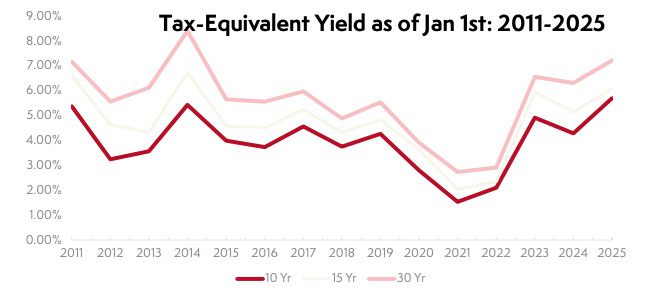

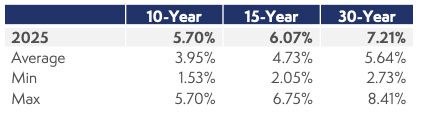

Muni value can be defined in several different ways. One way is to view the muni yield ratio versus its taxable equivalent. As we enter 2025, muni ratios are close to fair value versus recent levels. Another way to measure value that is focused on by investment advisors, is the level of taxequivalent income. Below is a chart showing tax equivalent yield as of January 1st from 2011 to 2025 for 10, 15- and 30-year AA rated essential service bonds after adjusting for the top Federal tax rate and Medicare tax.

Once these yields are adjusted for state income exemption (assume 5% state income tax for half of the portfolio), an investor can earn a 6.40% for 15 years, and a 7.60% for 30 years. Tax-equivalent yields are up and look attractive versus recent history. Add to it the growing population of older people looking for fixed income, MainLine feels investment advisors will see munis as attractive as we enter 2025 and fund flows should start out positive.

Muni Volatility:

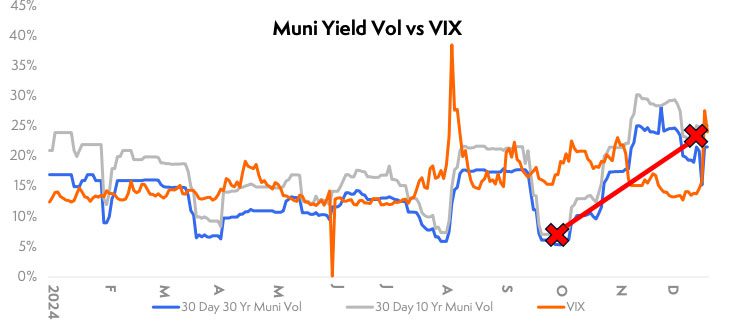

- In February 2024 MainLine’s monthly review introduced the “Muni Fear Index”. The volatility of the VIX (S&P stock price volatility) and yield volatility of muni yields were shown as indicators of future muni performance. When volatility increases, muni investors get concerned, stop buying, and munis tend to underperform. The chart below show these fear indices over in 2024.

There has been a recent spike up in volatility as 2024 comes to an end. Levels are now at 20% to 25% up from pre-election levels of 5 % to 10%. Is this the after-effect of the election, or a sign of things to come? MainLine thinks it is both: the effects of the election on the muni market and its possible ramifications going forward.

The Dawn of the Red Wave:

The Red Wave brings a variety of risks to the municipal market. The timing, the probability of their reality, and the way market reacts will make 2025 a challenging year. MainLine sees the following “red” risks:

Tax rate reductions: The lower the income tax rate, the lower the intrinsic value of municipal bonds. The main policy issue at this moment is the extension of the tax cuts of 2017. This would keep the current max income tax rate at 37% and is priced into the market. This is expected to happen and is not an issue for the muni market. Does DC get more aggressive and look at a future reduction in tax rates? Corporate tax rate cuts appear to be an early agenda item. This would have minimal effects on munis, as corporates represent less than 2% of its holders. MainLine thinks that max tax rate will remain 37% for 2025, but the next issue to be resolved, once tax cuts are extended, will be how to pay for them?

Restriction of tax-exempt status for select issuers: There is the possibility that some muni sectors will no longer have the ability to issue tax-exempt debt. In 2017, sectors such as healthcare, higher education, and transportation (port, airports) were in the initial tax bill to be excluded from issuing tax-exempts. Fortunately, they did not make the final bill. However, their initial inclusion caused a one-month record issuance of $69 billion, as these issuers brought deals at year-end 2016, in attempt to front-run the potential changes to their exempt status. As a result, the muni market sold off and greatly underperformed (we executed MainLine West Tax Advantaged Fund IV). MainLine feels strongly that this change in status will be discussed, once again, as tax cuts get extended, especially for the higher education sector, as some in DC have a disdain for the academia. What happens to munis then? Will the surge in issuance once again cause munis to get cheap and greatly underperform the taxable market? Can you say MainLine West Tax Advantaged Opportunity Fund VIII?

Loss of tax-exempt status: There could be a discussion on municipalities losing their tax-exempt status to help pay to extend 2017 tax cuts and other red wave policies. This appears to be a valid concern among some of the street muni strategists. How would this impact munis? How would infrastructure get financed? What would happen to current outstanding bonds? MainLine will review this further in a monthly report in 2025. MainLine West does not fear the ultimate elimination of tax-exempt status for munis. Why is MainLine confident in the value of munis?

- Creates a large tax increase for American families: A study that came out mid-December by the Government Urban Center quantified the increase in cost to issuers for debt borrowings for non-exempt bonds at 200 bps (2%), which then translates to $6,600 increase in cost per family annually. Sounds very much like a flat tax increase.

- The biggest cost would be on small town Issuers: The small issuers, which make up the core of the muni market, would be most affected. They most likely could no longer issue debt and would have to look to banks for loans at significantly higher interest rates. The majority of these issuers are from rural counties/cities and are the core of the Red voting population.

- Represent less government regulation: The municipal market keeps local infrastructure in local hands, which is a theme for the Red politicians. The industry is doing a good job identifying the projects of value to its issuers and its tax paying residents.

- Not a big cost saving. The deduction is estimated to cost $3.37 trillion over the next ten years. This is roughly $37 billion average in cost savings annually for the Federal Government. The extension of the Trump tax cuts will cost $400 trillion over the next 10 years, which is $400 billion a year. This means the elimination of muni tax exemption does not even cover 10% of the tax cut costs.

This doesn’t mean, at some point, that some loose-lipped politician puts forth the idea and taxexempt status is debated, locking up the muni market as a result. Investors get concerned and issuers worry, as the market reacts negatively to credit quality outlooks, and tax implications.

The Era of Credit Muni Man II:

Public Finance credit quality has most likely peaked, and the trend is down from here. The higher costs due to inflation, the need for more projects, cost of climate change, the slowing of tax revenues, an increase in debt issuance, and the unwillingness to increase taxes is creating structural deficits for some issuers. This will result in downgrades outpacing upgrades for the foreseeable future. MainLine is not worried about munis losing their SWAN qualities, as long as investors stay true to our credit quality guidelines.

This decline in overall credit quality will occur in certain types of bonds, creating much more credit “noise” and investor concerns, which will be reflected in an increase of pricing volatility. MainLine feels there will be certain sectors, regions, and issuers that will be impacted to a greater degree. Muni credit analysis will require looking out to longer time horizons and analyze beyond the issuer to related “muni family members.”

Other 2025 Outlook Thoughts:

Muni Market Structure Continues to Evolve

Electronic trading is slowly growing and buyers are using it more each year, as the platforms grow with offerings and improved efficiency. They can provide cost savings and smooth execution for the investment advisor. This does come at a price to an investor’s income, as Algos and sellers take their cut of the profit each time a trade is executed. Some smaller firms are up to 40% of their trades being electronically executed. MainLine West remains committed to buying bonds broker to broker and avoiding the excessive markups.

The top five firms still manage 50% of the assets. The growth in SMAs (separately managed accounts) remains the main source of new monies, at the expense of mutual funds. The increase in issuance, and the increase in use of technology, has 2024 looking like a good year of profits for muni firms. Do you think Citibank regrets leaving the business?

Continue Focus on SMA Growth

Small SMAs have been predominantly restricted to buying in the secondary market. This could be changing in the coming years. At the request of issuers, there are efforts to develop a system that allows small SMAs to aggregate their orders through an electronic platform during the underwriting phase. Instead of being viewed as one $100,000 order, it would come in as numerous $100,000 orders that add up to millions and, once allocated by the underwriter, split back up to the individual SMA order. There is also discussion of the big, liquid issuers creating a debt issuance system – sort of like a mutual fund. Investors looking to buy bonds could do so anytime, as the issuer just keeps a pool of new bonds ready when someone wants to buy them, as opposed to depending on large underwritings a couple times a year. MainLine will continue to source 80% of its bonds from the initial underwriting, while other SMAs can wait for the new technology to babysit them through the process. This allows us to provide our clients the most advantageous entry point.

Munis and Climate Change

MainLine has always felt the municipal bond market is ground zero for the impact of climate

change on investing. MainLine continued its focus on this with its review of the impact of climate

change on the electric utility sector in 2024. Disclosure is finally increasing and providing more

insights into the possible effects of climate change, and how issuers are preparing to prevent the

ensuing damage. Those issuers who do not provide the needed disclosures, are requested to do

so. Bonds from issuers with higher climate change risks still do not trade at much of a discount. The

market is still giving this risk time to evolve.

Banking Reforms:

The Red wave could bring the end of Basel III as the final set of rules are to be implemented in 2025. If these are rolled back, it could loosen up capital in the banking industry. Less banking regulation and more free capital could create an increase in demand for muni bonds by banks. This could more than offset the effects of a corporate tax rate cut and help support higher new issuance levels.

Conclusions:

MainLine sees the red wave as another potential “Meridith Whitney moment”. The demise and/or pairing back of the muni market is discussed, and then it is not. It’s just when do we get there, how disruptive can it be, and how will we take advantage of it?

How should you surf the Red Wave Rising? MainLine recommends the following:

- Early part of the year, munis could see strength as advisors see the current tax-equivalent value as attractive. If you are thinking of raising money at some point in 2025, the next 30 days may be the best time to sell bonds. After that, the first part of the year the red wave will be rising, and all the spending and handing out of favors will be a priority. Once this is done, and it is time to pay for all of it, the red wave could crash on munis.

- When red wave news hits, and muni yields go up and spreads widen out, it is time to invest. The longer duration the better. Lock that tax-exempt income stream in for as long as you can and take advantage of the tax-exempt scare. Look the for MainLine West Tax Advantaged Opportunity Fund VIII to be executed at that point.

- Stay the course on essential service credit quality and diversification. Munis are for the longrun, providing stable and safe tax-exempt income.

MainLine West Happenings:

- MainLine welcomes Craig DiRuzzo to the Family. Craig is heading our sales effort to grow our SMA and Fund business with the financial advisory community. We will not acknowledge his allegiance to the NY Yankees.

- In 2025, MainLine will include Fund updates in its monthly market review. This will provide an update to investors on strategy decisions, market outlook and a review on performance.

- AI (artificial intelligence) is not all scary. MainLine will be looking to train it to help review Official Statements and provide updated credit information. 2025 will be a year we look to get trained, and train AI in the muni world. MainLine will never use AI to make investment decisions or write monthly reviews or annual outlooks. Ok, maybe just one monthly, and we will let you guess which one it is!

- MainLine West manages over $1.7 billion, which includes SMA and Fund assets. We will be looking at ways to further streamline our customer service and investment process in 2025 to continue providing our clients best and low-cost execution of their investment goals.

- We would like to thank all of you for your commitment to MainLine West. There are\ many “muni specialists” out there, but you’ve placed your trust in us. We continue to work to prove you right and are “staying in shape” to do so again in 2025!