Rollercoaster: a train that carries people quickly, through tight turns, steep slopes, designed to produce a quick, thrilling experience – not a long sustainable ride.

Ferris Wheel: a large wheel consisting of carts that carry people up and down in a rhythmic and predictable fashion designed to enjoy the view and more in line with the cycle of life.

The last three years have been a rollercoaster ride for munis. Fast moves in rates, sharp changes in curve slopes, all-time highs and lows in value versus taxables, and at times flat out chaos highlighted by unexpected turns and sudden drops. COVID reset monetary policy and parts of society. MainLine thinks the end of the topsy-turvy ride is slowly and finally upon us. Going forward, things may not return to the way they were, but things will get back more in pattern and allow investors to plan more for the long-term. This doesn’t mean munis will forever make money and not have “issues”. It does mean it is time to settle into a long-term strategy and plan ahead for the ups and downs and lock in some good long-term tax-equivalent income.

2023 Review – Riding the Rollercoaster

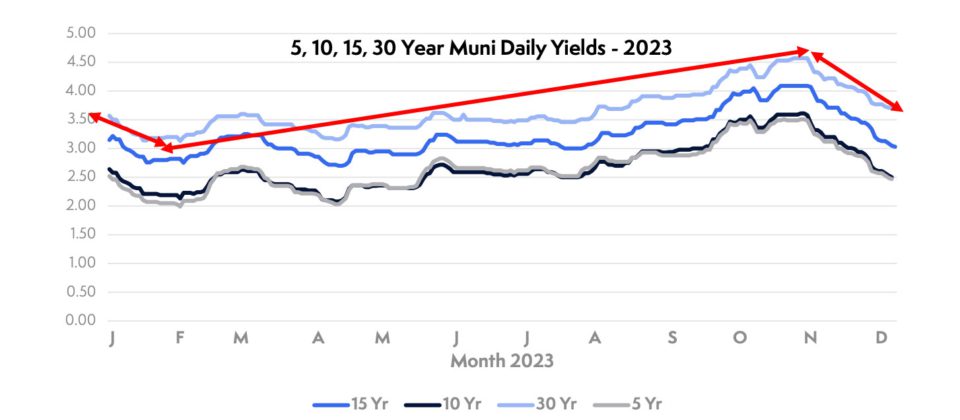

2023 was supposed to be the year for fixed income – until it wasn’t, and then it was??? The Bloomberg Composite Muni Index tells the track of highs, lows, and sudden turns:

- Munis started out the first 30 days up 2.88%, then sold off 2.26% over next 30 days

- The up 2.53% next five months, then sell off 5.14% over next three months

- Finished the last two months of the year up 8.82%

- Finish the full-year rollercoaster ride at up 6.40%

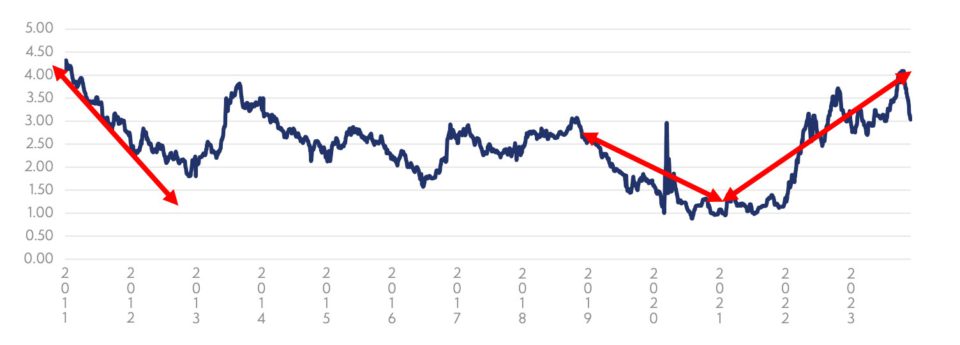

2023 turned out to be a continuation of the last three years. COVID reset Fed monetary policy (and parts of society) causing a lot of new highs/lows from 2020 to 2023. The markets, along with the entire world, are still trying to get things back to “normal” or “BC” “before COVID.” Over the last three years, investors have had to ride out the following:

- Record Fed Tightening, over 500 bps increase since March 2022

- Near record curve inversions June 2023 at 124 bps

- Roughly twice two standard deviation moves in rates (129 bps within 1 year, historically this has 5% chance of happening over 30 years)

- Highs(cheap) in muni yield ratios versus taxable(basis risk) of over 500%, to lows(rich) of 81%

MainLine’s outlook for 2023 had the following theme: once things settled down mid-year, munis would be on “cruise control” and a clip-the-coupon type of return. At the end of this topsy-turvy ride in 2024, munis are coming out a bit better than MainLine thought, but cruise control it wasn’t. Munis never lost their concern and were spooked at every economic number and Fed meeting. The craziness of 2023 and the last three years has investors wondering what is next. Can 2024 be any wilder of a ride? Or do munis finally hit cruise control? How about a controlled ride – with slow moving controlled highs and lows, and time in-between to enjoy the view

2024 Outlook – Riding the Ferris Wheel

Introduction:

The fixed income and muni markets seemed to find their peak yields in October after a turbulent three-year roller-coaster ride, with the comfort that inflation has been tamed. MainLine feels it’s time for the rollercoaster ride to slowly pull into the station and be over. COVID symptoms are fading away and the muni market can now get back to more rhythmic ups and downs, long-term planning and building wealth. In 2024 it’s time for a calm scenic ride on a Ferris wheel.

MainLine anticipates munis doing well in 2024, but challenges await and although we are going to be on a calmer ride, it doesn’t mean we lose track of good opportunities along the way. The view looks good as we enter 2024, but there are some clouds on the horizon that could cause an uphill climb at some point during the year. More specifically:

- Muni technicals, tax-equivalent income levels, and more economic certainty has munis feeling good heading into 2024, but ratios are rich.

- The era of easy credit quality analysis is coming to an end. Selecting the wrong bond at the wrong time will be costly.

- Muni market participants are changing, affecting distribution, pricing, and liquidity.

- 2024 is election year, with an unsettled society, polarizing politics and American history all providing fuel could make the fall interesting for markets. This is particularly true if you are a small-market asset class that serves and supported by the “public good.”

Muni Returns in 2024:

MainLine sees three possible muni return outcomes in 2024, two are muni friendly, and one is not.

- Inflation returns, rates go back up and the Fed is back in play, munis struggle and underperform posting ugly losses. This seems less likely as supply chains and labor shortages are getting back to BC (before COVID) and seem to be slowing down inflation, more so than the Fed.

- The Fed remains on hold, rates stay stable, the economy softens slowly, and a soft landing occurs. Munis outperform due to tax-equivalent value. Coupon returns in munis of 4% to 5%. This scenario seems most likely at this time.

- The economy tanks, the Fed is behind the curve and needs to ease, munis perform in line, and slightly underperform, but long 4% coupons and spread product pop big in value and returns exceed the coupon, thanks to price appreciation as rates decline.

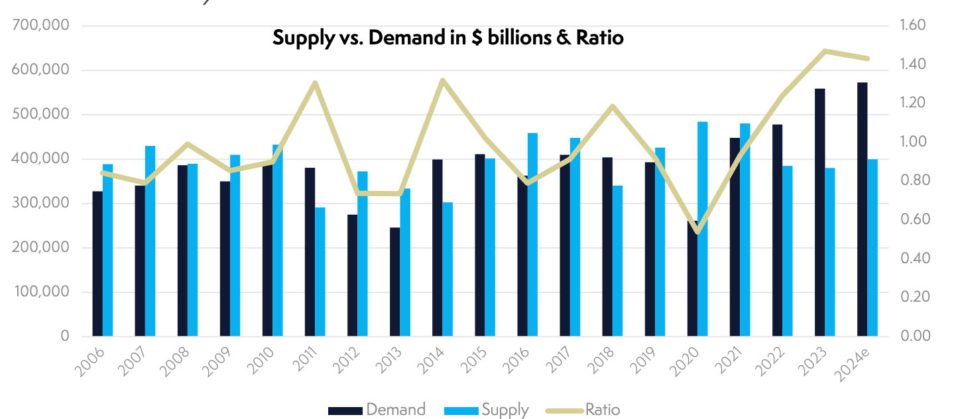

Supply & Demand Technicals Strong and Growing:

The street ranges from $400 to $430 billion of new issuance in 2024, up roughly 10% from the $370 billion in 2023. Technicals are bullish and close to record levels going into 2024 as muni “organic” demand ($416 billion principal payments plus $158 billion coupon payments = $574 billion) outpaces estimated new issuance ($400 billion). This is equivalent to $1 of supply versus $1.43 of demand. This is the second highest imbalance since 2006, only trailing 2023. 2023 rate volatility and Fed uncertainty was more than enough to drive this extra demand out. More rate certainty in 2024 will keep this extra demand in and could bring back the demand that left over the last three years.

Supply on the Up:

Infrastructure needs are big, growing and have been delayed due to higher borrowing costs and red tape. Add to it the need to prepare for climate change and lower tax revenues, you get a need for more bonds. Combine all of this with lower rates in 2024 and 2023 and supply levels will be a low point for years to come. In fact, MainLine would not be surprised if the street estimates for 2024 are a bit on the low side.

Muni Distribution and Liquidity set to Change:

The distribution of munis is evolving from a bigger concentration of deal flows to smaller platforms, algo trading and new bigger muni players.

- 50% of muni cash flows go through five major fund companies. Their behavior can greatly impact liquidity and pricing for investors.

- There appears to be a trend among some big banks to decrease their commitment to munis with Citigroup being the first to bow out at the end of 2023. The top underwriter firms and secondary market providers are changing, and, along with them the question of how to manage within the muni market for better value and opportunities.

- There is a growing industry for trading Munis on platforms with “algo” models (will highlight in a future monthly review) feeding on and eating up retail clients. This provides bonds to investors, but at market ups and downs that can be greater than 2% in price. At current yield levels for a +20 year bond, this can be 30 bps in yield or 10% decrease in annual income.

- What does this mean? More NAV volatility for the Funds and SMA accounts, but also more opportunities and the need to execute efficiently to save income.

Enter the Era of Credit Muni Man

Investors without a lot of muni knowledge and conservative credit criteria have been able to sleep well at night knowing munis for the most part are top tier quality. MainLine feels the era of sleeping well will require a little more work and muni expertise, as credit quality on average will decline and default rates increase for certain types of bonds.

2024 will be the beginning of the Era of the Muni Credit Man. What does this mean? Credit issues will become more in focus, as downgrades outpace upgrades and default rates increase. State revenues are slowing, and budget tightening will need to offset this, but this is only the beginning and is the typical economic cycle for state finances that municipalities have managed since the beginning of time. So why does MainLine think credit quality will weaken more than normal and default rates increase slowly over the next 10 to 30 years?

- Economic Cycle X2 – slowing economy, loss of Fed subsidies.

- Societal & Political Changes -States are becoming less homogenous and proud of it

- Sector Risk Changes– Unique challenges for revenue and general obligation bonds

- Climate change – Preparing for it, managing it as disasters occur

- Polarized Politics – Pending 2024 Election – Disputed election of 1876?

- Cyber security – A new threat that requires resources and money

MainLine detailed all of these changes in its November 2023 Monthly. Please

review for more details.

Why worry? Default rates could double to .02% for investment rated issuers and still mean nothing (2 out of every 10,000 issuers). Also credit ratings will, on average, be lower but still represent toptier quality. MainLine’s concern is a decline in overall credit quality will be focused on certain types of bonds and create a lot more credit “noise” and investor concerns which will be reflected in an increase of pricing volatility. The wrong type of bond at the wrong time can become very illiquid and discounted in price very quickly and impossible to sell.

MainLine feels there will be certain sectors, regions, and issuers that will be impacted to a greater degree. Muni credit analysis will require looking out further, such as longer time horizons, and beyond the issuer and to related “muni family members: and their relationships.

Polarized Politics, Unsettled Society and the 2024 Election:

The clear message from the 2020 election is that the USA is firmly divided, and that has not changed in four years, and in fact it may be worse. Services that the federal, state, and local governments are providing (or not providing) will be up for discussion, along with policies for taxes, distribution of wealth, personal choices and social freedoms. There is no agreement between parties, states or even people in the same party. The election of 2024 could complicate this process as opinions get wider, voices get louder, and actions get more extreme and nobody trusts the other. Could this be the election that finally causes political and social reform?

Let’s start with the best news for munis as expiring taxpayer provisions from 2017 will roll off. This means top income tax levels will return to 39%, the SALT cap removed, and AMT levels revert back. AMT is likely to get renewed, loss of SALT hurts state budgets with loss revenue, but the return to 39% increases the value of tax-exempt income.

MainLine feels the muni market could get nervous as politics get spicier moving into the second half of the year when the election gets more in focus. Munis do not like uncertainty and could struggle like they did after the 2016 election. This could be the ugliest election in US history, right there with the most contentious Presidential election ever in 1876.

1876 – Hayes versus Tilden, allegations of voter fraud, election violence. Popular vote was towards Tilden, and the electorate seemed to go his way too until it didn’t. The Democrats continued to litigate the election, until the great compromise was reached in March when the electoral votes were finally counted, and Hayes confirmed as President.

After the 2020 election does this sound too far-fetched?

Conclusion:

As MainLine begins to look out into 2024 the view looks good, but the scene is changing. The possible outcomes and probabilities favor a good year for fixed income, and in most cases the muni market. We view this for the first three to six months of 2024.

The volatility of certain bonds and issuers will increase, and their value be adversely affected. Their true credit quality will be questioned, and the evolving muni distribution system will not deal with them nicely.

Some issuers will struggle, and their credit quality will worsen. Increase in taxes and fees could become a theme to help fund the problem, or the questioning of what services need to be provided versus what society wants could be examined.

If it wasn’t election year, cruise control could be our theme for the year with everything downhill. The election risk, credit quality to be on the decline, and more attention to the type of bond, will provide some uphill action before 2024 is over.

MainLine feels investors should focus on the good tax-equivalent yield now with the right bonds and strategy and be ready to take advantage of any muni struggles later in 2024.

After riding a roller coaster for three years, enjoy the quiet scenic Ferris wheel ride for early 2024, but stay ready for a potential “circus” in the fall.

View the Monthly Review PDF here

This document is for informational purposes only and is summary in nature. No representations or warranties express or implied, are made as to the accuracy or the completeness of the information contained herein. Any prior investment results presented herein are provided for illustrative purposes only and have not been verified by a third party. Further, any hypothetical or simulated performance results contained herein have inherent limitations and do not represent an actual performance record. Actual future performance will likely vary and vary sharply from such hypothetical or simulated performance results. This document does not constitute an offer to invest in securities in the funds. No offer of securities in the funds can be made without delivery of The Fund’s confidential private placement memorandum and related offering materials. An investment in securities of The Funds involve risk, including potential risks that could lead to a loss of some, or all, of one’s capital investment. There is no assurance that the fund will achieve its investment objective. Past performance does not guarantee future results. There can be no possibility of profit without the risk of loss, including loss of one’s entire investment. There are interest and management fees associated with an investment in The Funds which are disclosed in The Funds’ offering materials.