Introduction:

In our 2022 Market Outlook, MainLine forecast a rough beginning to the year, due to Federal Reserve Bank interest rate uncertainty combined with the overvaluation of Munis relative to other asset classes. MainLine also felt that, by year-end, investors would have more clarity regarding the Fed and the economy, allowing munis to recover, while setting themselves up for a smooth 2023. Ok, so we got two out of three right. Now we are anticipating the cruise control.

Munis were on a 4-by-4 ride in 2022, and at times seemed to be going off the road. The market found a safe lane over the last 45 days of 2022, but there still remains some rough road conditions ahead and more miles to drive before reaching the end of the bumpy ride. The start of 2023, like 2022, has the makings of a little more confusion, but MainLine feels this will ease, and munis will be on cruise control as fixed income is now an “investable asset”. Investors who either bought munis in the second half of 2022 or take advantage of any early 2023 volatility, will be proud of their holdings and enjoy them for the next ten-plus years.

MainLine’s 2023 Outlook is very simple. When you can invest in a principal safe tax-free strategy that will guarantee a 10 to 30-year annualized tax-equivalent yield payout over 7.5%, you buy it. It’s just a matter of investors finally realizing the value and buying munis, leading to mutual fund inflows. As 2023 begins, there is long-term value in fixed income and munis. However, prices finished a little too strong at year-end and munis could have a pull back or get off to a slow start before they finally get to cruise control.

2022 Rearview Review:

In 2022, the muni market withstood many potholes, cracked asphalt, and a poorly working GPS to finish the year fundamentally sound and ready for the road ahead in 2023.

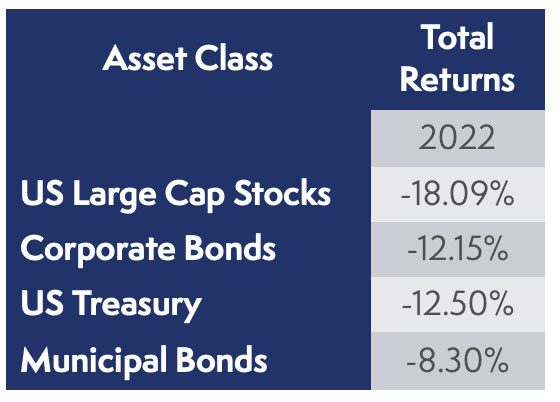

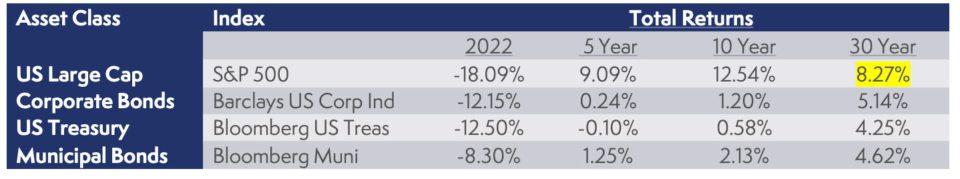

For the year, thanks to the last 90 days, munis finished as an outperforming asset class versus other Bloomberg composite indices. Yet a total return on the year of -8.30% is nothing to be happy about and tough for investors who like the usual “quiet nature” of munis. Still, it could have been worse. In fact, depending on a bond’s coupon, maturity date, and issuer sector, some parts of the muni market were off closer to -20% on the year.

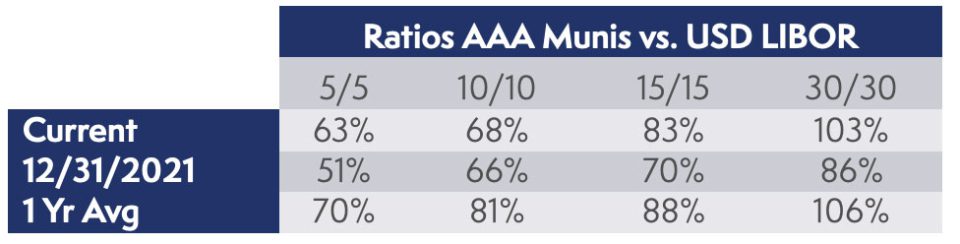

As MainLine looks ahead from where things ended in 2022, technically munis are set up for a slow underperformance, with a possible down start to the year. Fundamentally, as we drive through 2023, munis are set up to make up for the losses in 2022. Unlike the beginning of 2022, when munis were priced for perfection, munis are a bit overvalued in comparison with taxables, but not overvalued if they come back in favor. Below, the 30-year ratio is now at 103%, versus 86% this time last year, and the 106% average in 2022.

Other 2022 Low Moments:

- 48 weeks of outflows that totaled an 11% decrease in the size of muni mutual fund investors. This led to mutual funds liquidating bonds for the entirety of 2022.

- The upward changes in rates on the year were sizeable, with the greatest changes in short rates and long tax-exempts

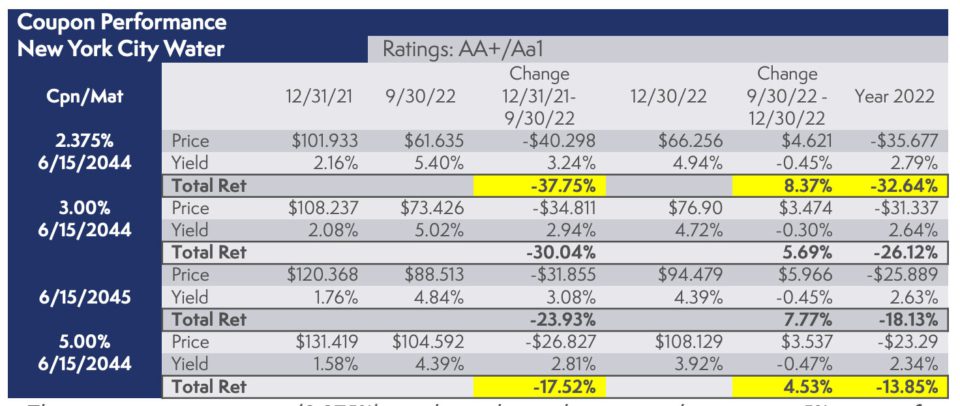

- The curse of the lower coupon caused bonds with 3% and 4% coupons to severely underperform 5% coupon bonds. This was due to two main factors:

- Bond prices fell below par and extended, trading to maturity and not the call date, adding more duration risk, and causing a larger decrease in price when rates go up.

- De minimis issues that caused bonds to be priced lower to offset tax implications from the discount below par price.

Below is an example of how different coupon bonds performed during two isolated time periods 2022. The below analysis uses the same issuer and bonds with close to the same maturity, the only relative difference is the coupon. What a difference!

2022 MainLine West Highlights:

- MainLine executed over $25 million in tax loss swaps for clients, realizing over $1.7 million in losses to offset future gains and lower taxes. The reinvestment of proceeds then provided an increase in annual income of roughly $450,000, on average $30,745 per client.

- As of June 2022, MainLine’s monthly review turned ten years old. That is a lot of muni information that has been encapsulated, especially when there is only one chapter in most university business books.

- MainLine is appreciative of the patience and confidence our investors showed in 2022, as market conditions and new risks tested the Family of Funds. MainLine remains committed to the discipline, and investment strategy of the Funds, and looks forward to better performance in 2023.

MainLine West 2023 Municipal Market Outlook:

In looking back at 2022, one of the worst performance years ever, and assessing where munis are today, it is hard to find reasons to be worried about munis in 2023. Investor logic and emotion are not always the same, and not always understood. In fact, munis’ inability to reach a cruising speed in 2022 is reason to be concerned and possibly why it may take a little while to get there in 2023.

Many investors are focusing on the potholes in the rearview mirror, and not the muni landscape ahead. MainLine sees the following as we drive down the 2023 road:

- Very bullish supply & demand technicals

- Long-term tax equivalent value, and the return of fixed income

- History as a late cycle performance maven:

o Credit quality remains solid but has peaked

o Excellent source of principal protection and fixed income - In time, a return in investor confidence

Muni Supply and Demand Technicals are Very Bullish for 2023.

- Supply estimates, on average among the Wall Street firms, are a high estimate at $500 billion and low of $385 billion. 2022 issuance was 19% lower than 2021, at $390 billion. This was due mainly to taxable issuance and refundings being much lower than estimated, due to the increase in rates. New issue volume was on target. It seems realistic to anticipate a bit higher issuance this year somewhere around the street average of $425 billion.

- Demand forecast shows 2023 maturities of $402 billion and coupon payments of $151 billion, which added together create a total demand from muni cashflows of $553 billion. This far outpaces anticipated supply by more than $125 billion.

- The ratio of the demand to supply forecast is 1.3 times, meaning there will be $1.30 chasing $1.00 in municipal bonds in 2023. This is a nice GPS coordinate showing it could be a sellers’ market in 2023, as investors go looking for bonds.

Munis Represent Long-Term Value, Top Performance for Years by simply “Clipping the Coupon”

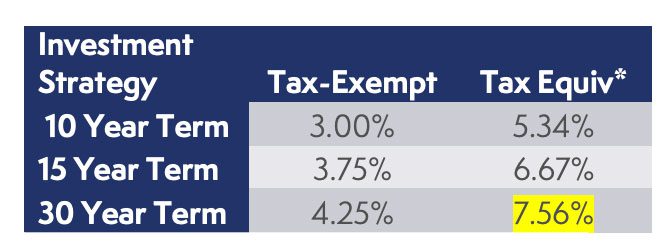

Munis represent good long-term value at current yields. As we enter 2023, an investor with a 30-year buy and hold strategy can book yields at levels that, on a tax-equivalent basis, are very favorable versus historical returns on US assets. Base on historic precedent, munis booked today will be a winning investment strategy over the next 30 years.

An investor can build a long-term, principal protected portfolio and book a 4% to 4.25% taxexempt yield, which, if half of the bonds are state exempt (assume 5% state income tax), is a taxable equivalent yield of 7.56%. This historically is 75 bps lower than the long-term annual stock market return (8.27%).

This relative value should attract investors back to fixed income and back to Munis as a long-term sleep well at night strategy.

Munis, Late Cycle Performance Mavens:

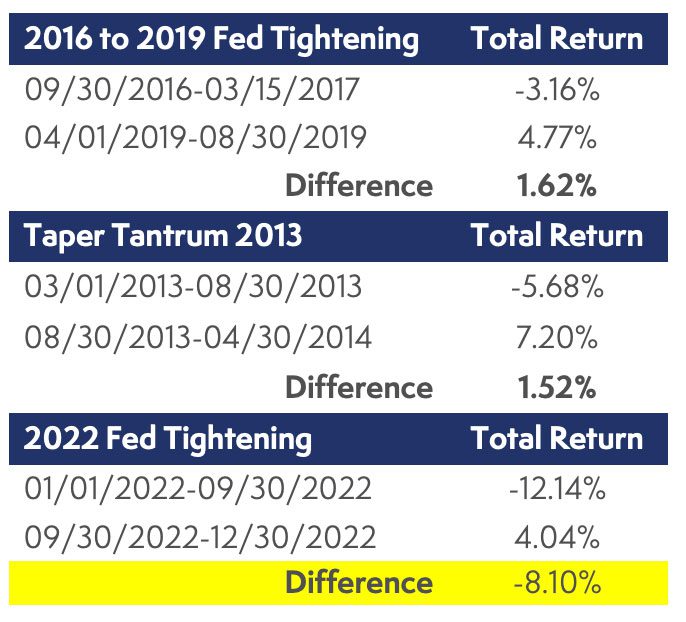

Municipal bonds have a reputation for being a strong late-economic-cycle performer. As the Fed rate hikes start to slow the economy, unlike corporates, muni issuers’ credit quality remains strong. Yields are at elevated levels, making tax-equivalent income look attractive. In reviewing the last two Fed tightening cycles, the returns demonstrate this in the chart on the following page.

MainLine looked back at the last two “Fed tightening movements” in 2019 and in the case of the 2013 market anticipation that never materialized. The calculations in the chart are based on the performance at the beginning of the “tightening” cycle and then when the cycle is close to over. In the end, the muni market made up for the losses (and then some) as a late-cycle performance maven. As the 2022 cycle indicates, munis still have some “recovery” left in them. MainLine feels that, once the Fed is done tightening and investors regain their confidence, munis will perform well. Over 2023, MainLine anticipates they will close the gap left in 2022 losses.

Munis Need the Speed Limit and Direction to Hit Cruising Speed:

In MainLine’s 2022 Outlook, we discussed our concerns regarding the increase in potential market volatility. This was based on the fact that, in 2021, during a year with close to record inflows, four muni fund managers received roughly 50% of the inflows. Unfortunately, this played out to a greater degree than we feared in 2022, but in the form of outflows.

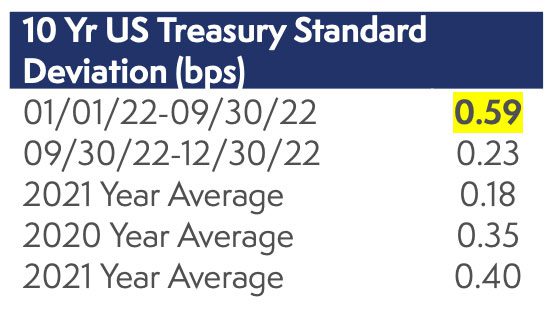

Munis do not like uncertainty. When markets are volatile, investors are scared about what could happen to their investments. Most muni investors do not focus on the long-term, which is why, on average, the short-end of the curve is much richer relative to other fixed income markets. When stock prices and interest rates are changing significantly each day, muni investors tend to take their money and go home. For the muni market to finally get to cruise control, US Treasury and stock market volatility will need to settle down. A simple comparison below shows the difference in volatility, using standard deviation, during the sell-off and recovery in 2022 for the ten-year US Treasury bond yield.

The .59 is higher than the .18 from 2021, .35 from 2020, and .40 from 2019. Investors were getting used to calm and/or quickly changing markets. In 2022, the size of the moves and their duration brought on a whole new level of volatility and record muni outflows. Roughly 11% of the assets in munis left the market in 2022. Given the imbalance of supply and demand in 2023, a return in investor confidence and a flow back to munis, these factors could quickly get the market back to cruising speed.

Other Thoughts for 2023:

- The Importance of the Muni Coupon: In MainLine’s 2022, outlook we discussed not paying up for a 5% coupon; 4% was all the protection an investor needed. Wow, were we proven wrong! One of the biggest performance variables for bonds in 2022 was the coupon. Needless to say, 5% was king and, once again, to protect against de minimis issues and extension risk, it should remain that way, unless you promise to own the bond until maturity.

- Climate Change & Munis: Munis have always been known as bonds for the public good, but now they are becoming known for being environmentally and socially conscious. ES&G issuance has been growing though the years and is estimated to reach 20% of issuance in 2023. Not surprising, as it goes hand in hand with what municipal finance is all about.

- 2022 also saw the release of new studies on the potential impact of climate. The big take away was that Muni bonds experiencing a natural disaster substantially reduced returns for at least 20 weeks following an event. The average decline was 31 bps ($31,000 on $1 million par or 3.1%), over the post-event period. Bond price declines occurred gradually after the disaster, peaking at ten weeks.

- Most investors still ignore the risk of climate change and this is reflected in the fact that pricing remains unaffected. MainLine does not ignore it and remains disciplined in managing this long-term risk.

- The Taxable Muni Market is shrinking. Issuance was much lower than anticipated, due to an increase in rates and, therefore, a lack of refunding candidates. At the end of 2022, issuance is estimated at $70 billion with original estimates for 2022 being twice as much. Estimates for 2023 are a bit lower at $55 billion. Unless DC decides to spotlight muni finance and create a true lasting infrastructure program, the market for taxable bonds will remain limited and tied to the level of interest rates. The MainLine West Taxable Arbitrage Fund remains on hold until the return of taxable supply and its role in true muni finance.

- DC Policies Remain Neutral. Politics are so thick in DC, the states at this time seem to be out of sight and out of mind. Long-term, MainLine remains concerned about the slow demise of State Sovereignty and what the ramifications could be to muni finance. The Federal government’s actions continue to place demands and controls on states regarding what they can and cannot do without their consent or funding. MainLine is hoping to do some work on this in 2023.

- The Death of LIBOR – RIP as of June 2023. SOFR is finally being accepted, regretfully, and replacing LIBOR. The MainLine Family of Funds have made the conversion, and we are pleasantly happy with their performance as a replacement for LIBOR. It appears the change will be a non-event, as authorities and regulators continue to force SOFR as the replacement. Once this is complete, the limitations of SOFR still exist and development of new products by Wall Street will likely be pursued.

Conclusion:

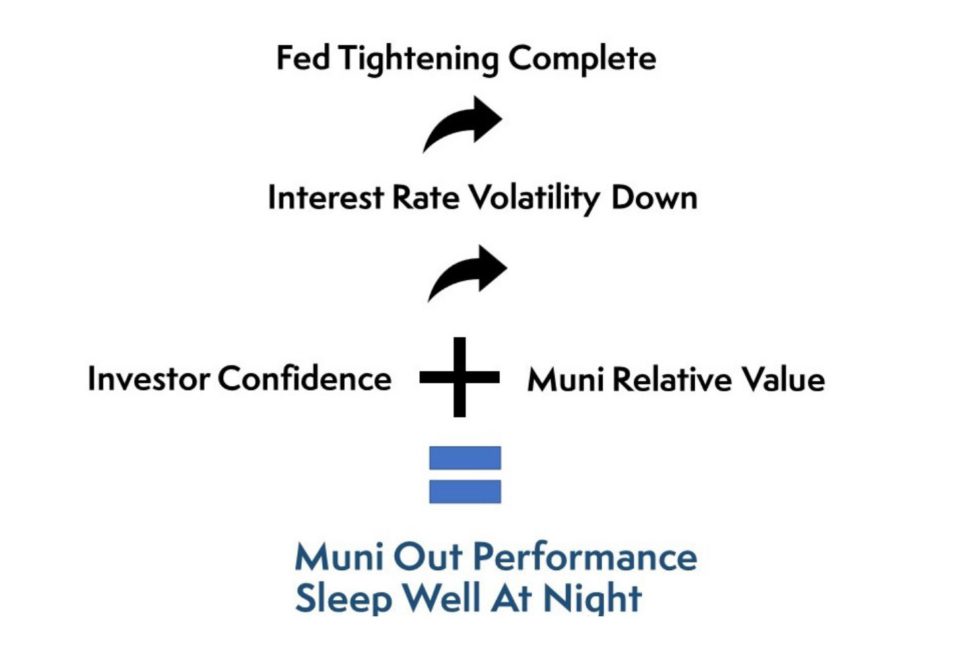

When uncertainty is gone and tax-equivalent value remains, the late cycle performance maven will take over and munis will fully recover and everyone can go back to sleeping well at night. Below is MainLine’s recipe for munis over the next twelve months. It may start out a little rough, but the foundation is there for muni outperformance in 2023.